Stock Market HIGHLIGHTS: Flat closing for Sensex, Nifty ahead of monthly expiry; Titan, Maruti top gainers

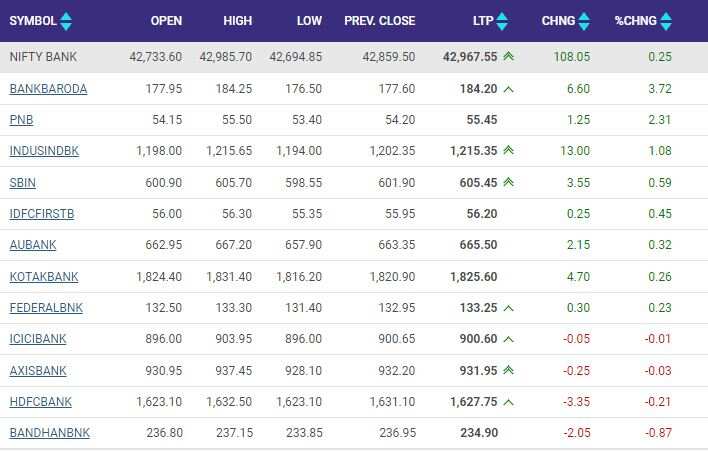

Stock Market HIGHLIGHTS: Indian frontline indices S&P BSE Sensex and Nifty50 ended flat on Wednesday trading in a narrow range for the entire session. Balance shifted between bulls and bears. While Sensex ended at 60,910.28, down by 17 points or 0.03 per cent, the broader market Nifty50 finished at 18,122.50, down just 9.80 points or 0.05 per cent. Banking gauge Nifty Bank closed 31 points or 0.07 per cent lower at 42,827.70.

Top takeaways from the day's action:

1) Nifty50 traded in a 100-point range.

2) In the 50-stock Nifty, 19 stocks advanced against 31 declines. The top gainers were Power Grid, Titan, Mahindra & Mahindra, UPL and Maruti Suzuki while top losers were Bharti Airtel, Apollo Hospitals, Bajaj Finserv, Axis Bank and Hindalco Industries.

3) Out of 15 Nifty sectoral indices, 9 ended in the red. Pharma and healthcare stocks were worst performers today with declines seen in banks, IT and metal stocks. The best performing indices were Consumer Durables, Oil & Gas and auto stocks.

4) There was stock specific action in broader markets as well, with selling pressure playing strongly ahead of the monthly expiry on Thursday. In the 100-stock Nifty Mid Cap 100, 42 advanced, 56 declined and 2 remained unchanged. The top gainers were Adani Wilmar, Tata Teleservices Maharashtra and JSW Energy while top losers were Union Bank, Indian Bank and Bank of India. In the Nifty Small 100, 44 stocks advanced, 55 declined and 1 remained unchanged. The top gainers were Deepak Fertilizers, Lux Industries and GNFC while top losers were Maharashtra Bank, Brightcom Group and Amararaja Batteries.

5) India VIX, a measure of volatility in Nifty was up 0.68 per cent at 15.40.

Read More: Multiple levers to lift Axis Bank stock, says Motilal Oswal; sees 21% upside

6) Out of 3,629 shares that were traded on BSE, 2,079 advanced, 1,399 declined while 151 remained unchanged. 71 stocks hit their 52-week highs while 35 hit their 52-week lows.

7) Rupee settles flat at 82.87 (provisional) against US dollar, PTI reported. USDINR moved in a range of 82.81 to 82.93 during the day with gains capped by RBI, Anil Kumar Bhansali, Head of Treasury at Finrex Treasury Advisors LLP said. Range for tomorrow is expected to be 82.40 to 83.20, he added.

8) Singapore-based SGX Nifty futures were trading in red at 18,137, down 11 points or 0.06 per cent. They were up 16 points or 0.09 per cent while Dow Futures were trading at 33,314, up by 72 points or 0.22 per cent. Asian benchmark indices traded mix with Nikkei 225 ending down 107 points or 0.41 per cent lower at 26,340.50 while China's Shanghai Composite closed at 3,087.57, up 8 points or 0.26 per cent.

9) In the commodity markets, Gold and Silver future prices corrected on MCX. February Gold futures were trading at 54760 per 10 gram, down by Rs 237 or 0.43 per cent while March Silver futures were trading at Rs 69242 per kg, down by Rs 559 or 0.80 per cent.

Read More: Rane Madras shares shoot-up 18% intraday; a conviction buy, says analyst with 20% upside

Catch all the Updates from the markets here. For all other news related to business, politics, sports, tech, auto and others, visit Zeebiz.com.

Stock Market HIGHLIGHTS: Indian frontline indices S&P BSE Sensex and Nifty50 ended flat on Wednesday trading in a narrow range for the entire session. Balance shifted between bulls and bears. While Sensex ended at 60,910.28, down by 17 points or 0.03 per cent, the broader market Nifty50 finished at 18,122.50, down just 9.80 points or 0.05 per cent. Banking gauge Nifty Bank closed 31 points or 0.07 per cent lower at 42,827.70.

Top takeaways from the day's action:

1) Nifty50 traded in a 100-point range.

2) In the 50-stock Nifty, 19 stocks advanced against 31 declines. The top gainers were Power Grid, Titan, Mahindra & Mahindra, UPL and Maruti Suzuki while top losers were Bharti Airtel, Apollo Hospitals, Bajaj Finserv, Axis Bank and Hindalco Industries.

3) Out of 15 Nifty sectoral indices, 9 ended in the red. Pharma and healthcare stocks were worst performers today with declines seen in banks, IT and metal stocks. The best performing indices were Consumer Durables, Oil & Gas and auto stocks.

4) There was stock specific action in broader markets as well, with selling pressure playing strongly ahead of the monthly expiry on Thursday. In the 100-stock Nifty Mid Cap 100, 42 advanced, 56 declined and 2 remained unchanged. The top gainers were Adani Wilmar, Tata Teleservices Maharashtra and JSW Energy while top losers were Union Bank, Indian Bank and Bank of India. In the Nifty Small 100, 44 stocks advanced, 55 declined and 1 remained unchanged. The top gainers were Deepak Fertilizers, Lux Industries and GNFC while top losers were Maharashtra Bank, Brightcom Group and Amararaja Batteries.

5) India VIX, a measure of volatility in Nifty was up 0.68 per cent at 15.40.

Read More: Multiple levers to lift Axis Bank stock, says Motilal Oswal; sees 21% upside

6) Out of 3,629 shares that were traded on BSE, 2,079 advanced, 1,399 declined while 151 remained unchanged. 71 stocks hit their 52-week highs while 35 hit their 52-week lows.

7) Rupee settles flat at 82.87 (provisional) against US dollar, PTI reported. USDINR moved in a range of 82.81 to 82.93 during the day with gains capped by RBI, Anil Kumar Bhansali, Head of Treasury at Finrex Treasury Advisors LLP said. Range for tomorrow is expected to be 82.40 to 83.20, he added.

8) Singapore-based SGX Nifty futures were trading in red at 18,137, down 11 points or 0.06 per cent. They were up 16 points or 0.09 per cent while Dow Futures were trading at 33,314, up by 72 points or 0.22 per cent. Asian benchmark indices traded mix with Nikkei 225 ending down 107 points or 0.41 per cent lower at 26,340.50 while China's Shanghai Composite closed at 3,087.57, up 8 points or 0.26 per cent.

9) In the commodity markets, Gold and Silver future prices corrected on MCX. February Gold futures were trading at 54760 per 10 gram, down by Rs 237 or 0.43 per cent while March Silver futures were trading at Rs 69242 per kg, down by Rs 559 or 0.80 per cent.

Read More: Rane Madras shares shoot-up 18% intraday; a conviction buy, says analyst with 20% upside

Catch all the Updates from the markets here. For all other news related to business, politics, sports, tech, auto and others, visit Zeebiz.com.

Latest Updates

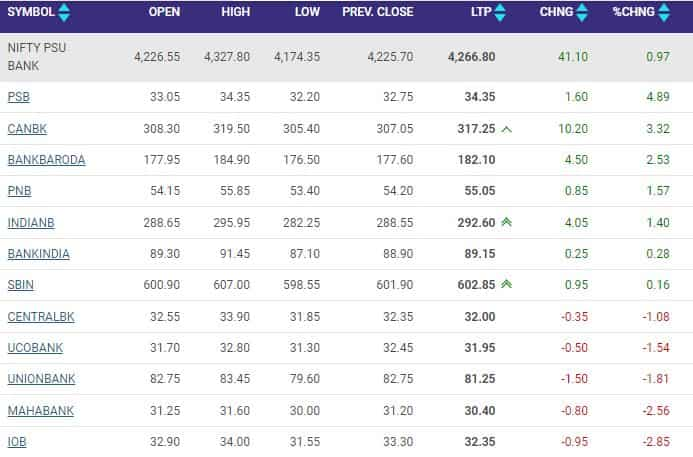

Markets LIVE - PSU Banks continue winning streak

In the 12-stock index, 7 were gainers with Punjab & Sind Bank astop gainer. PSB Board will meet on 30 December to consider on raising Rs 250 crore fund. The company plans to raise money via issue of FPO/QIP/ Rights issue.

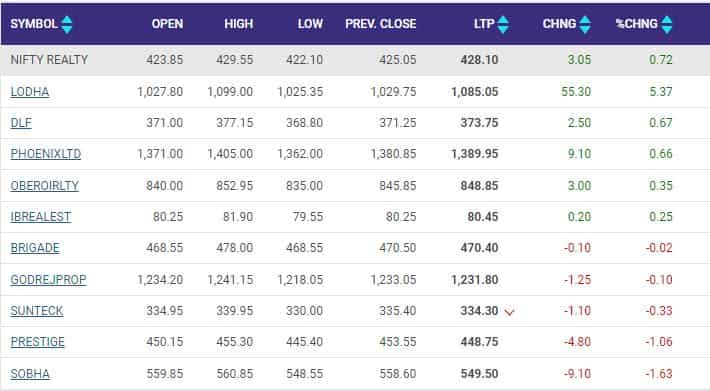

Markets LIVE - Housing sales up 19 pc in October-December across 8 cities, Nifty realy trades in green

Housing sales increased 19 per cent year-on-year to 80,770 units during the October-December period across eight major cities on better demand, according to PropTiger. Sales of residential properties stood at 67,890 units in the corresponding period of the last year.

According to housing brokerage firm PropTiger.Com's report Real Insight, the housing sales rose 50 per cent to 3,08,940 units during this year across eight major cities as compared to 2,05,940 units sold in 2021.

Nifty Reallty Index was trading at 426.90, up 0.44 per cent. Five stocks advanced in this 10-stock index. The top gainers were Macrotech Developers, DLF and The Phoenix Mills Limited while the top losers were Sobha and Prestige.

Vikas Wadhawan, Group CFO, Housing.Com, Makaan.Com & PropTiger.Com, said "Despite the steady climb in home loan interest rates, customers have been interested in locking in lower prices rather than fretting about mortgage interest rates."

As per the data, housing sales in Ahmedabad rose 23 per cent in October-December to 6,640 units from 5,420 units in the year-ago period. Sales were up 62 per cent in 2022 to 27,310 units from 16,880 units last year.

Bengaluru witnessed a 30 per cent drop in housing sales to 6,560 units in October-December from 9,420 units in the year-ago period. However, the IT city saw a 22 per cent growth in sales to 30,470 units in 2022 from 24,980 units last year.

Housing sales in Chennai fell 2 per cent to 3,160 units in the fourth quarter of this calendar year from 3,210 units in the year-ago period. But, in the full year, the city clocked 8 per cent higher sales to 14,100 units from 13,050 units in 2021.

Delhi-NCR market saw a 3 per cent fall in sales to 4,280 units during October-December from 4,430 units in the corresponding quarter last year. However, sales grew 7 per cent in the NCR to 19,240 units in 2022, from 17,910 units in the last year.

Inputs from PTI

Markets LIVE - Global markets at a glance

Singapore-based SGX Nifty futures wer trading in red at 18,164.5, recovering from morning losses. They were up 16 points or 0.09 per cent while Dow Futures were trading at 33,314, up by 72 points or 0.22 per cent.

Asian benchmark indices traded mix with Nikkei 225 ending down 107 points or 0.41 per cent lower at 26,340.50 while China's Shanghai Composite closed at 3,087.57, up 8 points or 0.26 per cent.

On Tuesday, US markets ended with losses. S&P 500 fell by 15.57 points or 0.40 per cent to 3,829.25 while Nasdaq Composite was down 144 points or 1.38 per cent at 10,353.20 on losses incurred by Tesla. Meanwhile, Dow 30 finished at 33,241.60, up 37.63 points or 0.11 per cent.

Markets LIVE - Triggers

-- 494 shares will go to T+1 system from Friday, 30 December, 2022.

-- Punjab & Sindh Bank board meeting to consider Rs 250 crore to raise funds

-- Welspun Enterprises board meeting to consder share buyback and interim dividend

-- Anjani Portland Cement- Right Issue of Shares to open (Period- 30th Dec to 19th Jan, Shares- 1.26 cr shares, Price- Rs 197 Ratio- 1:2 )

-- DFM Foods- Counter offer for delisting to open (Period- 30 Dec to 5th Jan, No of Shares- 1.32 crore, Price- Rs 467)

IPO:

-- Elin Electronics IPO - Listing likely on 30 December (Price Band- Rs 234 to 247, Issue Size- 475 Cr, OFS- 300cr, Subscription-3.09 times)

-- Sah Polymers- IPO to open (Period- 30 Dec to 4th Jan, Price- Rs 61 to Rs 65, Lot Size- 230 Shares, Issue Size- 66.3Cr)

Record Date:

Technocraft Industries (India)- Buy Back of Shares (No of Shares- 15 Lakh, Price- Rs 1000)

Global:

UK- New Year's Day Half-Day Trading (Early close at 12:30)

UK- House Price Index for Dec

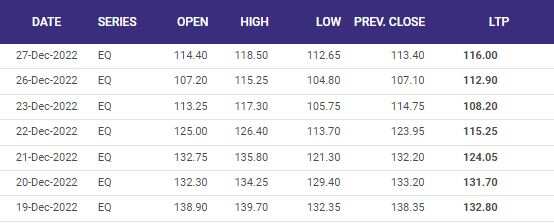

Markets LIVE - Buzzing Stock

IRFC Share Price NSE: Shares of Indian Railway Finance Corporation (IRFC) surged on Wednesday amid a volatile session in the markets. The Indian Railways stock opened in green at Rs 32.15 apiece on NSE and zoomed around 4 per cent to hit day's high of Rs 33.20. Market expert Ambareesh Baliga said the counter could show Rs 35-36 levels over the next few days. The Railway sector has outperformed in 2022 and that IRFC has been in momentum.

Markets LIVE - Nifty Index Quarterly Rebalancing

Nifty Index Quarterly Rebalancing

Adjustment date - December 29

Changes to be effective-December 30

Source – Nuvama

Nifty 50 – Index wt changes

Weight up Old wt% New wt%

Axis bank 3.1% 3.2%

Bharti airtel 2.6% 2.6%

Adani ports 0.7% 0.8%

Weight down Old wt% New wt%

Bajaj finserv 1.2% 1.0%

Bajaj – auto 0.6% 0.5%

Kotak Bank 3.4% 3.3%

Nifty bank – Index wt changes

Weight up Old wt% New wt%

HDFC Bank 26.9% 27.7%

ICICI Bank 23.5% 24.2%

Kotak Bank 10.0% 10.2%

Indusind Bank 5.6% 6.2%

Federal bank 1.9% 2.2%

BOB 2.4% 2.6%

Weight down Old wt% New wt%

Axis bank 12.5% 10.2%

SBI 11.1% 10.2%

CPSE Index - Index wt changes

Weight up Old wt% New wt%

Powergrid 19.5% 20%

NTPC 19.5% 20%

Weight down Old wt% New wt%

ONGC 20.9% 20%

COAL INDIA 17.2% 17.1%

BEL 13.3% 13.2%

by Nupur Jainkunia

Markets LIVE -Stock in Focus

Rane (Madras) Limited shares shot-up 18 per cent in the intraday trade on Wednesday, maintaining a strong momentum from the past three trading sessions. The stock was trading at Rs 431.95 on the NSE, up by Rs 61.60 or 16.63 per cent around 12:10 pm.

The shares of Rane Madras gained on a report from Icra which said that the industry size of airbags, a key safety feature in vehicles, will likely to grow to up to Rs 7,000 crore by FY2027 in India, from the current levels of around Rs 2,500 crore.

This auto component manufacturing company makes steering and suspension systems and boasts of clients including Audi, BMW, Hyundai, Daimler among others.

Market expert Simi Bhaumik recommends a buy in this counter. The current momentum, she said, will stay. She said that it will reclaim its 52-week high of Rs 452.95 that it had hit in January this year.

Read More: Rane Madras shares shoot-up 18% intraday; a conviction buy, says analyst with 20% upside

Markets LIVE - Stock to Buy is Axis Bank; experts tell why?

Axis Bank shares have a potential upside of Rs 200 per share as multiple levers could lift the price upwards, brokerage firm Motilal Oswal opines. The bank remains on track to deliver sustainable 18 per cent returns on equity (RoE) while offsetting the rising funding cost, it said in a note.

Motilal Oswal maintains a buy on Axis Bank stock with a price target of Rs 1130 which is nearly 21 per cent higher from the price at which it was recommended.

Read More: Multiple levers to lift Axis Bank stock, says Motilal Oswal; sees 21% upside

Markets LIVE - Nifty Bank Movement

Nifty PSU Bank index was gaining with slight gains. In the 12-stock index, 8 were gainers, 3 declined while 1 stock remained unchanged. The top gainers were Bank of Baroda and PNB which were up 3.71 per cent and 2.32 per cent, The top losers were Bandhan Bank, HDFC Bank and Axis Bank.

Commodity LIVE - Expert take on Crude Oil, Gold

Gold

“COMEX Gold is trading a tad lower in the early session today after good gains in the previous session. On Tuesday Gold spiked to as high as $1841.9/oz as dollar weakened. However, the close was much

lower near $ 1823/oz as rising US treasury yields capped the gains. Holdings in SPDR gold witnessed an inflow of 5.5 tons or 0.60 as on Dec 27. The inflow was the biggest inflow in one day (in tons) since 17th June 2022," Ravindra V. Rao, CMT, EPAT, VP-Head Commodity Research Kotak Securities said.

"We expect the prices to remain range bound amid lack of triggers and thin volume amid year-end holiday season. On the price front we maintain that the range bound move will continue until the range of USD 1778-1830/oz breaks on closing basis," he added.

Crude

“WTI Crude oil ended flat on

Tuesday after hitting a session high of around USD 81.20/bbl. In today’s early session crude is trading mildly higher just above USD 79.50/bbl mark. Recently oil has been supported by refinery closures in the US due to severe winter storm Elliott, further relaxation in COVID restrictions in China and Russia’s response to G7 and EU’s price cap on Russian oil. Crude might continue to take cues from China’s COVID stance as well reopening of refineries as US weather comes to normal. On the technical front, we maintain that the bulls might target $81.50 before we see some corrective move as 52 DMA resistance is placed

near $81.76/bbl that could limit further gains in oil.” - Ravindra V. Rao

(Disclaimer: The views/suggestions/advises expressed here in this article is solely by investment experts. Zee Business suggests its readers to consult with their investment advisers before making any financial decision.)

Source: NSE

Source: NSE

Source: BSE

Source: BSE