Anil Singhvi’s Strategy November 8: Day support zone on Nifty is 17,800-17,850 & Bank Nifty is 39,300-39,400

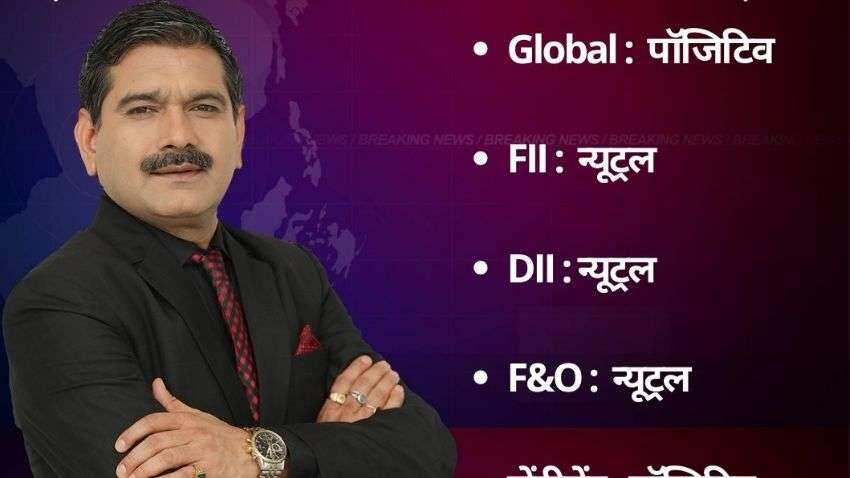

Amid positive global markets, sentiment, neutral foreign institutional investors (FIIs), domestic institutional investors (DIIs) and future & options (F&O) cues, the short-term trend of the Indian stock markets will be neutral on Monday, November 8, 2021.

Amid positive global markets, sentiment, neutral foreign institutional investors (FIIs), domestic institutional investors (DIIs) and future & options (F&O) cues, the short-term trend of the Indian stock markets will be neutral on Monday, November 8, 2021.

See Zee Business Live TV Streaming Below:

The domestic benchmarks started the Hindu Samvat year 2078 on a positive note on Thursday, November 4, 2021. On the day, the S&P BSE Sensex rallied 295.70 points or 0.49 per cent to settle higher at 60,067.62. The Nifty 50 index gained 87.60 points or 0.49 per cent to 17,916.80. The Bank Nifty closed with a gain of 171.65 points or 0.44 per cent at 39,573.70. This was the fourth straight year the market has notched up gains on Muhurat day.

The broader markets also ended in green with S&P BSE MidCap ending at 0.73 per cent higher and S&P BSE SmallCap rose1.36 per cent.

Zee Business’s Managing Editor Anil Singhvi’s Market Strategy for November 8:

Day support zone on Nifty is 17,800-17,850, below that 17,700-17,750 is a strong Buy zone.

Day higher zone on Nifty is 17,975-18,025, above that 18,100-18,175 is a strong Profit booking zone.

Day support zone on Bank Nifty is 39,300-39,400, below that 39,000-39,125 is a strong Buy zone.

Day higher zone on Bank Nifty is 39,750-39,850, above that 39,950-40,150 is a Profit booking zone.

The small day range for trading on Nifty is 17,900-18,000, while the medium and bigger day ranges are 17,850-18,100 and 17,800-18,125, respectively.

The small day range for trading on Bank Nifty is 39,400-39,850, while the medium and bigger day ranges are 39,300-39,950 and 39,125-40,100, respectively.

FIIs Index long increased to 53% Vs 52%.

PCR at 1.08 Vs 1.01.

India VIX unchanged at 16.13.

For Existing Long Positions:

Nifty Intraday stop loss is 17,750 and Closing stop loss is 17,800.

Bank Nifty Intraday stop loss is 39,300 and Closing stop loss is 39,000.

For Existing Short Positions:

Nifty Intraday and Closing stop loss are 18,050.

Bank Nifty Intraday stop loss is 40,150 and Closing stop loss is 40,000.

For New Positions:

Buy Nifty with a stop loss of 17,750 and target 17,975, 18,025, 18,100, 18,125, 18,175.

Sell Nifty in 18,100-18,175 range with a stop loss of 18,250 and target 18,025, 18,000, 17,925, 17,900.

For New Positions:

Buy BankNifty in 39,300-39,400 range with a stop loss of 39,100 and target 39,500, 39,575, 39,750, 39,850.

Aggressive Traders Buy Bank Nifty with a strict stop loss of 39,300 and target 39,750, 39,850, 39,950, 40,050, 40,150.

Sell BankNifty in 39,950-40,150 range with a stop loss of 40,200 and target 39,850, 39,750, 39,575, 39,500, 39,400

F&O Ban Update:

Already In Ban: Escorts, PNB

New In Ban: Nil

Out Of Ban: Nil

Stock Of The Day:

Buy Ashok Leyland Futures: Stop loss of 142 and target 150, 155, 160.

Petrol-Diesel price cut positive for the commercial vehicle.

Subsidiary to launch first Electric LCV in December.

The company delivered ten Ultra low floor CNG Buses to Indigo.

Paytm IPO Preview: ONLY HISH RISK TAKING INVESTORS CAN APPLY FOR LONG TERM

Positives:

Strong Brand and Promoters.

Strong Track Record and Market Leader.

Diversification into new areas.

Negatives:

Continuous loss-making and don’t know when it will come to profit.

Highly competitive Business, crowded with many places.

Revenue declining from consumers.

Focus on inorganic growth is costly.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

08:33 AM IST

Market guru Anil Singhvi explains 5 investment lessons from Mahatma Gandhi's life

Market guru Anil Singhvi explains 5 investment lessons from Mahatma Gandhi's life Zee Business wins 'Commodity Public Policy Influencer Award' at Wheat Summit

Zee Business wins 'Commodity Public Policy Influencer Award' at Wheat Summit Budget Bonanza on Zee Business: Check winners name and how to participate

Budget Bonanza on Zee Business: Check winners name and how to participate Sula Vineyard IPO Review by Anil Singhvi: Subscribe or avoid? Check recommendation here

Sula Vineyard IPO Review by Anil Singhvi: Subscribe or avoid? Check recommendation here Five Star Business Finance IPO review by Anil Singhvi: Subscribe or avoid? Check recommendation here

Five Star Business Finance IPO review by Anil Singhvi: Subscribe or avoid? Check recommendation here