Anil Singhvi’s Strategy March 15: Support zone on Nifty is 16,700-16,750 & Bank Nifty is 34,425-34,625

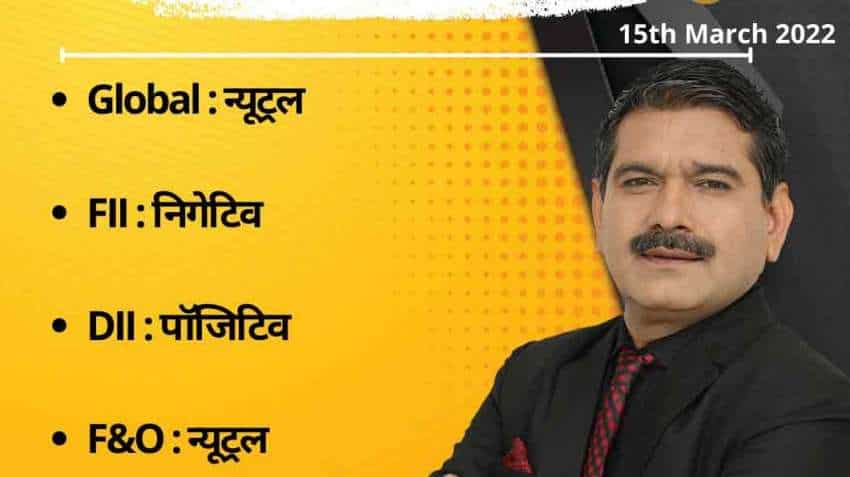

Amid neutral global markets, future & options (F&O), sentiment, negative foreign institutional investors (FIIs) and positive domestic institutional investors (DIIs) cues, the short-term trend of the Indian stock markets will be negative on Tuesday, March 15, 2022

Amid neutral global markets, future & options (F&O), sentiment, negative foreign institutional investors (FIIs) and positive domestic institutional investors (DIIs) cues, the short-term trend of the Indian stock markets will be negative on Tuesday, March 15, 2022.

Domestic equity markets climbed around one and a half per cent on Monday, March 14, 2022, amid mixed cues from the global share markets. The S&P BSE Sensex closed near 56,500 points while the NSE Nifty settled above the 16,850 level.

The Sensex rose 935.72 points, or 1.68 per cent to end at 56,486.02. The Nifty also gained 240.85 points, or 1.45 per cent, to finish at 16,871.30. In the sectoral indices at the NSE, the Bank Nifty index gained 765.90 points, or 2.22 per cent, to close at 35,312.15.

See Zee Business Live TV Streaming Below:

In the broader market at the BSE, the S&P BSE MidCap index rose 0.02 per cent while the S&P BSE SmallCap index added 0.31 per cent.

Zee Business’s Managing Editor Anil Singhvi’s Market Strategy for March 15:

Nifty support zone is 16,700-16,750, Below that 16,600-16,650 is a strong buy Zone.

Nifty higher zone is 16,925-16,975, Above that 17,025-17,150 is a Profit booking zone.

Bank Nifty support zone is 34,425-34,625, Below that 34,100-34,225 is a strong buy zone.

Bank Nifty higher zone is 35,550-35,750, Above that 35,975-36,200 is a profit booking zone.

Nifty support levels are 16,800, 16,750, 16,700, 16,650, 16,625, 16,600, 16,500.

Nifty higher levels are 16,925, 16,975, 17,025, 17,075, 17,100, 17,150.

Bank Nifty support levels are 35,100, 34,950, 34,725, 34,625, 34,475, 34,425, 34,225, 34,100.

Bank Nifty higher levels are 35,425, 35,550, 35,750, 35,850, 35,975, 36,025, 36,200, 36,365.

FIIs index long position at 45% Vs 43%.

PCR at 1.13 vs 1.03.

India VIX up by 1% at 25.68.

For Existing Long Positions:

Nifty Intraday and Closing stop loss are 16,600.

Bank Nifty Intraday stop loss is 34,900 and Closing stop loss is 34,700.

For Existing Short Positions:

Nifty Intraday and Closing stop loss are 16,900.

Bank Nifty Intraday and Closing stop loss are 35,550.

For New Positions:

Buy Nifty in 16,600-16,650 range with a stop loss of 16,500 and target 16,700, 16,750, 16,800, 16,875, 16,975.

Aggressive Traders Buy on gap down opening Nifty with a strict stop loss of 16,675 and target 16,925, 16,975, 17,025, 17,075, 17,100, 17,150.

Sell Nifty in 16,975-17,075 range with a stop loss of 17,200 and target 16,900, 16,800, 16,750, 16,700, 16,650, 16,625.

Aggressive Traders Sell Nifty with a strict stop loss of 17,025 and target 16,800, 16,750, 16,700, 16,650, 16,625, 16,600, 16,500.

For New Positions:

Buy Bank Nifty 34,425-34,625 range with a stop loss of 34,200 and target 34,725, 34,950, 35,100, 35,325, 35,425.

Aggressive Traders Buy Bank Nifty with a strict stop loss of 34,900 and target 35,425, 35,550, 35,750, 35,850, 35,975, 36,025, 36,200, 36,365.

Sell Bank Nifty in 35,750-35,975 range with a stop loss of 36,400 and target 35,550, 35,425, 35,325, 35,100, 34,950, 34,725, 34,625, 34,425.

Stock in F&O Ban

New in Ban: Balrampur Chini

Still in Ban: None

Out of Ban: None

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

08:39 AM IST

Market guru Anil Singhvi explains 5 investment lessons from Mahatma Gandhi's life

Market guru Anil Singhvi explains 5 investment lessons from Mahatma Gandhi's life Zee Business wins 'Commodity Public Policy Influencer Award' at Wheat Summit

Zee Business wins 'Commodity Public Policy Influencer Award' at Wheat Summit Budget Bonanza on Zee Business: Check winners name and how to participate

Budget Bonanza on Zee Business: Check winners name and how to participate Sula Vineyard IPO Review by Anil Singhvi: Subscribe or avoid? Check recommendation here

Sula Vineyard IPO Review by Anil Singhvi: Subscribe or avoid? Check recommendation here Five Star Business Finance IPO review by Anil Singhvi: Subscribe or avoid? Check recommendation here

Five Star Business Finance IPO review by Anil Singhvi: Subscribe or avoid? Check recommendation here