Stock Markets HIGHLIGHTS: Sensex ends 90 points down, Nifty over 30 points lower as auto stocks drag

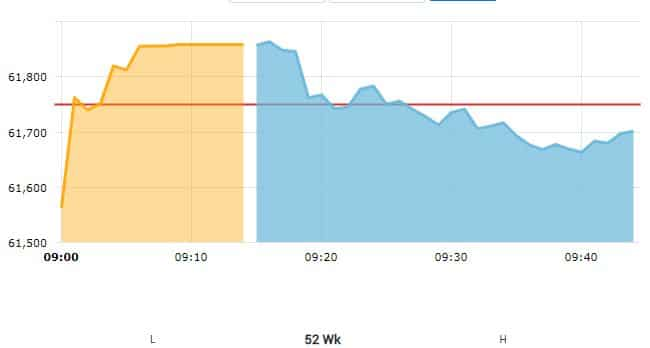

Stock Markets Today HIGHLIGHTS: Indian equity markets ended the week on a negative note. The BSE Sensex closed at 61,663.48, down 87.12 points or 0.14 per cent. Meanwhile, the Nifty settled at 18,307.65, down by 36.25 points or 0.20 per cent. The Nifty Bank index closed at 42,437.45, down 20 points or 0.05 per cent.

Here are top highlights of the day's session:

1) Frontline indices Sensex and Nifty50 gave their third negative closing this week - two on the go. Sensex traded in 600-points range while Nifty traded in 370-points range.

2) In the 52-stock Nifty50, 14 stocks advanced while 35 declined and 1 stock remained unchanged. The top gainers were HCL Technologies, Hindustan Unilever, Asian Paints, SBI and Infosys while the top losers were Mahindra & Mahindra, Bajaj Auto, NTPC, Bajaj Finance and Indusind Bank.

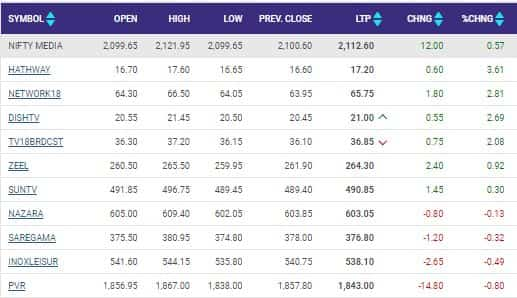

3) Out of the 15 sectoral indices, 13 closed the session in the red against two gainers in Nifty PSU Bank (+1.53 per cent) and Nifty Realty (+0.10 per cent). The worst performers were Nifty Auto, Nifty Pharma and Nifty Healthcare Index which dropped 1.18, 0.67 and 0.65 per cent respectively.

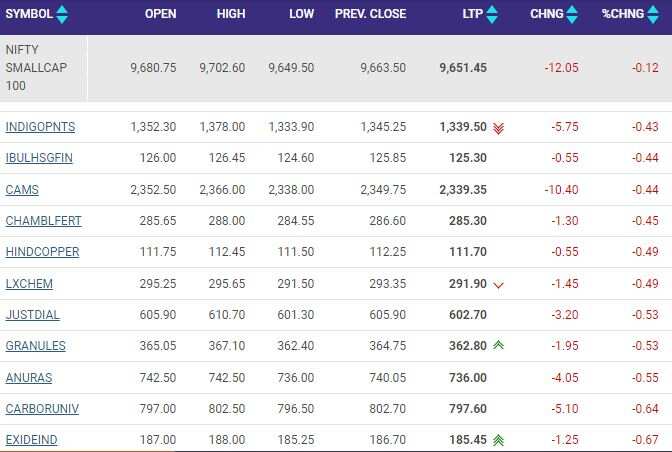

4) Profit booking was seen even in the broader markets with Nifty Mid Cap 100 and Nifty Small Cap 100 indices closing with declines of 0.50 per cent.

5) India VIX, a measure of volatility in the Nifty was down 3.27 per cent from the Thursday closing to end at 14.39.

6) The rupee depreciated 6 paise to close at 81.70 (provisional) against the US dollar on Friday amid a lacklustre trend in domestic equities and firming crude oil prices. However, a weak dollar in the overseas market and fresh foreign capital inflows restricted the loss, forex traders said. At the interbank foreign exchange market, the local unit opened up at 81.59 and later erased all its early gains. During the session, it witnessed a high of 81.52 and a low of 81.78. The domestic unit finally settled at 81.70 against the American currency, registering a fall of 6 paise over its previous close of 81.64. Meanwhile, the dollar index, which gauges the greenback's strength against a basket of six currencies, declined 0.28 per cent to 106.39. PTI

7) Global oil benchmark Brent crude futures rose 0.36 per cent to USD 90.10 per barrel.

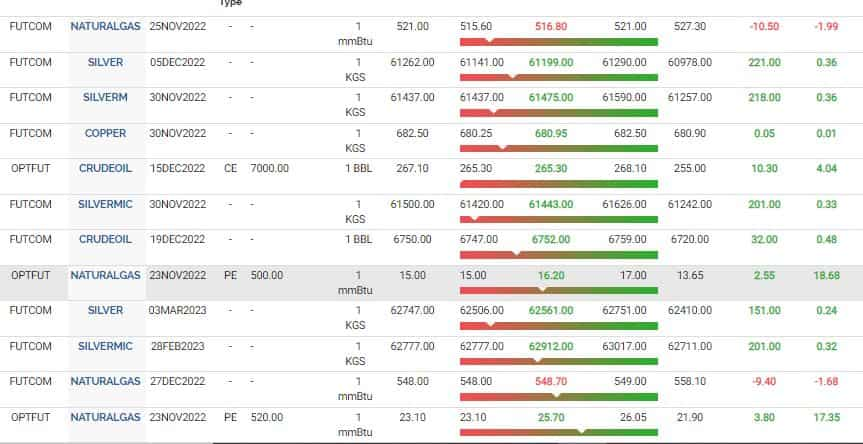

8) The week also witnessed significant declines in commdities across the board from crude oil, base metals and bullion.

9) Singapore-based SGX Nifty futures were trading at 18,347.5, down 27.5 points or 0.15 per cent. Dow Futures were trading at 33,635.60, up 89.30 points or 0.27 per cent.

10) On BSE, out of 3,626 which traded, 1,461 stocks advanced, 2,037 declined while 128 remained unchanged. 119 stocks hit their 52-week highs while 74 hit their 52-week lows.

Catch all the Updates here!

Stock Markets Today HIGHLIGHTS: Indian equity markets ended the week on a negative note. The BSE Sensex closed at 61,663.48, down 87.12 points or 0.14 per cent. Meanwhile, the Nifty settled at 18,307.65, down by 36.25 points or 0.20 per cent. The Nifty Bank index closed at 42,437.45, down 20 points or 0.05 per cent.

Here are top highlights of the day's session:

1) Frontline indices Sensex and Nifty50 gave their third negative closing this week - two on the go. Sensex traded in 600-points range while Nifty traded in 370-points range.

2) In the 52-stock Nifty50, 14 stocks advanced while 35 declined and 1 stock remained unchanged. The top gainers were HCL Technologies, Hindustan Unilever, Asian Paints, SBI and Infosys while the top losers were Mahindra & Mahindra, Bajaj Auto, NTPC, Bajaj Finance and Indusind Bank.

3) Out of the 15 sectoral indices, 13 closed the session in the red against two gainers in Nifty PSU Bank (+1.53 per cent) and Nifty Realty (+0.10 per cent). The worst performers were Nifty Auto, Nifty Pharma and Nifty Healthcare Index which dropped 1.18, 0.67 and 0.65 per cent respectively.

4) Profit booking was seen even in the broader markets with Nifty Mid Cap 100 and Nifty Small Cap 100 indices closing with declines of 0.50 per cent.

5) India VIX, a measure of volatility in the Nifty was down 3.27 per cent from the Thursday closing to end at 14.39.

6) The rupee depreciated 6 paise to close at 81.70 (provisional) against the US dollar on Friday amid a lacklustre trend in domestic equities and firming crude oil prices. However, a weak dollar in the overseas market and fresh foreign capital inflows restricted the loss, forex traders said. At the interbank foreign exchange market, the local unit opened up at 81.59 and later erased all its early gains. During the session, it witnessed a high of 81.52 and a low of 81.78. The domestic unit finally settled at 81.70 against the American currency, registering a fall of 6 paise over its previous close of 81.64. Meanwhile, the dollar index, which gauges the greenback's strength against a basket of six currencies, declined 0.28 per cent to 106.39. PTI

7) Global oil benchmark Brent crude futures rose 0.36 per cent to USD 90.10 per barrel.

8) The week also witnessed significant declines in commdities across the board from crude oil, base metals and bullion.

9) Singapore-based SGX Nifty futures were trading at 18,347.5, down 27.5 points or 0.15 per cent. Dow Futures were trading at 33,635.60, up 89.30 points or 0.27 per cent.

10) On BSE, out of 3,626 which traded, 1,461 stocks advanced, 2,037 declined while 128 remained unchanged. 119 stocks hit their 52-week highs while 74 hit their 52-week lows.

Catch all the Updates here!

Latest Updates

Trading Strategy Today by Anuj Gupta of IIFL Securities : Gold, Silver, Nifty, Bank Nifty, USDINR, Copper, Crude Oil

BUY MCX GOLD December AT 52700 STOP LOSS 52450 TARGET 53200

BUY MCX SILVER December AT 60500 STOP LOSS 59800 TARGET 61500

Buy MCX CRUDEOIL December AT 6700 STOP LOSS 6550 TARGET 6900

Buy MCX COPPER dec AT 677 STOP LOSS 671 TARGET 687

Buy Usdinr at 81.50 Stop Loss 81.20 target 82.10

Buy Nifty at 18280 Stop Loss 18100 target 18560

Buy Bank Nifty at 42250 Stop Loss 41900 target 42900

(Disclaimer: The views/suggestions/advises expressed here in this article is solely by investment experts. Zee Business suggests its readers to consult with their investment advisers before making any financial decision.)

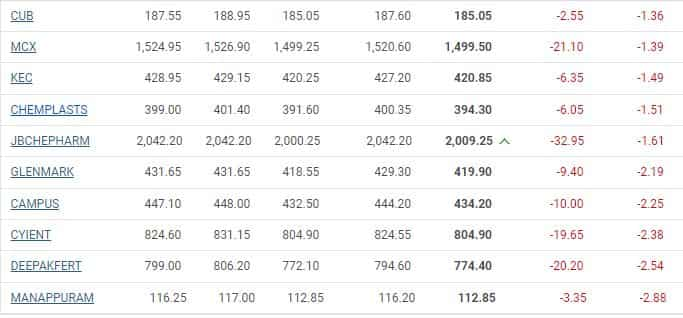

Stock Markets Live: Small Cap Index was relatively weak and there was sock specific action. In the 10 stock index, 42 stocks advance while 56 declined and two remained unchanged.

Maharashtra Bank, IIFL, IDBI and Aether were top gainers in this index while Deepka Fertiliser, Cyient and Mannapuram Finance were biggest losers.

Stock Markets LIVE Today: Broader Markets

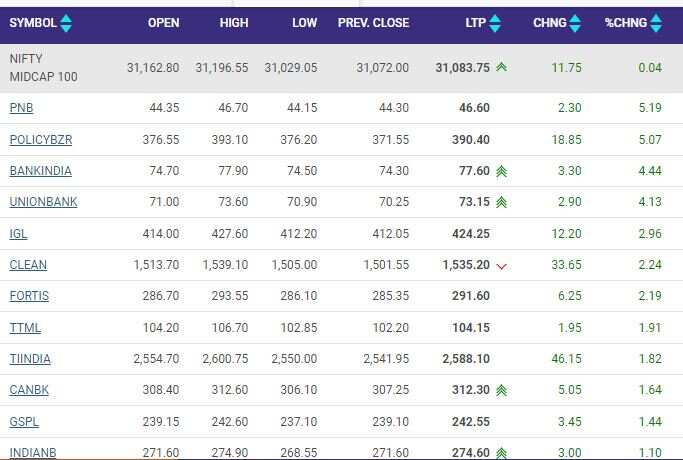

Lacklustre trade in broader markets was seen around this time. The NIFTY Mid Cap 100 was trading 31,075.15 almost flat from the Thursday closing. Bank were trading strongly with Punjab National Bank, Union Bank taking lead. Policy Bazar and Bank of India shares were also among top gainers.

Market Recap

Stock Markets Today LIVE UPDATES: US markets ended negatively on Thursday, recovering from day's lows. Dow 30 closed at 33,546.30, down 7.51 points or flat while S&P 500 closed at 3,946.56, down 12.23 points or 0.31 per cent. Nasdaq Composite ended at 11,145, down 38.70 per cent or 0.35 per cent. The late recovery was triggered by results from companies like Bed Bath and Beyond. The Wall Street was also looking at commentary from Fed on inflation and interest rates. St. Louis Fed President James Bullard on Thursday said that the policy rate was not yet in a zone that may be considered sufficiently restrictive indicating further rat hikes. He said that the hikes undertaken till now have not yielded the desired results.

Domestic stock markets ended in the red on Thursday amid profit booking. Nifty50 was trading at 18,343.90, down 65 points or 0.36 per cent while the 30-stock BSE Sensex was trading at 61,750.60, down by 230.12 points or 0.37 per cent. The top gainers were Tata Consumer Products, Adani Enterprises, Larsen & Toubro, Power Grid HDFC Life while the top losers were Apollo Hospitals, Tata Motors, Eicher Motors, Mahindra & Mahindra and Titan. Bank Nifty closed trading at 42,458.05, down by 77.25 points or 0.18 per cent.

Stock Markets Today: Recommendations from top brokerages on ICICI Bank, SBI, Axis Bank, Indigo, Vedanta

-- Morgan Stanley on Axis Bank (CMP: 858)

Maintain Overweight, Target 1150

Loan Demand is holding up well

Bank expects sustained market share gains, particularly in high margins segments

Margin Expansion has upside leg over near term

Deposit cost should catch up starting in Q4FY23

No asset quality concerns as of Now

Asses that credit cost could remain at below cycle averages in near term

Reiterated that cost to assets will moderate to 2% by FY25

HSBC on Axis Bank (CMP: 858)

Maintain Buy, Target 1075

___________________________

CLSA on ICICI Bank (CMP: 920)

Maintain Buy, Target 1200

Ni margins outlook is +ve; broad based growth pickup

Growing faster in the banking business on a low base

NI Margins outlook is +ve in a rising Interest rate environment

Low branch additions but not holding back on operating exp

Pristine asset quality, 17% return on equity, remain top pick

HSBC On ICICI Bank (CMP: 920)

Maintain Buy, Target 1100

___________________________

Morgan Stanley on AU Small Finance Bank (CMP: 611)

Maintain Overweight, Target 875

Bank looks to pursue growth in a risk calibrated manner in Tight liquidity Environ

Asset quality remains benign & slippages from restructured book are broadly in line

Bank continues to Invest in various Initiatives

Bank expects operating leverage to play out over next 2-3 years

_____________________________________

HSBC on SBI (CMP: 599)

Maintain Buy, Target 710

________________________

HSBC on Kotak Mahindra Bank (CMP: 1951)

Maintain Hold, Target 2030

_______________________________

HSBC on Bank Of Baroda (CMP: 164)

Maintain Buy, Target raised to 194 from 184

______________________________________

Goldman Sachs on Sun Pharma (CMP: 1013)

Maintain Sell, Target 830

Expect growth momentum to continue

Specialty Rev led by market share gains & New product ramp up to aid growth

New Pdt Launches in India Biz & Improvement in Mr productivity to aid growth

Co expects R&D Costs to inch higher as patient enrolments for its clinical trials pick up

___________________________________________

Morgan Stanley on Apollo Tyres (CMP: 278)

Maintain Overweight, Target 329

European business continues to gain share

Growth in india has mainly been led by pricing as volumes are flat

Co aims to remain as the pricing leader

Stable pricing & declining commodity costs likely to provide margin tailwinds in Q3FY23

From current 7% levels, Mgmt targets 12-15% ROCE

________________________________________________________

Morgan Stanley on Indian Hotels (CMP: 316)

Maintain Overweight, Target 381

Demand Momentum remains stong

G20 summit in India & wedding season should support demand in Q3

Supply growth is likely to remain Slower than demand growth

Supply growth would support a revenue PAR Upcycle

Mgmt sees its upper midscale hotel brand, Ginger as next driver growth

________________________________________________

CLSA on Info Edge (CMP: 3908)

Maintain Underperform, Target cut to 4100 from 4425

(management meet takeaways)

Steady execution but normalisation in IT demand is a dampener

Demand undercurrents are strong in real-estate & education businesses,

However, these businesses remain in investment mode

_______________________________________________

Nomura on Exide Industries (CMP: 187)

Maintain Buy, Target Raised to 221 from 216

2Q results in line

Steady growth to continue; plans to invest Rs 6000cr in Lithium-ion plant

raise FY23F revenue est. by 10% to factor in higher 1HFY23 run rate

Valuations attractive at 15.1x FY25F core EPS

____________________________________________

Morgan Stanley on Indigo (CMP: 1749)

Maintain Overweight, Target 2749

Mgmt highlighted that yields in Q3FY23 to date are well above Q1 levels

Domestic traffic is back to pre covid levels

Mgmt believes that international travel will be next leg of growth

No change in the ASKM Outlook But Q3 will face cost impact

________________________________

Citi on Vedanta (CMP: 307)

Maintain Sell, Target raised to 235 from 215

________________________________________

Morgan Stanley on PB Fintech (CMP: 372)

Maintain Overweight, Target 620

(Asia Pacific Summit Feedback)

Co reiterated its profit guidance of Rs1000cr for F27 &

adjusted EBITDA break-even in 4QF23

Management highlighted a lesser-known point–its cash losses are already near zero

Co does not have plans to set up any other businesses or intl ops

____________________________________

JP Morgan On Paytm (CMP: 540)

Maintain Overweight, Target 1100

Devices, lending, indirect costs-troika driving profitability in FY24

Co remains focused on achieving its Sep’23 target of Adj Ebitda breakeven

High quality investments will continue as bigger goal is to start generating higher free cash flows

______________________________

Citi on Consumer Staples

Consumer staple companies reported an in line Q2

Consumption demand remained under pressure

A key trend across companies is the likely strategy to increase ad spends

FY23E consensus earnings EPS est were cut more than rev est

Companies prioetize growth over profitability

Remain Selective – Prefer HUL, Britannia and GCPL

(Disclaimer: The views/suggestions/advises expressed here in this article is solely by investment experts. Zee Business suggests its readers to consult with their investment advisers before making any financial decision.)

Stock Markets Today: Rupee Vs Dollar

With Brent oil prices falling to USD 90 per barrel and dollar index at 106.67 levels rupee is expected to open at 81.55 levels, Anil Kumar Bhansali, Head of Treasury at Finrex Treasury Advisors LLP said.

The rupee had fallen to 81.80 levels overnight in NDF after some hawkish comments on interest rates by FED speakers but soon recovered, Bhnsali said.

The Finrex Treasury expert expects a stronger opening in rupee against the USD i a range of 81.20 to 81.80 for the day. "Exporters can sell near to 81.80 if they get it and importers may buy the dips towards 81.20 if they are able to get it," he opined.

On Thursday, rupee had fallen to 81.65 levels on dollar demands from corporates but remained in a small range throughout the day.

(Disclaimer: The views/suggestions/advises expressed here in this article is solely by investment experts. Zee Business suggests its readers to consult with their investment advisers before making any financial decision.)

Source: NSE

Source: NSE  Source: MCX

Source: MCX

Source: BSE

Source: BSE

Source: NSE

Source: NSE Source: MCX

Source: MCX