Anil Singhvi’s Strategy December 28: Day support zone on Nifty is 16,950-17,000 & Bank Nifty is 34,700-34,850

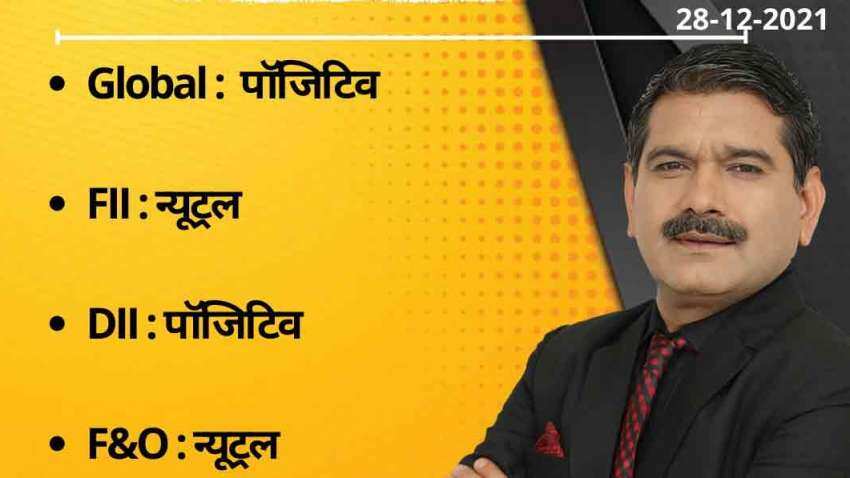

Amid positive global markets, domestic institutional investors (DIIs), sentiment, neutral foreign institutional investors (FIIs) and future & options (F&O) cues, the short-term trend of the Indian stock markets will be negative on Tuesday, December 28, 2021.

Amid positive global markets, domestic institutional investors (DIIs), sentiment, neutral foreign institutional investors (FIIs) and future & options (F&O) cues, the short-term trend of the Indian stock markets will be negative on Tuesday, December 28, 2021.

Benchmark indices ended with decent gains on Monday, December 27, 2021. Both stocks gained amid mixed cues from the global equity markets. The S&P BSE Sensex rose 295.93 points, or 0.52 per cent, at 57,420.24. The Nifty 50 index rose 82.50 points, or 0.49 per cent, at 17,086.25. The Bank Nifty ended with a gain of 200.85 points, or 0.58 per cent, at 35,057.90.

See Zee Business Live TV Streaming Below:

In the broader markets at the BSE, the S&P BSE MidCap index rose 0.27 per cent and S&P BSE SmallCap gained 0.52 per cent.

Zee Business’s Managing Editor Anil Singhvi’s Market Strategy for December 28:

Day support zone on Nifty is 16,950-17,000, below that 16,890-16,915 is a strong Buy zone.

Day higher zone on Nifty is 17,150-17,200, above that 17,225-17,300 is a strong Profit booking zone.

Day support zone on Bank Nifty is 34,700-34,850, below that 34,400-34,600 is a strong Buy zone.

Day higher zone on Bank Nifty is 35,225-35,325, above that 35,475-35,625 is a strong Profit booking zone.

The small day range for trading on Nifty is 17,000-17,150, while the medium and bigger day ranges are 16,950-17,200 and 16,915-17,250, respectively.

The small day range for trading on Bank Nifty is 34,850-35,325, while the medium and bigger day ranges are 34,600-35,475 and 34,450-35,550, respectively.

FIIs long position increased to 67% Vs 66%.

PCR near overbought at 1.25 Vs 1.00, Cautious at higher levels.

India VIX up by 6% at 17.12.

For Existing Long Positions:

Nifty Intraday and Closing stop loss are 16,950.

Bank Nifty Intraday and Closing stop loss are 34,850.

For Existing Short Positions:

Nifty Intraday and Closing stop loss are 17,250.

Bank Nifty Intraday stop loss is 35,500 and Closing stop loss is 35,200.

For New Positions:

Buy Nifty with a stop loss of 16,950 and target 17,150, 17,175, 17,200, 17,225, 17,250, 17,300.

Sell Nifty in 17200-17300 range with a stop loss of 17,400 and target 17,150, 17,120, 17,085, 17,025, 17,000.

For New Positions:

Buy Bank Nifty in 34,600-34,850 range with a stop loss of 34,400 and target 35,025, 35,125, 35,225, 35,325.

Aggressive Traders Buy Bank Nifty with a strict stop loss of 34,850 and target 35,225, 35,325, 35,475, 35,525, 35,625, 35,700.

Sell Bank Nifty in 35,450-35,625 range with a stop loss of 35,700 and target 35,325, 35,225, 35,150, 35,050.

F&O Ban Update:

New In Ban: RBL Bank

Already In Ban: Vodafone Idea, IB Housing Finance, Escorts

Out Of Ban: Nil

Stock Of The Day:

Buy UPL Futures: Stop loss 740 and target 775, 790, 800, 850. Focus on Chemical and Fertilizer stocks till budget.

Supriya Lifesciences Listing Preview: Expected to list in 400-450 range against issue price of 274. Investors should HOLD with a Stop Loss of 375 and keep trailing.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

08:42 AM IST

Anil Singhvi Market Strategy November 22: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 22: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy November 21: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 21: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy November 18: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 18: Important levels to track in Nifty50, Nifty Bank today  Anil Singhvi Market Strategy November 14: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 14: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy November 13: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 13: Important levels to track in Nifty50, Nifty Bank today