Anil Singhvi’s Strategy April 28: Support zone on Nifty is 16,950-17,000 & Bank Nifty is 35,525-35,750

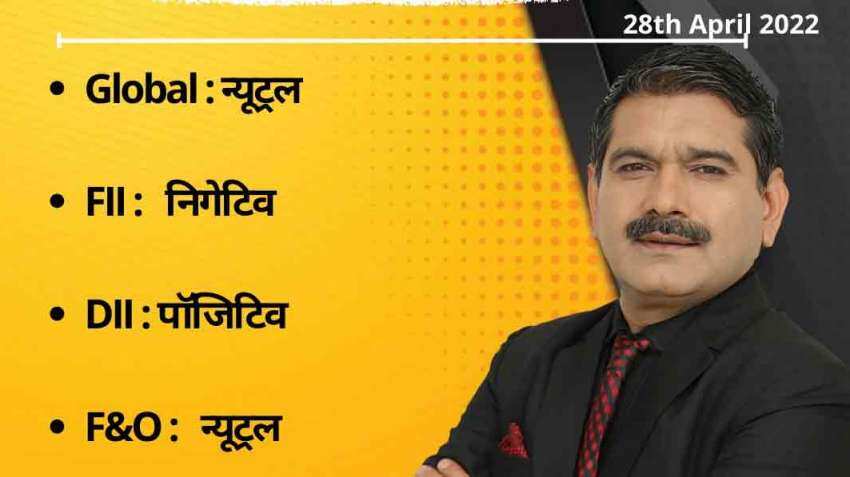

Amid neutral global markets, future & options (F&O), negative foreign institutional investors (FIIs), positive domestic institutional investors (DIIs) and cautious sentiment cues, the short-term trend of the Indian stock markets will be neutral on Thursday, April 28, 2022.

Amid neutral global markets, future & options (F&O), negative foreign institutional investors (FIIs), positive domestic institutional investors (DIIs) and cautious sentiment cues, the short-term trend of the Indian stock markets will be neutral on Thursday, April 28, 2022.

Indian stock markets fell around one per cent on Wednesday, April 27, 2022, amid negative cues from global share markets. The Sensex at Bombay Stock Exchange closed near 56,800 points while the Nifty at National Stock Exchange settled near the 17,000 level. The Sensex lost 537.22 points, or 0.94 per cent to trade at 56,819.39 while the Nifty slipped 162.40 points, or 0.94 per cent, to trade at 17,038.40. In the sectoral indices, the Bank Nifty index fell 375.95 points, or 1.03 per cent, to 36,028.85.

In the broader markets, the S&P BSE MidCap and S&P BSE SmallCap declined 0.88 per cent and 0.61 per cent, respectively.

Zee Business’s Managing Editor Anil Singhvi’s Market Strategy for April 28:

Nifty support zone is 16,950-17,000, below that 16,800-16,875 is a strong Support zone.

Nifty higher zone is 17,065-17,150, above that 17,175-17,250 is a Profit booking zone.

Bank Nifty support zone is 35,525-35,750, below that 35,200-35,425 is a strong Buy zone.

Bank Nifty higher zone is 36,275-36,400, above that 36,450-36,600 is a Profit booking zone.

Nifty support levels are 17,000, 16,975, 16,950, 16,875, 16,825, 16,775.

Nifty higher levels are 17,065, 17,125, 17,150, 17,175, 17,200, 17,225, 17,250.

Bank Nifty support levels 35,925, 35,850, 35,750, 35,525, 35,425, 35,325, 35,200.

Bank Nifty higher levels are 36,175, 36,275, 36,350, 36,400, 36,450, 36,500, 36,600, 36,725.

FIIs Index Long at the bottom at 33% Vs 44%, short-covering expected.

PCR light at 0.91 Vs 1.06.

India VIX is up by 7% at 20.61.

For Existing Long Positions:

Nifty Intraday stop loss is 16,800 and Closing stop loss is 16,950.

Bank Nifty Intraday stop loss is 35500 and Closing stop loss is 35,900.

For Existing Short Positions:

Nifty Intraday and Closing stop loss are 17,225.

Bank Nifty Intraday stop loss is 36,600 and Closing stop loss is 36,400.

For New Positions:

Buy Nifty in 16,825-16,950 range with a stop loss of 16,750 and target 16,975, 17,035, 17,065, 17,100, 17,125, 17,150.

Aggressive Traders Buy Nifty with a strict stop loss of 16,925 and target 17,065, 17,125, 17,150, 17,175, 17,200, 17,225, 17,250.

Sell Nifty in 17,150-17,225 range with a stop loss of 17,325 and target 17,115, 17,075, 17,050, 17,000, 16,975, 16,950, 16,875, 16,825.

For New Positions:

Buy Bank Nifty in 35525-35750 range with a stop loss of 35,375 and target 35,850, 35,925, 36,000, 36,075, 36,275, 36,350.

Aggressive Traders Buy Bank Nifty with a strict stop loss of 35,700 and target 36,175, 36,275, 36,350, 36,400, 36,450, 36,500, 36,600, 36,725.

Sell Bank Nifty in 36,400-36,600 range with a stop loss of 36,750 and target 36,350, 36,275, 36,075, 36,000, 35,925, 35,850, 35,750, 35,525.

No Stock In F&O Ban

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

EPS Pension Calculator: Age 32; basic salary Rs 22,000; pensionable service 26 years; what will be your monthly pension at retirement?

Rs 55 lakh Home Loan vs Rs 55 lakh SIP investment: Which can be faster route to arrange money for Rs 61 lakh home? Know here

Top 7 Mid Cap Mutual Funds With Highest SIP Returns in 10 Years: Rs 13,333 monthly SIP investment in No. 1 fund is now worth Rs 67,61,971

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Rs 4,000 Monthly SIP for 33 years vs Rs 40,000 Monthly SIP for 15 Years: Which can give you higher corpus in long term? See calculations

08:46 AM IST

Anil Singhvi Market Strategy December 18: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy December 18: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy December 16: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy December 16: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy December 13: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy December 13: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy December 11: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy December 11: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy December 10: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy December 10: Important levels to track in Nifty50, Nifty Bank today