Stock Market Today Highlights: Indices slip for 7th day in a row; Sensex down 200 points, Nifty settles below 16,850

Stock Market Latest Update: The Indian markets ended Thursday’s session on a negative note, extending decline for seventh straight session ahead of RBI monetary policy’s decision tomorrow. The BSE Sensex fell around 200 points, while Nifty50 settled below 16850-mark today.

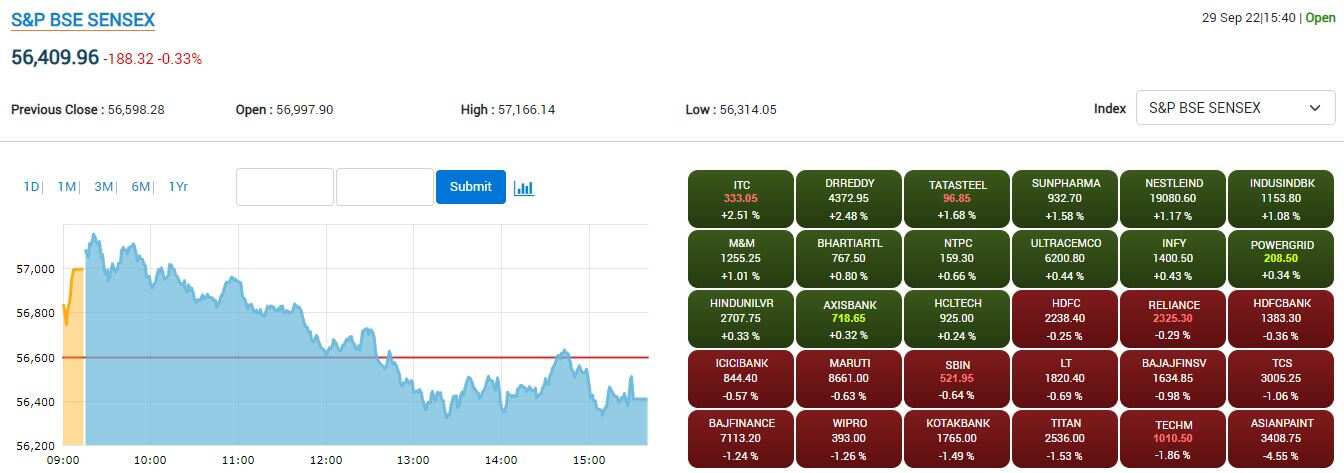

At the market close, the BSE Sensex was down by around 200 points or 0.33 per cent to 56,409 levels and the Nifty50 dipped by around 40 points or 0.24 to 16,818 levels. The broader markets outperformed the benchmarks as Nifty mid and small cap gained 0.4 and 0.6 per cent respectively.

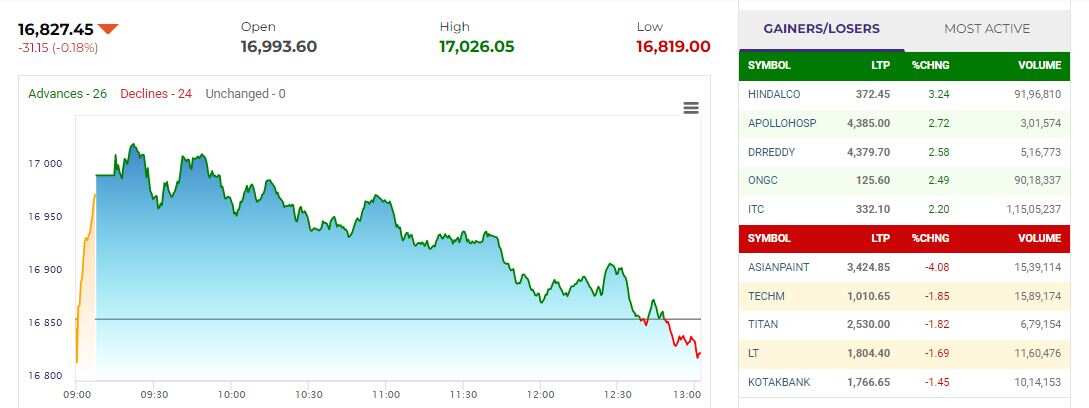

As many as 23 stocks advanced and 27 declined on the Nifty50 index. State-owned ONGC along with metal major Hindalco gained most, followed by HDFC Life, Apollo Hospital and ITC, conversely, Asian Paints slipped most in today’s trade, followed by Tech Mahindra, Hero Moto and Bajaj Auto.

Sectorally, most of the indices were in the green with Nifty Pharma and FMCG gaining most by around 1 per cent, while Nifty IT dragged the overall market most along with Bank, Financials, Auto segment during today’s session.

Stock Market Latest Update: The Indian markets ended Thursday’s session on a negative note, extending decline for seventh straight session ahead of RBI monetary policy’s decision tomorrow. The BSE Sensex fell around 200 points, while Nifty50 settled below 16850-mark today.

At the market close, the BSE Sensex was down by around 200 points or 0.33 per cent to 56,409 levels and the Nifty50 dipped by around 40 points or 0.24 to 16,818 levels. The broader markets outperformed the benchmarks as Nifty mid and small cap gained 0.4 and 0.6 per cent respectively.

As many as 23 stocks advanced and 27 declined on the Nifty50 index. State-owned ONGC along with metal major Hindalco gained most, followed by HDFC Life, Apollo Hospital and ITC, conversely, Asian Paints slipped most in today’s trade, followed by Tech Mahindra, Hero Moto and Bajaj Auto.

Sectorally, most of the indices were in the green with Nifty Pharma and FMCG gaining most by around 1 per cent, while Nifty IT dragged the overall market most along with Bank, Financials, Auto segment during today’s session.

Latest Updates

Editor’s Take: Anil Singhvi On Nykaa’s Bonus Issue

With Nykaa planning to issue bonus shares, Zee Business Managing Editor, Anil Singhvi shared his views on why issuance of bonus shares is not a big win for investors, while comparing ITC and Nykaa’s stock price during today’s edition of Editor’s Take. Full Report

Pharma Stocks Surge Upto 5%

In an otherwise weak market, the pharma stocks are on roll as they surged up to 5 per cent on the NSE on Thursday. The Nifty Pharma is one of the top sectoral gainers as compared to 0.16 per cent fall in the Nifty. Full Report

Sun Pharma Shares Up 7% In 2 Sessions – Here’s Why?

Surging for the second straight session, Sun Pharmaceutical share price has touched a five-month high to Rs 955 levels on the BSE and NSE intraday, after gaining over4 per cent on Thursday. Full Report

Multibagger Stock: Go Fashion Shares Hit New Life High

Go Fashion (India) share price touched a new lifetime high of Rs 1,373.90 and Rs 1374.6 per share on the BSE and NSE intraday, respectively, after surging nearly 6 per cent during Thursday’s trading session on the back of a healthy outlook. Full Report

Blue Dart Express Share Price Jumps 3.5%

Blue Dart Express share price gained over 3.5 per cent to Rs 8,881 and Rs 8,889 per share on the BSE and NSE, respectively, intraday on Thursday, after the company announced its general price increase (GPI) effective from January 1, 2023. Full Report

Nykaa Share Price Jumps 4% - Here’s Why?

Nykaa share price jumped over 4 per cent on Thursday on account of the announcement that the company could soon announce bonus shares. Full Report

Derivative Outlook:

The nifty weekly contract has highest open interest at 17000 for Calls and 16000 for Puts while monthly contracts have highest open interest at 17000 for Calls and 16800 for Puts. Highest new OI addition was seen at 17000 for Calls and 16000 for Puts in weekly and at 17000 for Calls and 16700 for Puts in monthly contracts. FIIs increased their future index long position holdings by 64.12%, increased future index shorts by 16.54% and index options by 9.26% in Call longs, 12.57% in Call short, -1.33% in Put longs and 14.50% in Put shorts.

- Anand James - Chief Market Strategist at Geojit Financial Services,

Stocks To Buy With Anil Singhvi

IIFL Securities Director Sanjiv Bhasin on Thursday said that market volatility is not in anyone's hands, but it is a suitable time to buy good shares. In a special segment ‘Bhasin Ke Hasin Share' aired on Zee Business with Managing Editor Anil Singhvi, he picked Tata Steel and HDFC AMC Futures as the best bet. Full Report

Nifty Bank Jumps 1% Ahead Of RBI Policy Decision Tomorrow

Bank stocks are in focus during Thursday’s session as Nifty Bank jumped by over 1 per cent to 38,243 levels in the early morning trade. All stocks in Nifty Bank traded in the green, aiding most to the overall markets today. Full Report

Market Outlook: What Should Investors Do?

"When negative sentiments become dominant, the risk-off gathers momentum and markets get oversold. Then, usually, an unexpected trigger reverses the near-term outlook leading to short covering and a market rally. This was precisely what happened yesterday in global markets when the Bank of England surprised markets with Quantitative Easing. This desperate act by BoE is more a reflection of the economic woes of the UK. But the market’s interpretation of the BoE’s surprise decision is that the Fed might pause its rate hike to avert a sharp economic downturn. The relief rally is likely to soon run out of steam and, therefore, investors need not make aggressive buys now.

- Dr. V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services

Rupee Outlook:

The sharp pull back after playing around in the 82 vicinity hints at bullish exhaustion. Inability to pull back above 81.6 would confirm a drop extending as far as 80.95. Alternatively, expect sideways moves while above 81.6.

- Anand James - Chief Market Strategist at Geojit Financial Services

Nifty Outlook:

With 16860 encouraging bulls to regroup on anticipated lines, the play today would be to see how far Nifty could stretch on the bounce. The 17170 region is natural resistance. We expect this to be overcome, but fear that long liquidation pressure will re-emerge much before 17350 is achieved. As maintained earlier, rejection trades would rekindle prospects of 16650-16300.

- Anand James - Chief Market Strategist at Geojit Financial Services