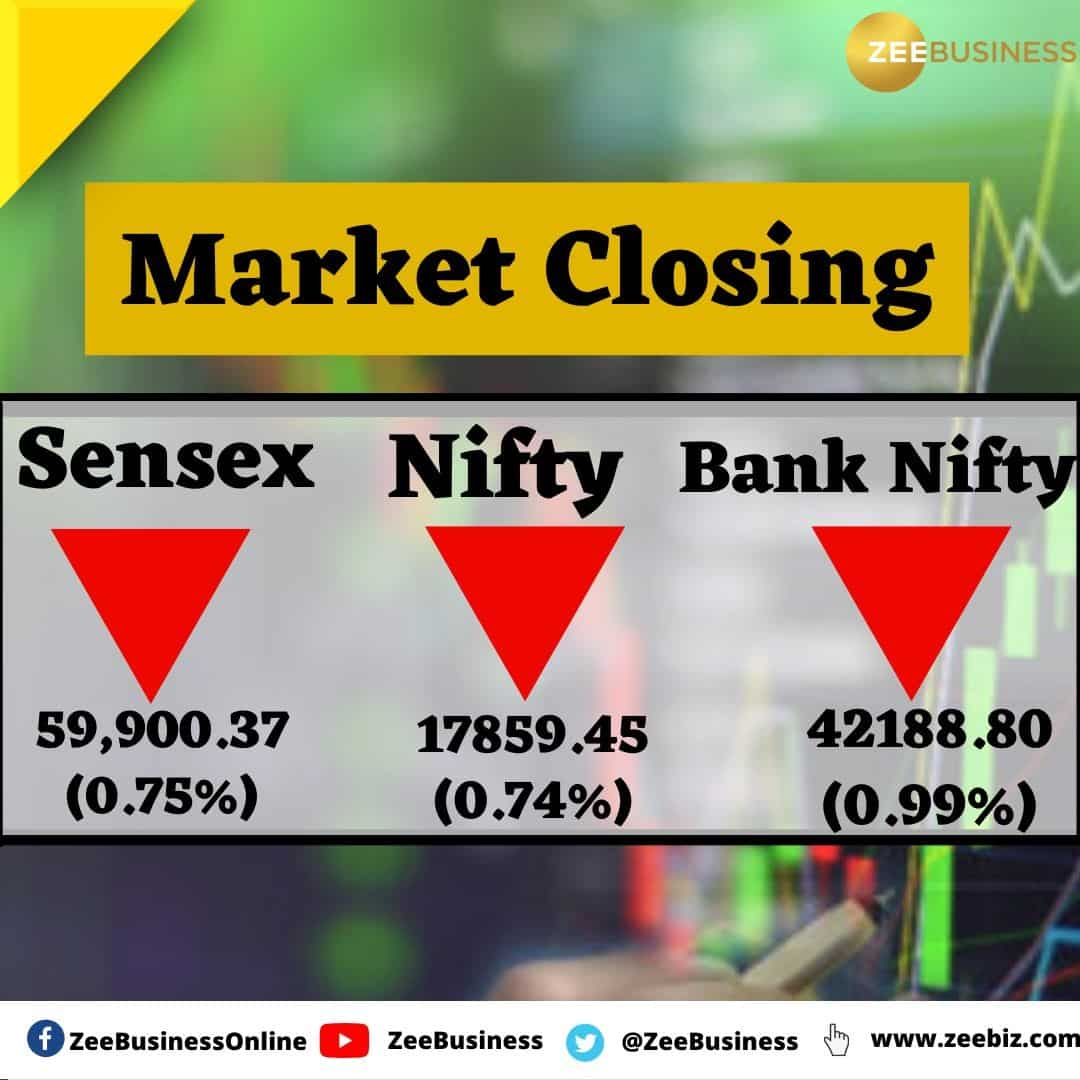

Stock Market HIGHLIGHTS: Sensex ends 453 points lower, Nifty50 gives up 17,900 as market extends losses to third straight day

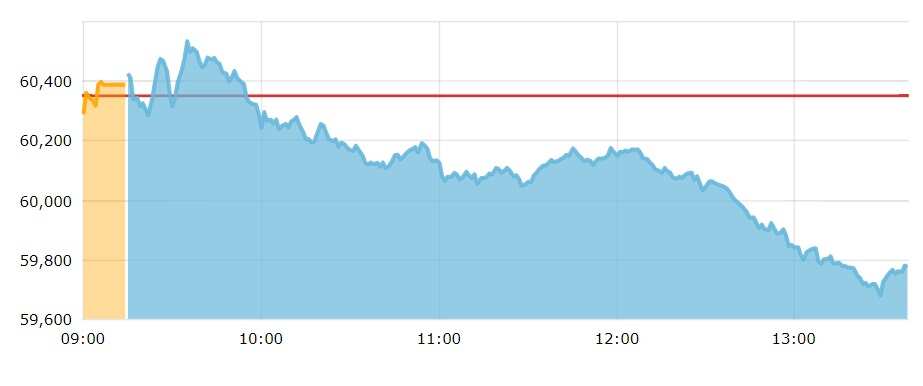

Stock Market HIGHLIGHTS: Indian benchmark indices S&P BSE Sensex and NSE Nifty50 extended losses to a third straight day on Friday amid selling pressure across sectors. Losses in financial and IT stocks including the likes of ICICI Bank, HDFC Bank, TCS and Infosys were the biggest drag on headline indices. The Sensex ended 452.9 points or 0.8 per cent lower at 59,900.4 and the Nifty50 settled at 17,859.5, down 132.7 points or 0.7 per cent from its previous close.

Here are 10 key things to know about the January 6 session:

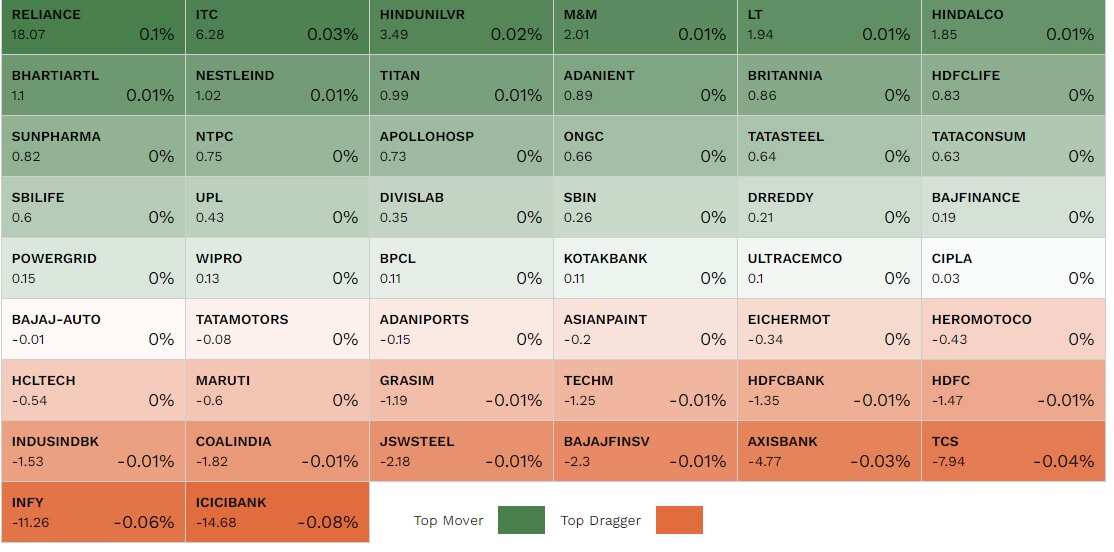

1) Thirty nine stocks in the Nifty50 basket finished lower. JSW Steel, TCS, IndusInd Bank, Bajaj Finance, Bajaj Finserv, Tech Mahindra, Coal India, Kotak Mahindra Bank and Infosys -- finishing between 1.7 per cent and three per cent lower -- were the top laggards. On the other hand, Britannia, Reliance, M&M, BPCL, ONGC, Nestle, Bajaj Auto and ITC -- rising between 0.5 per cent and 1.2 per cent -- were the top gainers.

2) TCS, Infosys, ICICI Bank and HDFC together contributed more than 250 points to the loss in the 30-scrip index.

3) Barring the Nifty FMCG and the Nifty Consumer Durables, which saw minor gains, all of NSE's sectoral gauges succumbed to negative territory.

4) The Nifty IT -- whose 10 constituents include IT majors TCS, Infosys and Wipro -- closed with loss of two per cent.

5) The Nifty Bank and the Nifty Metal gauges fell one per cent each.

6) Overall market breadth turned from largely neutral to negative in the second half of the day. At the close, the advance-decline ratio on BSE stood at 7:10, as 1,424 stocks rose and 2,084 fell.

7) The rupee depreciated by 16 paise or 0.2 per cent to settle at 82.72 against the greenback.

8) Crude oil rose on hopes of a boost in demand from China. Brent futures were last up 0.6 per cent at $79.2 a barrel.

9) European shares began the day on a mixed note, but were on track to log their best week in eight, as investors awaited euro zone inflation and US jobs figures for clarity on the future course of rate hikes. The UK's FTSE 100 was up 0.3 per cent at the last count. France's CAC was up 0.2 per cent and Germany's DAX down 0.1 per cent.

10) S&P 500 futures edged up 0.1 per cent, suggesting a mildly positive start ahead on Wall Street.

Catch all the LIVE action from the stock markets here. For all other news related to business, economy, tech, sport, auto and more, visit Zeebiz.com.

Stock Market HIGHLIGHTS: Indian benchmark indices S&P BSE Sensex and NSE Nifty50 extended losses to a third straight day on Friday amid selling pressure across sectors. Losses in financial and IT stocks including the likes of ICICI Bank, HDFC Bank, TCS and Infosys were the biggest drag on headline indices. The Sensex ended 452.9 points or 0.8 per cent lower at 59,900.4 and the Nifty50 settled at 17,859.5, down 132.7 points or 0.7 per cent from its previous close.

Here are 10 key things to know about the January 6 session:

1) Thirty nine stocks in the Nifty50 basket finished lower. JSW Steel, TCS, IndusInd Bank, Bajaj Finance, Bajaj Finserv, Tech Mahindra, Coal India, Kotak Mahindra Bank and Infosys -- finishing between 1.7 per cent and three per cent lower -- were the top laggards. On the other hand, Britannia, Reliance, M&M, BPCL, ONGC, Nestle, Bajaj Auto and ITC -- rising between 0.5 per cent and 1.2 per cent -- were the top gainers.

2) TCS, Infosys, ICICI Bank and HDFC together contributed more than 250 points to the loss in the 30-scrip index.

3) Barring the Nifty FMCG and the Nifty Consumer Durables, which saw minor gains, all of NSE's sectoral gauges succumbed to negative territory.

4) The Nifty IT -- whose 10 constituents include IT majors TCS, Infosys and Wipro -- closed with loss of two per cent.

5) The Nifty Bank and the Nifty Metal gauges fell one per cent each.

6) Overall market breadth turned from largely neutral to negative in the second half of the day. At the close, the advance-decline ratio on BSE stood at 7:10, as 1,424 stocks rose and 2,084 fell.

7) The rupee depreciated by 16 paise or 0.2 per cent to settle at 82.72 against the greenback.

8) Crude oil rose on hopes of a boost in demand from China. Brent futures were last up 0.6 per cent at $79.2 a barrel.

9) European shares began the day on a mixed note, but were on track to log their best week in eight, as investors awaited euro zone inflation and US jobs figures for clarity on the future course of rate hikes. The UK's FTSE 100 was up 0.3 per cent at the last count. France's CAC was up 0.2 per cent and Germany's DAX down 0.1 per cent.

10) S&P 500 futures edged up 0.1 per cent, suggesting a mildly positive start ahead on Wall Street.

Catch all the LIVE action from the stock markets here. For all other news related to business, economy, tech, sport, auto and more, visit Zeebiz.com.

Latest Updates

Bajaj Finance among Sanjiv Bhasin's top stock picks today

RBI, government in talks with South Asian countries to have cross-border rupee trade: Shaktikanta Das

The RBI Governor says the central bank is moving very carefully and cautiously on the launch of the digital rupee. (Read more)

The RBI kicked off the CBDC pilot project in December 2022 after the successful launch of a wholesale pilot.

Sensex and Nifty50 extend losses amid weakness across sectors

Both headline indices fall as much as 1.1 percent amid broad-based selling on Dalal Street. The 30-scrip index falls 678.8 points to hit 59,674.4 at the weakest level of the day so far.

The Nifty50 slides some four points below the 17,800 mark.

Top brokerages cut targets on M&M, Bajaj Auto, Hero MotoCorp, Maruti Suzuki

Goldman Sachs maintains a 'buy' on Maruti shares but lowers its target price for the stock to Rs 10,600 from Rs 11,250.

JP Morgan has maintained a ‘neutral’ call on the stock and brought down its target to Rs 8,310 from Rs 8,700. (Read more on auto stocks)

Can IDBI Bank share price surge to Rs 100?

IDBI Bank shares are trading near their intraday high. The stock is up 8.9 per cent at Rs 59.6 apiece on BSE with huge volumes.

A total of 42.7 lakh IDBI Bank shares have changed hands so far on Friday, as against a daily average of 14.1 lakh in the past two weeks, according to exchange data.

So what's driving the IDBI Bank stock? Capital market regulator SEBI has allowed the lender to reclassify government stake in it as public after its strategic disinvestment, subject to the condition that its voting rights do not exceed 15 per cent of the total voting rights.

The government and LIC together are looking to sell a 60.7 per cent stake in IDBI Bank, out of the 94.7 per cent that they hold. (Read more on IDBI Bank shares)

Godrej Industries, IDBI, Radico, Paytm top gainers in BSE 500 universe

Max Financial, Sona BLW Precision, GSFC, Sobha and Bandhan Bank are also among the stocks that are rising the most among some 180 gainers in the 500-scrip pack.

On the other hand, MMTC, Home First, GIC, Prism Johnson and UCO Bank are among the top laggards.

Most sectors in the red; Nifty FMCG among three indices that buck the trend

The Nifty IT and the Nifty Bank are among the worst hit sectoral indices on NSE at this hour.

| INDEX | Change |

| NIFTY IT | -0.8% |

| NIFTY PRIVATE BANK | -0.7% |

| NIFTY BANK | -0.7% |

| NIFTY MEDIA | -0.7% |

| NIFTY FINANCIAL SERVICES | -0.6% |

| NIFTY CONSUMER DURABLES | -0.2% |

| NIFTY AUTO | -0.2% |

| NIFTY PSU BANK | -0.2% |

| NIFTY REALTY | -0.2% |

| NIFTY PHARMA | -0.1% |

| NIFTY HEALTHCARE INDEX | 0 |

| NIFTY OIL & GAS | 0.1 |

| NIFTY METAL | 0.3 |

| NIFTY FMCG | 0.5 |

Markets LIVE - Trading Strategy by Anuj Gupta of IIFL Securities

Dow at 33168

Support 33000 / 32800

Resistance 333000 / 33550

Sideways to Up

SGX Nifty at 18050

Support 18000 / 17900

Resistance 18200 / 18350

Sideways

Bank Nifty at 42770

Support 42400 / 42100

Resistance 43000 / 43450

Sideways

USDINR at 82.56

Support 82.30 / 82.10

Resistance 82.70 / 82.85

Down

Daily Calls

Buy Gold FEB at 55000 STOP LOSS 54700 TARGET 55500

BUY Silver MARCH at 67500 STOP LOSS 66900 TARGEt 68500

Buy MCX COPPER January AT 715 Stop Loss 709 target 725

Buy crude oil January at 6050 Stop Loss 5950 target 6200

Buy NSE NIFTY AT 18000 STOP LOSS 17900 TARGET 18200

BUY BANKNIFTY AT 42400 STOP LOSS 42100 TARGET 43100

Sell USDINR January at 82.80 Stop Loss 83.10 target 82.20

(Disclaimer: The views/suggestions/advises expressed here in this article is solely by investment experts. Zee Business suggests its readers to consult with their investment advisers before making any financial decision.)

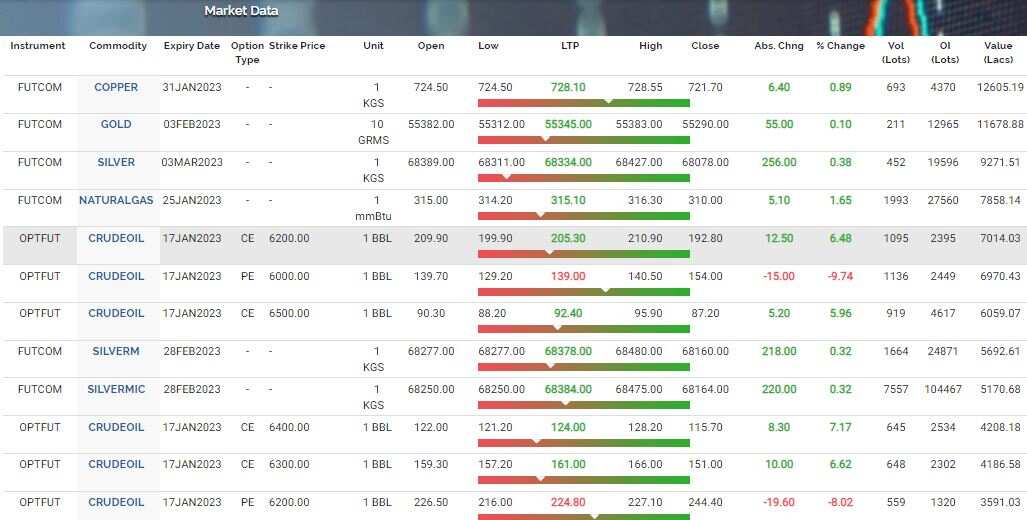

Source: MCX

Source: MCX Source: NSE

Source: NSE Source: NSE

Source: NSE