Anil Singhvi’s Strategy November 4: Day support zone on Nifty is 17,750-17,800 & Bank Nifty is 39,300-39,400

Key equity barometers finished the last day of the Samvat 2077 on a weak note on Wednesday, November 3, 2021, amid selling in the banking and auto stocks and weak global cues.

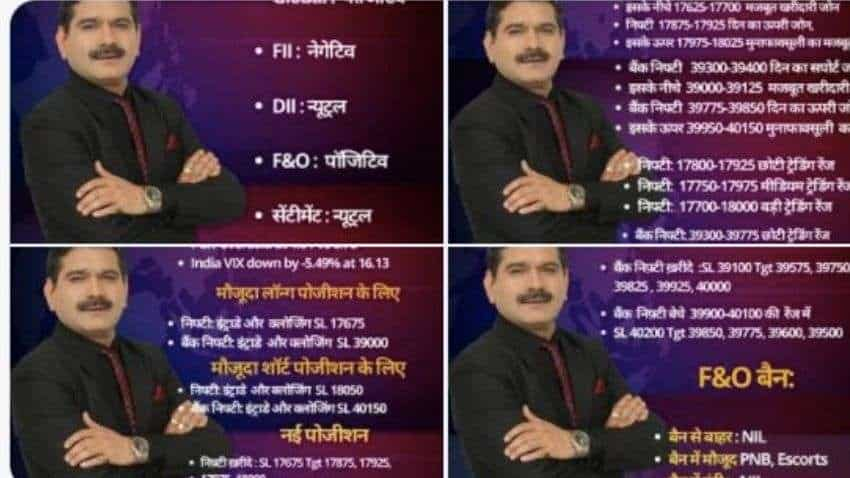

Amid positive global markets, future & options (F&O), negative foreign institutional investors (FIIs), neutral domestic institutional investors (DIIs) and sentiment cues, the short-term trend of the Indian stock markets will be neutral on Thursday, November 4, 2021.

WATCH | Click on Zee Business Live TV Streaming Below:

Key equity barometers finished the last day of the Samvat 2077 on a weak note on Wednesday, November 3, 2021, amid selling in the banking and auto stocks and weak global cues. The S&P BSE Sensex tumbled 257.14 points of 0.43 per cent to 59,771.92. The Nifty 50 index lost 59.75 points or 0.33 per cent to end at 17,829.20. The Bank Nifty index declined 436.40 points or 1.34 per cent to 39,402.05.

In the broader markets at the BSE, the S&P BSE MidCap fell 0.22 per cent and S&P BSE SmallCap declined 0.33 percent.

Zee Business’s Managing Editor Anil Singhvi’s Market Strategy for November 4:

Day support zone on Nifty is 17,750-17,800, below that 17,625-17,700 is a strong Buy zone.

Day higher zone on Nifty is 17,875-17,925, above that 17,975-18,025 is a strong Profit booking zone.

Day support zone on Bank Nifty is 39,300-39,400, below that 39,000-39,125 is a strong Buy zone.

Day higher zone on Bank Nifty is 39,775-39,850, above that 39,950-40,150 is a Profit booking zone.

The small day range for trading on Nifty is 17,800-17,925, while the medium and bigger day ranges are 17,750-17,975 and 17,700-18,000, respectively.

The small day range for trading on Bank Nifty is 39,300-39,775 Small Day Range, while the medium and bigger day ranges are 39,125-39,850 and 39,000-39,950, respectively.

FIIs Index long increased to 52% Vs 51%

PCR at 1.01 Vs 0.78

India VIX down by -5.49% at 16.13

For Existing Long Positions:

Nifty Closing stop loss is 17,675.

Bank Nifty Intraday and Closing stop loss are 39,000.

For Existing Short Positions:

Nifty Intraday and Closing stop loss are 18,050.

Bank Nifty Intraday and Closing stop loss are 40,150.

For New Positions:

Buy Nifty with a stop loss of 17,675 and target 17,875, 17,925, 17,975, 18,000.

Sell Nifty in 17,975-18,025 range with a stop loss of 18,100 and target 17,925, 17,875, 17,850, 17,800.

For New Positions:

Buy Bank Nifty with a stop loss of 39,100 and target 39,575, 39,750, 39,825, 39,925, 40,000.

Sell Bank Nifty in 39,900-40,100 range with a stop loss of 40,200 and target 39,850, 39,775, 39,600, 39,500.

Sector of the year: PSU, PSU Bank, Realty, Textile

Diwali Picks

BUY SBI: Target 650, 700, 850.

Strong economy recovery

Listing of lather subsidiary like SBI MF, SBI CAP, YONO

STOCK OF THE DAY

BUY BOB FUT: Stop loss 98 and target 108, 113, 118.

STRONG UP MOVE ON PSU BANK AFTER SBI RESULT

F&O Ban Update:

F&O BAN

New in Ban: Nil

Already in Ban: PNB, Escorts

Out of Ban: NIL

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

05:42 PM IST

Anil Singhvi Market Strategy December 19: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy December 19: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy December 18: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy December 18: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy December 16: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy December 16: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy December 13: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy December 13: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy December 11: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy December 11: Important levels to track in Nifty50, Nifty Bank today