Stock Market Highlights: Sensex, Nifty50 end negative for 3rd day in row as covid-led concerns hit D-Street; Metal, Auto stocks drag

Stock Market Today Updates: Correcting for the third straight session, the Indian equity markets on Thursday closed in the red, emanating concerns related to the comeback of coronavirus. The benchmark indices – Sensex and Nifty50 – ended below levels of 61,000 and 18,150, dragged by Metal, Auto, and Private Bank stocks today

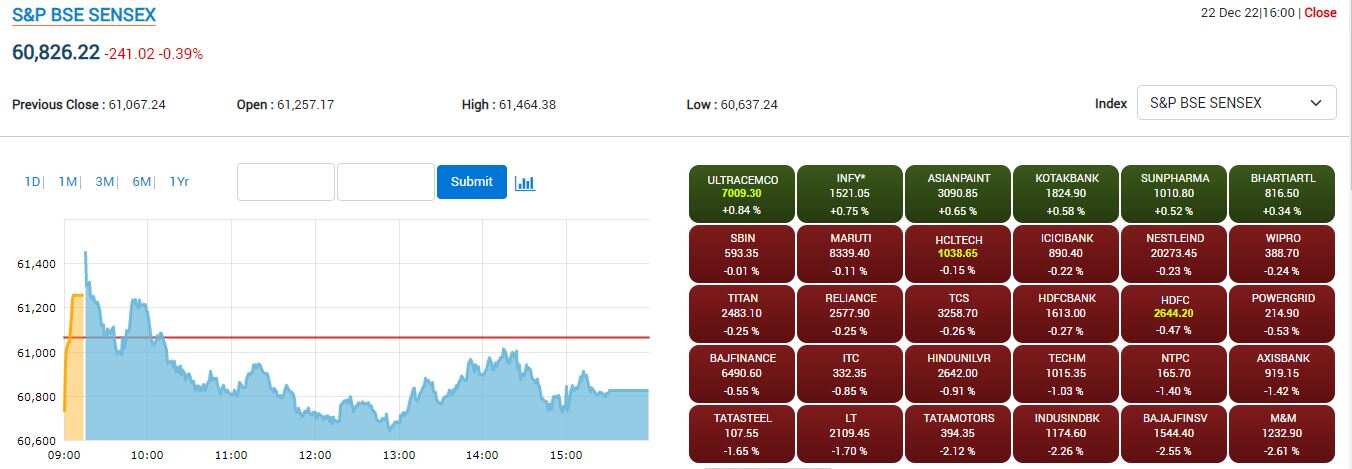

At the market open, the BSE Sensex was down 241 points or 0.39 per cent to the 61,826 level, and Nifty50 was down 72 points or 0.39 per cent to the 18,127 level on Thursday. Similarly, the broader markets underperformed the benchmarks as Nifty mid and small-cap ended between 0.5-1 per cent lower.

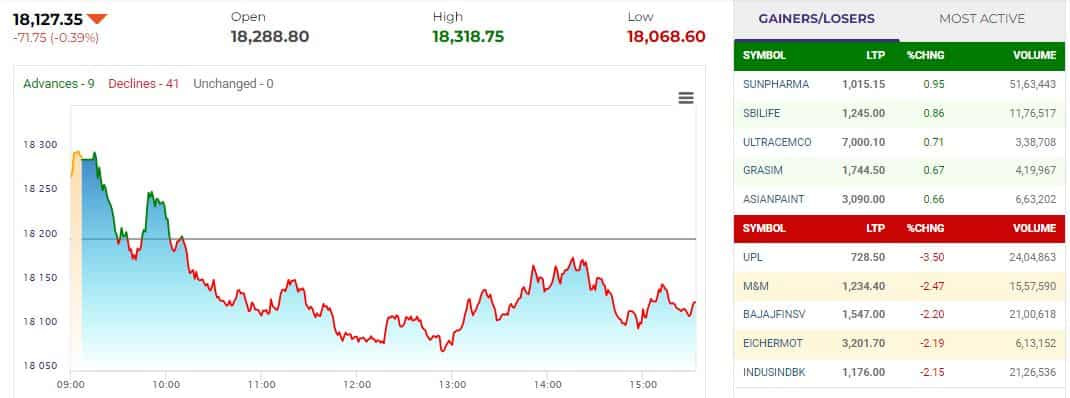

As many as 09 stocks advanced, while 41 declined on Nifty50 at the close. Heavyweights such as UltraTech Cement, Asian Paint, Infosys, SBI Life, and Grasim were each down between 0.5-1 per cent today. Conversely, UPL cracked around 3.5 per cent, followed by Bajaj Finserv down 2.5 per cent at the market close.

While Auto stocks such as M&M, Eicher Motor, Tata Motors were also among the top laggards, each down over 2 per cent, while Tata Steel, BPCL, L&T, and Axis Bank were each down between 1-1.5 per cent at the market close.

Global stock markets rose on Wednesday, as the US consumer confidence rebounded in December, and the dollar regained stability after the Bank of Japan rocked markets with a surprise decision to loosen its grip on government bond yields.

Catch all the updates from the stock markets here. For all other news related to business, politics, sports, tech, auto and others visit Zeebiz.com.

Stock Market Today Updates: Correcting for the third straight session, the Indian equity markets on Thursday closed in the red, emanating concerns related to the comeback of coronavirus. The benchmark indices – Sensex and Nifty50 – ended below levels of 61,000 and 18,150, dragged by Metal, Auto, and Private Bank stocks today

At the market open, the BSE Sensex was down 241 points or 0.39 per cent to the 61,826 level, and Nifty50 was down 72 points or 0.39 per cent to the 18,127 level on Thursday. Similarly, the broader markets underperformed the benchmarks as Nifty mid and small-cap ended between 0.5-1 per cent lower.

As many as 09 stocks advanced, while 41 declined on Nifty50 at the close. Heavyweights such as UltraTech Cement, Asian Paint, Infosys, SBI Life, and Grasim were each down between 0.5-1 per cent today. Conversely, UPL cracked around 3.5 per cent, followed by Bajaj Finserv down 2.5 per cent at the market close.

While Auto stocks such as M&M, Eicher Motor, Tata Motors were also among the top laggards, each down over 2 per cent, while Tata Steel, BPCL, L&T, and Axis Bank were each down between 1-1.5 per cent at the market close.

Global stock markets rose on Wednesday, as the US consumer confidence rebounded in December, and the dollar regained stability after the Bank of Japan rocked markets with a surprise decision to loosen its grip on government bond yields.

Catch all the updates from the stock markets here. For all other news related to business, politics, sports, tech, auto and others visit Zeebiz.com.

Latest Updates

Company Update: JK Cement Jumps Over 1%

JK Cement paint arm JK Paints to invest Rs 153 cr in 1st tranche for the acquisition of 60 per cent stake in Acro Paints.

The remaining 40 per cent stake of Acro Paints shall be acquired over a period of 12 months.

Shares of JK Cement surged over 1 per cent to Rs 3040 per share on the BSE on Thursday.

Volatility Index India Was Up By 4% In Early Trade

The India VIX index, which measures the market’s volatility, was at the day’s high level, gaining more than 4 per cent to 16.225 in the early morning trade on Thursday. Eventually, the index is in the red with a minor cut at 15.50 level. Read More

Ace Investor Ashish Kacholia Offload Stakes In This Company

Ace investor Ashish Kacholia dumped over 2 lakh shares in D-Link (India) Limited through open market transactions on Wednesday. The share price of the computer hardware and equipment company cracked more than 6 per cent to trade at Rs 215 per share on the BSE during Thursday’s trading session.

YES Securities On Markets

India’s resilience to global turbulence is amply manifested in its outperformance. The moderated retail participation in the market (owing to decreased demat accounts) suggests that the market is not in an overheated zone. In such a scenario, heavyweight stocks like Banks, and IT Services look attractive.

Market Update: Sensex, Nifty Slip Further

Domestic markets slip further as Sensex declined over 300 points and Nifty50 trades below 18100 – each down more than 0.5 per cent. While the broader markets continue to underperform as Midcap Index falls more than 1 per cent on Thursday.

Tata Power Slips Over 6%

Tata Power shares slumped over 6 per cent to Rs 215.35 per share on the BSE intraday during Thursday's trading session. The stock opened at Rs 214.90. At 12:15 PM, the stock quoted Rs 207.30, declining by 3.04 per cent from the previous day's close of Rs 213.80 apiece.

The stock has been trading under pressure. It slumped around 7 per cent in the past 5 sessions. Zee Business panelist and Global Capital Market's Himanshu Gupta recommended a 'Sell' rating on the counter.

Stock To Buy: Prestige Estate

Hemang Jani of Motilal Oswal Financial Services on Thursday, December 22, recommended shares of Prestige Estate to Zee Business viewers as 2023 pick. Jani, who is the group senior VP at the financial company, said that the outlook of the real estate sector is positive. Read More

What Market Analyst Says On Covid Concerns

"Investors need to be careful of the sharp intra-day volatility seen in the last few sessions due to growing uncertainty over rising COVID cases in China and recessionary fears in key economies," said Prashanth Tapse - Research Analyst, Senior VP (Research), Mehta Equities Ltd.

Bandhan Bank Shares Down 6%

Shares of Bandhan Bank slumped on Friday, December 22, on the back of the private lender receiving a binding bid of Rs 801 crore from an Asset Reconstruction Company (ARC) for its written-off portfolio.

The stock opened at Rs 247.95 on NSE. At 10:57 AM the counter quoted Rs 227.60, declining 6.40 per cent.

The bank received the offer on a security receipts consideration basis, for the written-off portfolio with an outstanding of Rs 8,897 crore.

YES Securities On Markets

Foreign Institutional Investors (FII) inflows are returning to the Indian market and the best of FII flows are yet to come, with their positive shift for Indian equities in the fag-end of 2022,

Similarly, Nifty will tend to move to a new high over the next 12 months. India holds a concrete advantage over other markets and India’s manufacturing will gain from production-linked incentives and global re-shoring.

Rupee Vs Dollar Update

The rupee strengthened against the US dollar in opening trade on Thursday due to a weak greenback in the overseas markets and early gains in domestic equity markets.

Firm crude oil prices and forex outflows from capital markets, however, restricted the rupee's gains, according to forex dealers.

At the interbank foreign exchange market, the rupee opened higher at 82.78 to a dollar against the previous close of 82.84.

With PTI Inputs

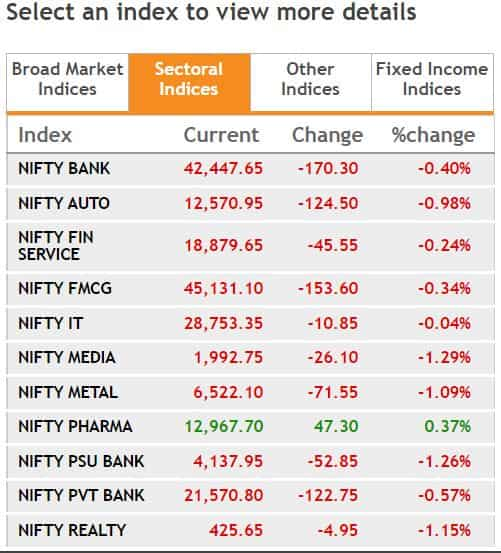

Sectoral Update: Only Pharma Index In Green

Except for the Pharma index on NSE, all other sectors are in the red. Nifty Metal and Realty along with Auto continue to drag the market today on Thursday as each slipped around 1 per cent. Similarly, other sectors such as Nifty Bank, Financials, and FMCG were down marginally.

On the contrary, Nifty Pharma was up around 0.3 per cent on the NSE, led by stocks like Sun Pharma, Alkem Labs, Gland Pharma, and Lupin today.

Sula Vineyard IPO Makes Tepid Listing

India’s largest wine producer, Sula Vineyards made a tepid stock market debut on NSE and BSE. The shares were listed at a premium of 1.12 per cent to Rs 361 per share on the NSE and 0.28 per cent to Rs Rs 358 on the BSE on Thursday.

Goldman Sachs Bullish On KPIT Technologies

The global brokerage firm maintained a Buy rating on the stock with a target price of Rs 930 per share. The counter on Thursday was trading over 1.5 per cent higher to Rs 714.5 per share on the BSE intraday.

In management meet takeaways, Goldman Sachs said that the lateral hiring efforts focused largely around on the senior architect level, similarly, the ability to win entire vehicle platform projects versus single programs earlier supporting deeper client relationships. It added that longer duration of demand visibility against general IT services pointing to sustainable period of high organic growth