Highlights! Stock Market News Today: Sensex dips over 600 points, Nifty50 settles below 16,900 – Metal, FMCG, Auto top laggards

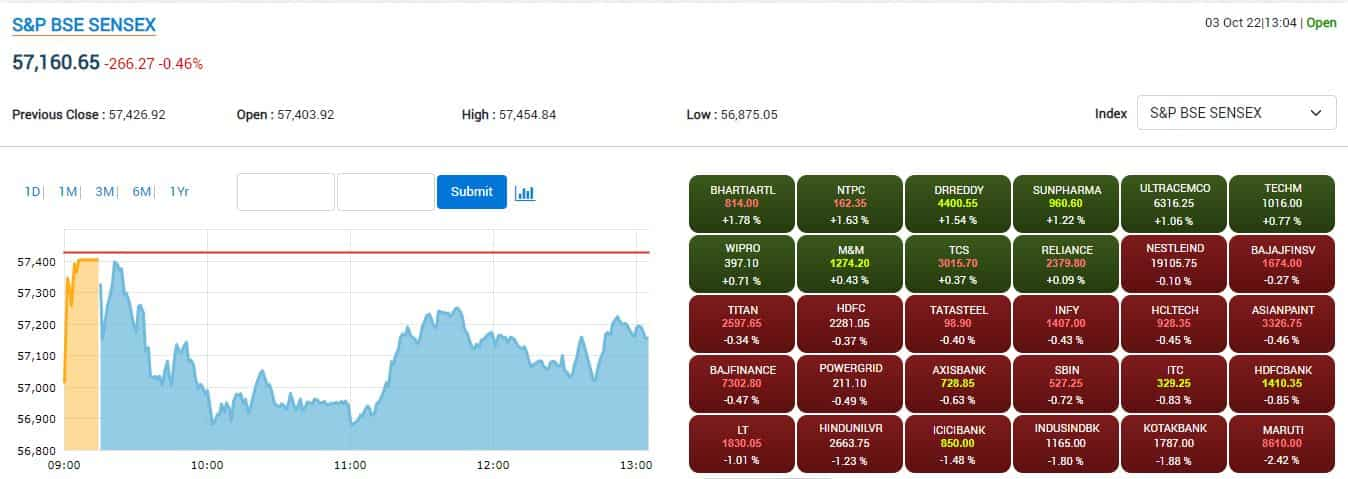

Stock Market Live Updates: The Indian markets ended Monday’s session on a negative note, down over 1 per cent amid high volatility tracking weak global cues. The BSE Sensex slumped more than 600 points and Nifty50 settled below 16,900 levels.

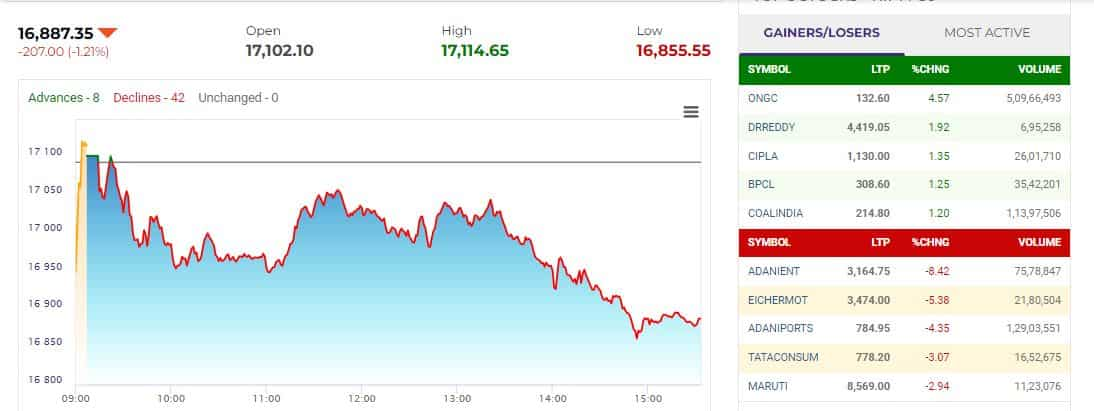

At the market closed, the BSE Sensex dipped 638 points or 1.11 per cent to 56,789, while Nifty50 fell by 207 points or 1.21 per cent to 16,887 levels on Monday. Following benchmark suites, the broader markets too declined, as Nifty mid-cap and small-cap down over 1 per cent and 0.5 per cent at close.

The 12-share banking index – Nifty Bank fell by 602 points or 1.56 per cent to 38,029 levels, dragged by private lenders such as IndusInd Bank and Kotak Mahindra Bank each down over 2 per cent.

As many as 8 stocks advanced and 42 declined on Nifty50. Adani Enterprises slumped over 8 per cent, followed by Eicher Motors down over 5.5 per cent and Adani Ports down over 4 per cent. While ONGC gained over 4 per cent, Dr Reddy around 2 per cent, and BPCL up over 1 per cent.

Except for pharma, all sectoral indices closed in the red on Monday at the close. Nifty Metal tumbled most by around 3 per cent, followed by Nifty FMCG and Auto each declined around 2 per cent, while Nifty Pharma was the only sector that gained over 1 per cent in an otherwise weak market on Monday.

Stock Market Live Updates: The Indian markets ended Monday’s session on a negative note, down over 1 per cent amid high volatility tracking weak global cues. The BSE Sensex slumped more than 600 points and Nifty50 settled below 16,900 levels.

At the market closed, the BSE Sensex dipped 638 points or 1.11 per cent to 56,789, while Nifty50 fell by 207 points or 1.21 per cent to 16,887 levels on Monday. Following benchmark suites, the broader markets too declined, as Nifty mid-cap and small-cap down over 1 per cent and 0.5 per cent at close.

The 12-share banking index – Nifty Bank fell by 602 points or 1.56 per cent to 38,029 levels, dragged by private lenders such as IndusInd Bank and Kotak Mahindra Bank each down over 2 per cent.

As many as 8 stocks advanced and 42 declined on Nifty50. Adani Enterprises slumped over 8 per cent, followed by Eicher Motors down over 5.5 per cent and Adani Ports down over 4 per cent. While ONGC gained over 4 per cent, Dr Reddy around 2 per cent, and BPCL up over 1 per cent.

Except for pharma, all sectoral indices closed in the red on Monday at the close. Nifty Metal tumbled most by around 3 per cent, followed by Nifty FMCG and Auto each declined around 2 per cent, while Nifty Pharma was the only sector that gained over 1 per cent in an otherwise weak market on Monday.

Latest Updates

Market Outlook: What Should Investors Do Tomorrow?

The Nifty lacked follow-through buying on October 03, after having formed a bullish outside bar & an Engulfing bull candle on September 30. It witnessed downside pressure throughout the day & ultimately formed an Inside bar pattern on the daily chart. In terms of the Fibonacci retracement, it retraced nearly 78.6% of Friday’s rise where the key Fibonacci level acted as a support near 16840. The weekly chart shows that the index has once again moved down to retest its key weekly moving averages. The overall structure shows that the index has stepped into a short-term consolidation mode & can see consolidation near 16800-17200. The internal structure shows that a move towards the upper end of the range is likely in the coming sessions.

- Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas

INR vs USD: Rupee Outlook

We expect Rupee to trade with a negative bias on risk aversion in global markets amid concerns over the financial health of Credit Suisse. Concerns over global economic slowdown may also put downside pressure on Rupee. However, any measures by RBI may prevent sharp fall in Rupee. The rupee may also take cues from India’s trade deficit and US ISM manufacturing PMI data. USDINR spot price is expected to trade in a range of Rs 80.50 to Rs 83 in the next couple of sessions.

- Anuj Choudhary - Research Analyst at Sharekhan by BNP Paribas

IGL, Solar Industries and Airtel Share Price: Buy, Sell Or Hold?

Despite strong September auto sales numbers amid the festive season, the launch of 5G services last week, and strong closings on Friday, the Indian market has been trading lower amid weak global cues on Monday. Full Report

5G Service Launch: Telecom Stocks Surge Up To 6%

Telecom companies’ shares gained up to 6 per cent on the BSE intraday during Monday’s trading session as the government Saturday launched 5G Services in the country. One of the major telecom service providers, Bharti Airtel touched a new lifetime high of Rs 813 per share on the BSE. Full Report

MGL, IGL, Gujarat Gas Shares Fall Up To 4.5% – Know Why?

City gas distribution (CGDs) companies – Gujarat Gas, Indraprastha Gas (IGL), and Mahanagar Gas (MGL) shares were trading in the red, down up to 4.5 per cent on the BSE intraday during Monday’s trading session as the government announced around 40 per cent hike in gas prices. Full Report

Nykaa Announces Share Bonus Ratio, Record Date

FSN E-Commerce Ventures Limited, the parent company of Nykaa, on Monday, October 3, informed the exchanges about the bonus share ratio and bonus share record date. The e-commerce had announced that it will give bonus equity shares to its investors, earlier in an exchange filing. Full Report

Nifty Outlook

We see 16980 and 17100 as critical pivots for the day. Initial trades closer to 17100 will improve confidence in a 17170 breach today, setting off on a 17350 run-up. Alternatively, the inability to float above 16980 would raise the possibilities towards a 16300 plunge. This outcome is less favoured, despite the sharp pull back on Friday, in the closing hour.

-Anand James - Chief Market Strategist at Geojit Financial Services

ONGC, Oil India, MRPL, and Chennai Petro gain up to 9.5% – know why?

Oil and Natural Gas Corporation (ONGC), Oil India, Mangalore Refinery & Petrochemicals (MRPL), and Chennai Petroleum Corporation – zoomed up to 9.5 per cent on the BSE intraday on Monday as the government cut windfall profit tax on domestic crude oil. Full Report

Motherson Sumi Shares Trade Ex-Bonus Today

Samvardhana Motherson International Limited (SMIL), NSE: MOTHERSON, shares trade ex-bonus on Monday, October 3, 2022. The company has fixed October 5 as the record date for its bonus issue. The bonus share will be issued in the ratio of 1:2, meaning 1 extra share will be issued to the investors for every 2 stocks. Full Report

Gold Price Today

The yellow metal is not showing interesting action on the first day of the week but maintained the psychologically important level of Rs 50,000 on MCX. The precious metal was trading in the green territory, up by 0.44 per cent to Rs 50415 per 10 grams. Full Report

Gold October Futures BUY by Trade Bulls

Buy - Rs 50,250

Price target - Rs 50,500

Stop loss - Rs 50,100

Stocks To Buy With Anil Singhvi: Bhasin Ke Hasin Share

Market expert and IIFL Securities Director Sanjiv Bhasin in a chat with Zee Business Managing Editor Anil Singhvi said that there is no doubt that India will perform and that he is "extremely optimistic" during today's edition of ‘Bhasin Ke Hasin Share'. He recommended 3 stocks for investors that can yield high returns in short term. Full Report

USD-INR Outlook:

The slippages failed to evolve into a plunge that we were anticipating. However, the pullback having settled in the 81.6-81.7 vicinity, we are encouraged to keep looking for morefalls. Towards this end, the 80.95 downside objective will be in play today, as long as early trades float below 81.7.

- Anand James - Chief Market Strategist at Geojit Financial Services

INR Weakens 38 Paise To 81.78 Against $

The Indian Rupee slipped sharply against the American dollar on Monday in early trade, tracking a muted trend in domestic equities and risk-off sentiment among investors. The Indian currency weakened 38 paise to 81.78 against the US dollar amid surging crude prices, the PTI report said. Full Report