"Storm in a tea cup:" Finance Secretary on the rout in Adani stocks

Adani Group stocks have taken a beating on the bourses after US-based short-seller Hindenburg Research made a litany of allegations in a report, but Finance Secretary said that the fluctuations in the stock market prices are not a concern and it is a universal phenomenon of all stock markets in all circumstances.

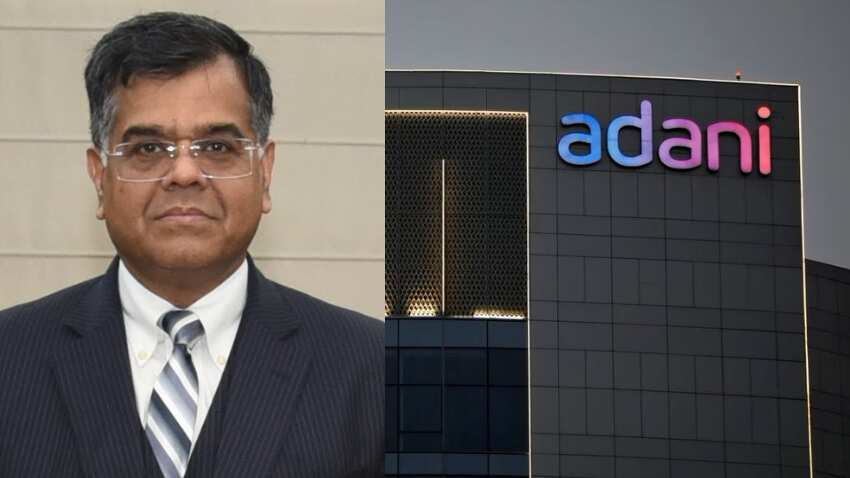

The stock market turmoil created by a rout in Adani group shares is a "storm in a teacup" from a macroeconomic point of view, finance secretary T V Somanathan said on Friday, emphasing that India's public financial system is robust.

The senior-most bureaucrat in the finance ministry also said that movements in the stock market per se are not the government's concern and there are independent regulators to take necessary action.

Replying to a question on the impact of the fraud allegations on the Adani group on the financial system considering banks and insurance companies' exposure to the group, Somanathan said India's public financial institutions are robust.

"There is absolutely no concern from the point of view of financial stability, either for depositors, or for policyholders, or for anyone holding shares in these institutions. The share of any one company is not such as to create any impact at the macro level and so there is absolutely no concern from that point of view," he told PTI in a post-budget interview.

The stock price of Adani Enterprises fell by over 70 per cent from its peak of Rs 4,190 in December, last year. Since January, the BSE Sensex has slumped by over 1,000 points largely driven by sell-off in Adani group stocks.

Asked if the turmoil in stock market will impact revised estimates of disinvestment collections, Somanathan said these gyrations do not affect the macro economy at all. "They are a side show. They are of interest to those who are interested in stock markets and investment. From a macroeconomic point of view, this is a non-issue. It's a complete non-issue from our point of view. It's a storm in a tea cup as far as macroeconomics are concerned, not in respect of markets."

The secretary further said that the fluctuations in the stock market prices are not a concern and it is a universal phenomenon of all stock markets in all circumstances. "The government's concern is with creating the right investment environment, creating a well-regulated set of the financial market... Making sure there is transparency and that the market functions well; making sure the information asymmetry is reduced; and making sure the government's own macroeconomic policies are sound," Somanathan said.

Adani Group stocks have taken a beating on the bourses after US-based short-seller Hindenburg Research made a litany of allegations in a report, including fraudulent transactions and share price manipulation at the Gautam Adani-led group.

Hindenburg released the report on January 24 -- the day on which Adani Enterprises' Rs 20,000-crore follow-on share sale opened for anchor investors, while the allegations have been rejected by the conglomerate.

Click Here For Latest Updates On Stock Market | Zee Business Live

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

05:04 PM IST

Adani to raise Rs 21,000 crore from share sale in two group companies

Adani to raise Rs 21,000 crore from share sale in two group companies 3 Adani Group stocks again placed under short-term surveillance framework

3 Adani Group stocks again placed under short-term surveillance framework Why has SEBI not yet got to bottom of Mauritius funds holding and trading Adani stocks: Raghuram Rajan

Why has SEBI not yet got to bottom of Mauritius funds holding and trading Adani stocks: Raghuram Rajan Once among top 3, Gautam Adani slips to 30th spot in world’s richest list a month after Hindenburg report

Once among top 3, Gautam Adani slips to 30th spot in world’s richest list a month after Hindenburg report George Soros in the eye of storm after comments on PM Modi: Know who is he and his net worth

George Soros in the eye of storm after comments on PM Modi: Know who is he and his net worth