Axis Bank shares fall after strong results. Should you buy, hold or sell the stock now?

Axis Bank share price: India's fifth largest lender by market value reported a strong set of quarterly results that beat analysts' estimates, boosted by strong interest income, higher fees and moderating operating expenses. Brokerages largely have positive views on Axis Bank after the earnings announcement, with targets as high as 34 per cent from Monday's closing price.

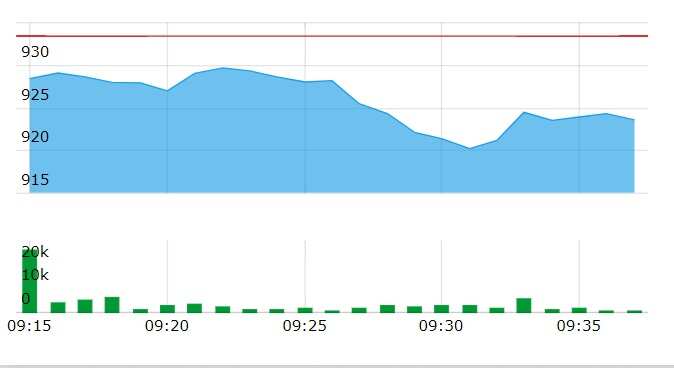

Axis Bank shares edged lower on Tuesday, even as India's fifth largest lender by market value reported a strong set of results for the October-December period driven by strong interest income, higher fees and moderating operating expenses. The Axis Bank stock weakened by Rs 14.5 or 1.5 per cent to Rs 918.9 in early deals to Rs 923.1 apiece on BSE.

Brokerages largely have positive views on Axis Bank after the earnings announcement, with targets as high as 34 per cent from Monday's closing price.

Minutes after the closing bell on Monday, the bank reported a 61.9 per cent year-on-year jump in quarterly net profit to Rs 5,853.1 crore, beating analysts' estimates. Its net interest income (NII) — or the difference between interest earned and interest paid — increased 32.4 per cent to Rs 11,459.3 crore, according to a regulatory filing.

According to Zee Business research, Axis Bank was estimated to report a quarterly net profit of Rs 5,480 crore and net interest income of Rs 10,900 crore.

Axis Bank's net interest margin (NIM) — a key measure of profitability for lenders — improved by 30 bps sequentially to 4.26 per cent for the quarter ended December 2022.

What brokerages say on Axis Bank

- UBS maintains 'buy' on Axis Bank, raises target price by Rs 70 to Rs 1,100; brokerage attributes quarterly beat to margin expansion, operating leverage

- CLSA retains 'buy' on Axis Bank with a target of Rs 1,250, raises net profit estimates for 2024, 2025 by 1-3 per cent

-

Morgan Stanley maintains 'overweight, raises target to Rs 1,200 from Rs 1,150; brokerage says NIM, fees, costs surprised positively in all-round beat; Moprgan Stanley finds Axis Bank valuation attractive

-

JPMorgan retains 'overweight' on Axis Bank, raises target to Rs 1,100 from Rs 990

-

HSBC continues with 'buy' call, raises target to Rs 1,200 from Rs 1,188

What's pulling the Axis Bank stock lower?

"Axis Bank results are good but concerns remain about whether the sector's earnings will remain good going forward... Deposit growth so far has not been good for any bank in this earnings season," AK Prabhakar, Head of Research at IDBI Capital Markets, told Zeebiz.com.

"Even ICICI Bank (shares) did not move up much owing to profit booking after good results," he said.

Catch LIVE stock market updates here. For all other news related to business, politics, tech, sports and auto, visit Zeebiz.com.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Post Office Guaranteed Return Schemes: PPF, SCSS, NSC, and 5 other financial schemes that provide up to 8.2% interest rate

Power of Compounding: How long it will take to build Rs 8 crore corpus with Rs 7,000, Rs 11,000 and Rs 16,000 monthly investments

Monthly Salary Calculations: Is your basic salary Rs 24,500, Rs 53,000, or Rs 81,100? Know how much total salary central government employees may get

Income Tax Calculations: What will be your tax liability if your salary is Rs 8 lakh, Rs 14 lakh, Rs 20 lakh, and Rs 26 lakh?

Top 7 Large and Mid Cap Mutual With Best Returns in 5 Years: Rs 1.5 lakh one-time investment in No. 1 scheme has sprung to Rs 4.46 lakh

EPS Pension Calculation: Estimate your monthly pension with Rs 35,000 salary, 25 years of service & age 33

Retirement Planning: How one-time investment of Rs 10,00,000 can create Rs 3,00,00,000 retirement corpus

12:43 PM IST

Axis Bank Q3 Results Review: Earnings miss estimates; brokerages slash targets

Axis Bank Q3 Results Review: Earnings miss estimates; brokerages slash targets Axis Bank Q3 Results: Net profit rises by 4% to Rs 6,304 crore

Axis Bank Q3 Results: Net profit rises by 4% to Rs 6,304 crore  No interest rate cut in RBI's February policy review, or anytime in FY26: Axis Bank chief economist Neelkanth Mishra

No interest rate cut in RBI's February policy review, or anytime in FY26: Axis Bank chief economist Neelkanth Mishra SEBI sends notices to Axis Bank, Axis Securities, Axis Capital over Max Life deal; more pain ahead for investors?

SEBI sends notices to Axis Bank, Axis Securities, Axis Capital over Max Life deal; more pain ahead for investors? Axis Bank shares zoom up 4% despite weak Q2; Here's what global brokerages suggest

Axis Bank shares zoom up 4% despite weak Q2; Here's what global brokerages suggest