Stock Market HIGHLIGHTS: Bank Nifty star performer as index hits new life high of 42800; Sensex, Nifty end with minor gains

Stock Market HIGHLIGHTS: Bank Nifty was the show stopper for today as the banking index hit a lifetime high of 42860 on the intraday basis before closing with a 220 point lead at 42,680.90. BSE Sensex closed at 61,510.58, up 91.62 points or 0.15 per cent after hitting intraday high of 61,780.90. Meanwhile, Nifty50 settled at 18,267.25, up 23 points or 0.13 per cent. The 50-stock index hit highs of 18,325.40.

Here are top highlights of the day' trade

23.05 (0.13%)

1) Frontline indices traded in a range ahead of the monthly expiry on Thursday. Bank Nifty moved in a 300-point range.

2) The top gainers on Nifty50 were Apollo Hospitals, Bajaj Finance, HDFC Life, JSW Steel and SBI while top losers were Adani Enterprises, Power Grid, Hero MotoCorp, Tech Mahindra and Adani Ports. 25 stocks gained and 25 declined.

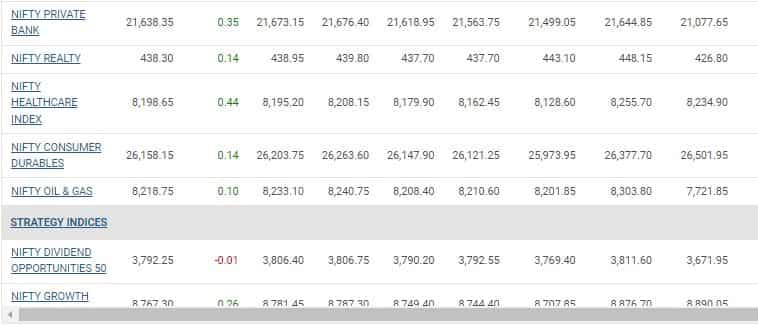

3) Of the 15 Nifty sectoral indices, 12 ended positively against 3 losers. The top gainers were Nifty Media (+1.14 per cent) Nifty PSU Bank (+1.02 per cent) and Nifty PSU Bank (+0.64 per cent). Nifty IT and Nifty Metal were top losers.

4) At 14.04, India VIX, a measure of volatility in Nifty ended up 1.44 per cent from the Tuesday closing level.

5) There was stock specific action in broader markets with Nifty Mid Cap 100 closing at 31,150.65, up 0.26 per cent. Nifty Small Cap 100 settled at 9,691.30, higher by 0.54 per cent.

6) The rupee depreciated 18 paise to close at 81.85 (provisional) against the US dollar on Wednesday on dollar demand from importers and recovery in crude oil prices. Forex traders said sustained foreign fund outflows and concerns over rising COVID-19 cases in China also weighed on investor sentiments. At the interbank foreign exchange market, the local unit opened at 81.81 and later witnessed an intraday high of 81.74 and a low of 81.87 during the session. The domestic unit finally settled at 81.85 against the American currency, registering a fall of 18 paise over its last close of 81.67. PTI

7) Inox Green Energy Serivices IPO was listed at a discount. The stock ended at Rs 59.25 on the NSE, down Rs 5.75 or 8.85 per cent from the issue price.

Catch all the day's UPDATES here!

Stock Market HIGHLIGHTS: Bank Nifty was the show stopper for today as the banking index hit a lifetime high of 42860 on the intraday basis before closing with a 220 point lead at 42,680.90. BSE Sensex closed at 61,510.58, up 91.62 points or 0.15 per cent after hitting intraday high of 61,780.90. Meanwhile, Nifty50 settled at 18,267.25, up 23 points or 0.13 per cent. The 50-stock index hit highs of 18,325.40.

Here are top highlights of the day' trade

23.05 (0.13%)

1) Frontline indices traded in a range ahead of the monthly expiry on Thursday. Bank Nifty moved in a 300-point range.

2) The top gainers on Nifty50 were Apollo Hospitals, Bajaj Finance, HDFC Life, JSW Steel and SBI while top losers were Adani Enterprises, Power Grid, Hero MotoCorp, Tech Mahindra and Adani Ports. 25 stocks gained and 25 declined.

3) Of the 15 Nifty sectoral indices, 12 ended positively against 3 losers. The top gainers were Nifty Media (+1.14 per cent) Nifty PSU Bank (+1.02 per cent) and Nifty PSU Bank (+0.64 per cent). Nifty IT and Nifty Metal were top losers.

4) At 14.04, India VIX, a measure of volatility in Nifty ended up 1.44 per cent from the Tuesday closing level.

5) There was stock specific action in broader markets with Nifty Mid Cap 100 closing at 31,150.65, up 0.26 per cent. Nifty Small Cap 100 settled at 9,691.30, higher by 0.54 per cent.

6) The rupee depreciated 18 paise to close at 81.85 (provisional) against the US dollar on Wednesday on dollar demand from importers and recovery in crude oil prices. Forex traders said sustained foreign fund outflows and concerns over rising COVID-19 cases in China also weighed on investor sentiments. At the interbank foreign exchange market, the local unit opened at 81.81 and later witnessed an intraday high of 81.74 and a low of 81.87 during the session. The domestic unit finally settled at 81.85 against the American currency, registering a fall of 18 paise over its last close of 81.67. PTI

7) Inox Green Energy Serivices IPO was listed at a discount. The stock ended at Rs 59.25 on the NSE, down Rs 5.75 or 8.85 per cent from the issue price.

Catch all the day's UPDATES here!

Latest Updates

"With the FOMC minutes to be released tonight the market is sceptical of the direction for USDINR to be taken and moved within a range of 8 paise during the entire day. The dollar index moved lower to 106.90 but again regained the level of 107 and was last quoting at 107.10. Brent oil was at $ 89.21 per barrel up from the morning. Chinese yuan had however moved to 7.16 from 7.14 keeping $ on bid side against the rupee. Wall street futures were slightly higher at 26 points as most Asian and European indices were flat while the Sensex and nifty gained by 0.4%. The rupee opened at 81.75 and was at 81.80 for most part of the day and is expected to remain between 81.40 and 82.00 for the rest of the week. Premiums continued to remain at 2.15% The cash premiums are also lower suggesting Cash dollar Shortage keeping spot well bid." - Anil Kumar Bhansali, Head of Treasury, Finrex Treasury Advisors LLP

(Disclaimer: The views/suggestions/advises expressed here in this article is solely by investment experts. Zee Business suggests its readers to consult with their investment advisers before making any financial decision.)

Gold Price Strategy - Expert take

Commodity expert Anuj Gupta of IIFL Securities recommend a Buy on December Gold Futures at Rs 52200 with a stop loss of 51900 and target of Rs 52800

Buying is also recomended in MCX December Silver futures at 61000 with a stop loss of Rs 60300 and target of Rs 62500.

(Disclaimer: The views/suggestions/advises expressed here in this article is solely by investment experts. Zee Business suggests its readers to consult with their investment advisers before making any financial decision.)

Paytm share: Shares of Paytm's parent company — One 97 Communications — hit yet another 52-week low on Wednesday as selling in this stock remains unabated. One 97 Communications shares' RSI (Relative Strength Index) suggests that the stock is trading in an oversold territory.

The RSI has fallen below 20 to 16.8 according to data sourced from Trendlyne. The level below 20 is considered as strongly oversold.

Another indicator, MFI or Money Flow Index has ebbed to 4.7, significantly lower from a benchmark of 20 and indicates a massive selling in the counter.

Out of 9 oscillators, 7 are trading below, the data suggests.

Markets Live - Broader Market Action

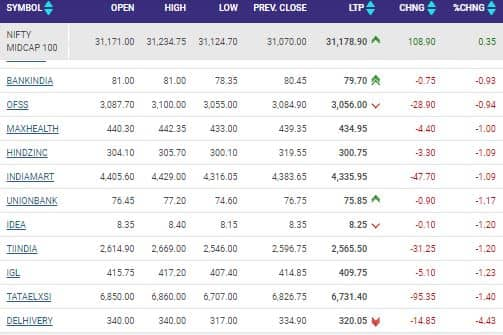

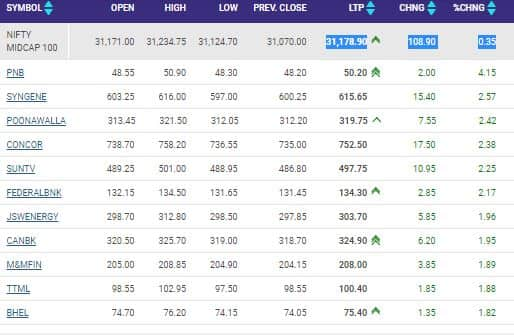

There was stock specific action in broader markets. Nifty Mid Cap 100 was trading with a 100-point gains at 31,178.90. PNB was the top gainer in this segment. Syngene, Concor and SunTV were other stocks that were trading up. Delhivery, Tata Elxsi and IGL were top losers in this segment. 61 stocks advanced while 39 declined.

Stock MArket LIVE - Top recommendations

Nifty 50 +0.16% 18273

Nifty 500 +0.18% 15538

Sensex +o.13% 61500

Bank Nifty +0.45% 42650

Top Nifty Losers

Tata Consumer Products -0.6%

ITC -0.5%

Power Grid Corp of India -0.5%

IndusInd Bank -0.4%

Top Nifty Gainers

HDFC Life Insurance Co +1.5%

Apollo Hospitals Enterprise +1.5%

Bajaj Finance +1.4%

State Bank Of India +1.2%

Fertilizer Stock in Focus

RCF +11.%

National Fertilizers + 9.2%

FACT + 7.3%

GNFC + 5.7%

Stock in Focus

Edelweiss Financial Service +11.5%

TCNS Clothing +8.4%

KPIT Tech +4.4%

Top Losers

Olectra Greentech - 5.3%

Delhivery -4.6%

UCO Bank -4%

Credit Access Grameen _2.5%

Top Gainers

RHI Magnestia India +9.6%

NBCC +7.16%

RVNL 5.4%

PNB +4.3%

Stock in Focus: Maruti Suzuki shares

Maruti Suzuki India Limited ’s (MSIL) shift from diesel to CNG and hybrid options could be a game changer for the company, global brokerage firm UBS said. The brokerage sees an estimated Rs 3100 per share gains for investors. This translates into 35 per cent upside from level of Rs 8874 at which the stock was recommended.

The Zurich headquartered financial services company said that Maruti’s shift from diesel will be a big positive or for country’s largest passenger car maker. The move will trigger customer switch to CNG and hybrid options, UBS noted.

Gold Price Today - What to do with yellow metal?

A strong support zone in Comex Gold is seen around USD 1730 level and breakdown and sustained selling below it may drag prices lower towards USD 1710 by this week, Deveya Gaglani, Research Analyst, Axis Securities said. On the other hand, breakouts above USD 7150 may push prices higher towards USD 1790 level, Gaglani said.

"Gold prices retreated from 52500 level after prices failed to sustain near the day's high in the last session. Comex gold is trading flat near $1740 on Wednesday, as the dollar index corrected on expectations that the Federal Reserve will hike interest rates at a slower pace in the near-term. Fed officials said in recent weeks that the central bank is likely to raise interest rate by 50 basis points (bps) in December. Such a structure is positive for Bullions, which was hammered by aggressive rate hikes this year. As the US market is closed tomorrow, we have a bulk of important economic data this evening. Investors will be closely tracking it as the economic data print may influence the rate hike decision," the Axis Securities expert said.

(Disclaimer: The views/suggestions/advises expressed here in this article is solely by investment experts. Zee Business suggests its readers to consult with their investment advisers before making any financial decision.)

Stocks to Buy, Sell or Hold - What brokerages say?

- Credit Suisse on Ultratech Cement (CMP: 6843)

Maintain Outperform, Target 7700

- Morgan Stanley on Nykaa (CMP: 175)

Maintain Overweight, Target 314

- Citi on Lupin (CMP: 720)

Maintain Buy, Target raised to 840 from 820

If gpiriva is approved, co is expected to enjoy sole exclusivity in a

$500-700m market for next couple of yrs

Product has potential to repair margins from sub 10% to c17-18% levels

On other hand, if approval is delayed following additional queries from USFDA,

believe downside is ltd as strong flu season in US

& impact of Suprep can help margins in 3QFY23, limiting downside

- Credit Suisse on Shree Cement (CMP: 23265)

Maintain Neutral, Target 21000

(Disclaimer: The views/suggestions/advises expressed here in this article is solely by investment experts. Zee Business suggests its readers to consult with their investment advisers before making any financial decision.)

Stocks to Buy, Sell or Hold: What brokerages recommend?

- Citi On Larsen & Toubro Infotech (CMP: 4756)

Sell, Target 4510

LT-IMINDTREE Merger

Key Things To Watch

A) Key Employee Attrition, If Any

b) progress on integration.

Challenging macro & focus shifting inwards could mean challenges near term.

There should be synergies playing out in medium term

- Macquarie on Siemens (CMP: 2804)

Maintain Outperform, Target 3020

- Citi on Vedanta (CMP: 310)

Maintain Sell, Target 235

- Macquarie on Siemens (CMP: 2804)

Maintain Outperform, Target 3020

(Disclaimer: The views/suggestions/advises expressed here in this article is solely by investment experts. Zee Business suggests its readers to consult with their investment advisers before making any financial decision.)

Inox Green Energy IPO Listing - Inox Green Energy IPO Listing Date, Inox Green Energy IPO Listing Pirce: Inox Green Energy Services failed to make a strong debut on the bourses today, November 23. Shares of Inox Green Energy open at Rs 60.50 apiece on the Bombay Stock Exchange (BSE) and Rs 60 apiece on the National Stock Exchange (NSE) - at a discount of around 5 per cent from the issue price of Rs 65. Earlier, Zee Business Managing Editor Anil Singhvi had said that short term investors can keep a stop loss of Rs 60.

The stock was trading at Rs 60 on NSE, down Rs 5 or 7.69 per cent.

Source: NSE

Source: NSE