Stock Markets on 25 October - Sensex falls by nearly 300 points, Nifty50 ends below crucial 17700 levels amid profit booking ahead of Thursday holiday

Stock Markets Today Updates: Indian stock markets shed their opening gains and ended today's trading session in the red amid profit booking ahead of market holiday on 26 October, Wednesday. While the BSE Sensex ended at 59,543.96, down by over 287.70 points or 0.5 per cent, the 50-share Nifty50 index closed at 17,656.35, down by 74.40 points or 42 per cent. The domestic equity markets will remain shut for trading on account of Diwali Balipratipada. There was presure in the market due to lacklustre show by the FMCG sector and private banks. The markets will reopen on Thursday which will also be a day of monthly expiry. Catch the FULL UPDATES of the action here!

Stock Markets Today Updates: Indian stock markets shed their opening gains and ended today's trading session in the red amid profit booking ahead of market holiday on 26 October, Wednesday. While the BSE Sensex ended at 59,543.96, down by over 287.70 points or 0.5 per cent, the 50-share Nifty50 index closed at 17,656.35, down by 74.40 points or 42 per cent. The domestic equity markets will remain shut for trading on account of Diwali Balipratipada. There was presure in the market due to lacklustre show by the FMCG sector and private banks. The markets will reopen on Thursday which will also be a day of monthly expiry. Catch the FULL UPDATES of the action here!

Latest Updates

Deveya Gaglani, Research Analyst, Axis Securities

The negative correlation between the Gold and Dollar index continues. Gold prices are currently trading near two-week high, around the $1665 level, as the dollar index sank below $110 for the first time in 6-week, boosting precious metals appeal. There is a mounting expectation from the Fed that they will soften its aggressive stance this year. Investors are betting that economic data in the US will ultimately lead to a softer approach by the FED in raising interest rates at the end of the year. The dollar index is down by nearly 5 percent from its recent high hit in September. We expect Gold prices to gain traction in the near future as it is in oversold territory. As long as the $1620 level is intact on the downside, it may rally up to $1720 in the month of November.

(Disclaimer: The views/suggestions/advises expressed here in this article is solely by investment experts. Zee Business suggests its readers to consult with their investment advisers before making any financial decision.)

Anil Kumar Bhansali, Head of Treasury at Finrex Treasury Advisors LLP

Rupee moved in a range of 82.58 to 82.79 during the course of the day when volumes were low due to holidays in many parts of India and Asian currencies were all down against the dollar.

The dollar index was at 112.01 virtually unchanged while oil was also unchanged. The only change was in CNH which almost touched 7.36 levels keeping rupee weaker.

The Indian markets are closed tomorrow and we are expecting rupee to be range bound in the balance two days between 82.40 to 83.00 with risk to the upside for the pair.

(Disclaimer: The views/suggestions/advises expressed here in this article is solely by investment experts. Zee Business suggests its readers to consult with their investment advisers before making any financial decision.)

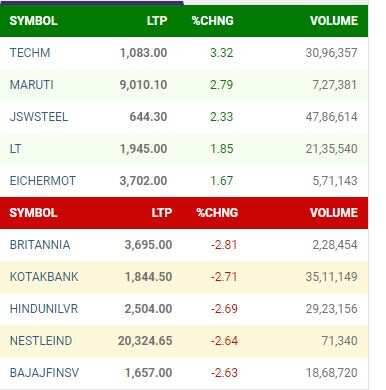

Nifty50, Sensex Top Gainers and Losers

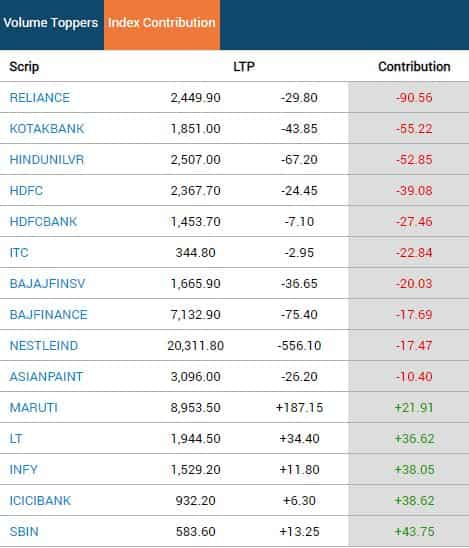

In the 30-stock BSE Sensex, 11 ended in the green while 19 in the red. The top gainers were Tech Mahindra, Larsen & Toubro, Maruti Suzuki, Dr Reddy's Laboratories and State Bank of India (SBI). The top losers were Nestle India, Hindustan Unilever, Bajaj Finserv, Kotak Mahindra Bank and HDFC.

In the 50-share Nifty50, 18 stocks advance while the remaining 32 declined.

Tech Mahindra, Larsen & Toubro, Maruti Suzuki, JSW Steel and Eicher Motors. The top losers were Britannia Industries Nestle India, Hindustan Unilever, Bajaj Finserv and Kotak Mahindra Bank.

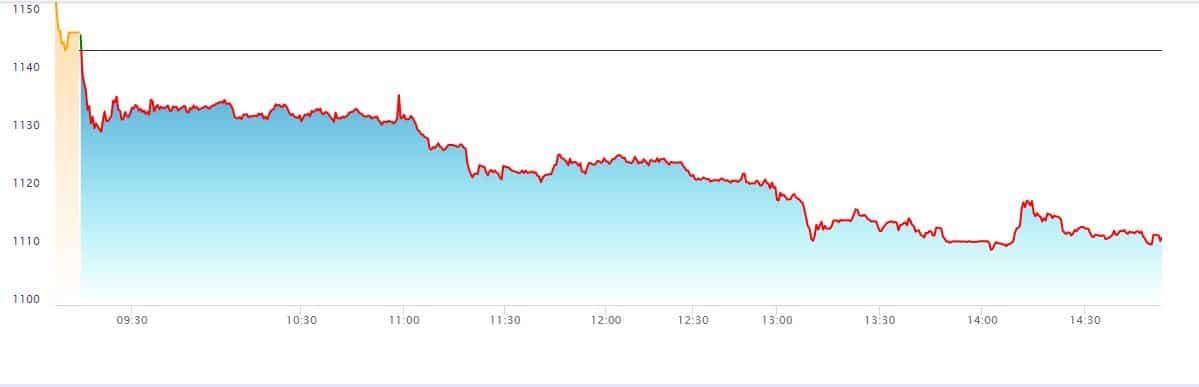

FSN E-Commerce Ventures or Nykaa shares have fallen below their issue price of Rs 1125 and were trading at Rs 1,111.65 on the NSE on Tuesday. The stock was down by Rs 32.25 or 2.82 per cent from the Monday closing price. In the process, the stock also hit its 52-week lows of Rs 1,108.05. The 52-week high is 2,573.70 which the stock hit in November last year.

Another stock Delhivery, also was trading at Rs 384.55, down by Rs 14.65 or 3.67 per cent from the previous closing price. The stock hit its 52-week lows of Rs 376.95 on 21 October.

Stocks to Buy - Expert Vikas Sethi gives two picks - one from cash market and second from Futures & Options.

RVNL: Sethi recommends Rail Vikas Nigam Limited has his top buy. The company is into developing rail infrastructure project implementation. He call this a compay with strong fundamantals and orderbook.

Another stock recommended by him is Hindustan Aeronautics Limited - another company with strong fundamentals. This is from the Futures & Options segment. The stock was recommended at a price of Rs 2508.40. Buying is advised in November futures, Sethi said.

Crude oil futures decline on low demand

Crude oil futures on Tuesday declined by 0.55 per cent to Rs 7,008 per barrel as participants trimmed their positions on low demand.

On the Multi Commodity Exchange, crude oil for November delivery fell by Rs 39 or 0.55 per cent to Rs 7,008 per barrel with a business volume of 4,227 lots.

Globally, West Texas Intermediate crude oil was trading 0.07 per cent higher at USD 84.64 per barrel, and Brent crude was down 0.05 per cent to USD 93.21 per barrel in New York.

Cottonseed oil futures fall on soft demand

Cottonseed oil cake prices on Tuesday declined by Rs 16 to Rs 2,419 per quintal in futures trade as participants reduced their bets following weak trends in spot markets.

On the National Commodity and Derivatives Exchange, cottonseed oil cake for December delivery fell by Rs 16 or 0.66 per cent to Rs 2,419 per quintal with an open interest of 41,460 lots.

Analysts said sell-off by participants at existing levels amid subdued trend in market mainly weighed on cottonseed oil cake prices.

Inputs from PTI

Volume Toppers on BSE today:

Market Expert Chandan Taparia's top recommendations

- Buy Nifty with a stop loss of 17500 and target of 17850

- Buy Bank Nifty on decline with a stop loss of Rs 40750 and price target of Rs 41840

- Buy Canara Bank with a stop loss of Rs 273 and price target of Rs 292

- Buy KPIT Technologies with a stop loss of Rs 720 and price target of Rs 765

(Disclaimer: The views/suggestions/advises expressed here in this article is solely by investment experts. Zee Business suggests its readers to consult with their investment advisers before making any financial decision.)

Nifty Midcap +0.40%

Nifty smallcap +0.105

Midcap Banks Gainers

South Indian Bank +17%

J&K Bank +7%

PNB +5%

Bank of India +4%

Cement Gainers

JK Lakshmi Cement +4.2%

Sagar Cement +2.50%

India Cement +2.50%

Saurashtra Cement +1.90%

Railway Gainers

RVNL +7%

Kernex Micro +5%

Rites Ltd +4%

Ircon International +3%

Midcap IT Gainers

KPIT Technologies +4%

Sasken Technologies +3.60%

Cigniti Technologies +3.5%

Persistent Systems +2.50%

Auto Ancillary Losers

Ramkrishna Forgings – 4%

Mahindra CIE - 2.5%

Lumax IND - 2.60%

Rane (Madras) -2.1%.

Consumer Durable Losers

TVS Electronics -3%

Amber Ent -2.60%

TTK Prestige -2.50%

Whirlpool -1.08%

Hosiery Losers

Page -2.50%

Lux Industies -2.30%

VIP CLothing -2%

Rupa and Company -1.05%

Pharma Losers

Laurus Labs - 5.55

Bajaj Healthcare - 2.50%

SMS Lifesciences - 2.10%

Strides Pharma -2%

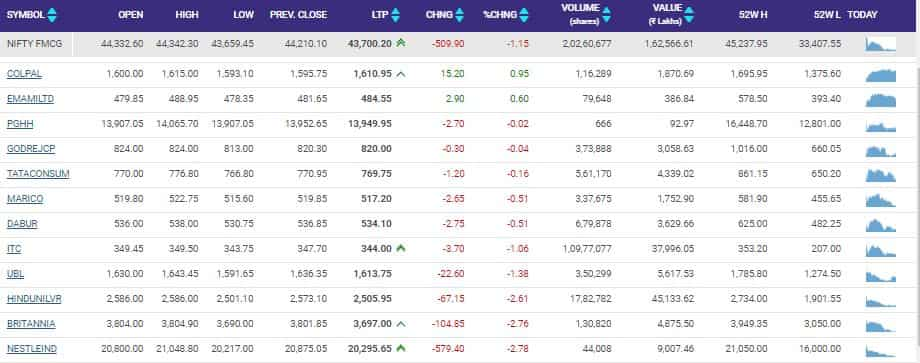

Indian markets today dragged because of a lacklustre show by FMCG and private banks. Pressure was seen in indices and in the overall markets. In the 15 sectoral indices on the NSE, 8 were trading in the red around 1:10 pm while sevem were in the green. The worst intraday performer was Nifty FMCG which was down by 1.15 per cent around this time. Ten stocks in this index were losers and the rest five were trading with gains. Nestle India and Britannia Industries were the biggest laggards while United Spirits and Varun Bewerages were top performers.

Rupee Vs Dollar:INR gains 26 paise to 82.62 against US dollar

The rupee appreciated 26 paise to 82.62 against the US dollar in early trade on Tuesday tracking a positive trend in domestic equities.

At the interbank foreign exchange, the domestic unit opened at 82.71 against the dollar, then gained some ground to quote at 82.62, a gain of 26 paise over its previous close.

In the previous session on Friday, the rupee slipped 9 paise to close at 82.88 against the dollar.

The forex market was closed on Monday on account of Diwali.

The dollar index, which gauges the greenback's strength against a basket of six currencies, slipped 0.12 per cent to 111.85.

Brent crude futures, the global oil benchmark, rose 0.28 per cent to USD 93.52 per barrel.

In the domestic equity market, the 30-share BSE Sensex was trading 51.96 points or 0.09 per cent higher at 59,883.62. Similarly, the broader NSE Nifty rose 23.80 points or 0.13 per cent to 17,754.55.

Foreign Institutional Investors (FIIs) were net sellers in the capital markets as they offloaded shares worth Rs 153.89 crore on Monday, according to exchange data.

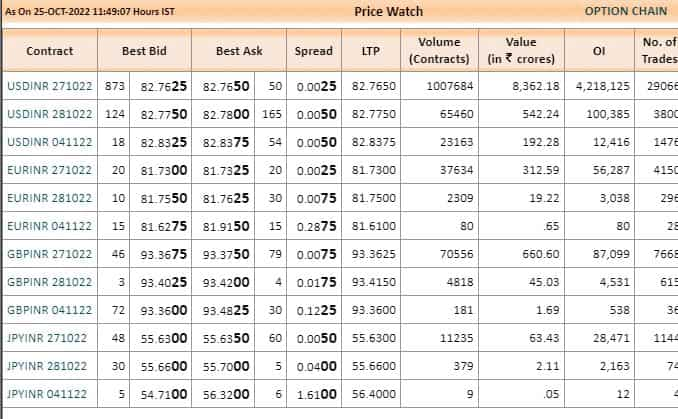

Currency expert Anuj Gupta recomemnds a BUY on NSE USDINR OCTOBER Futures at 82.60 with as stop loss of 82.40 with a price target of 82.90. The 27 October USDINR futures wee trading at 82.7775, down by 0.0550 or 0.0664 per cent.

Domestic stock markets gave some early gains and were trading in the green at 11:15 am on Tuesday. While the BSE Sensex was trading at 59,646.69 down by 184.97 points or 0.31 per cent, while Nifty50 was trading at 17,679.70, down by 51.05 points or 0.29 per cent.

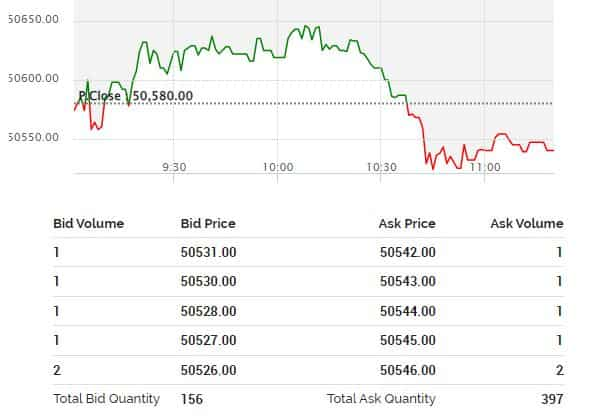

In the commodities markets, MCX December Gold futures were also trading with relative weakness around this time. The Gold Futures were trading at 50547, down by Rs 33 per 10 gram or 0.07 per cent. Meanwhile, 57685 was down by Rs 63 per kg and was trading at 57984.