Highlights! Stock Market News Today: Sensex ends over 1250 points higher, Nifty50 settles around 17300 – Metal, IT, Banks gain most

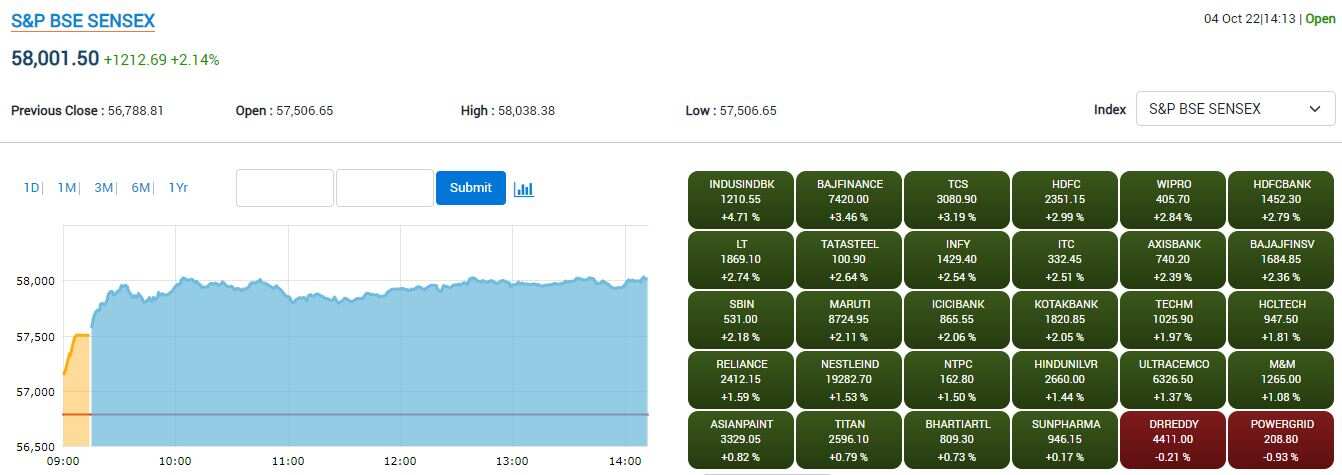

Stock Market Live Updates: The Indian markets reversed yesterday’s losses to gain over 2 per cent on the back of positive global cues. Almost all frontline indices witnessed a massive buying interest today as Sensex zoomed almost 1300 points and Nifty50 settled nearly 17300-mark at the close.

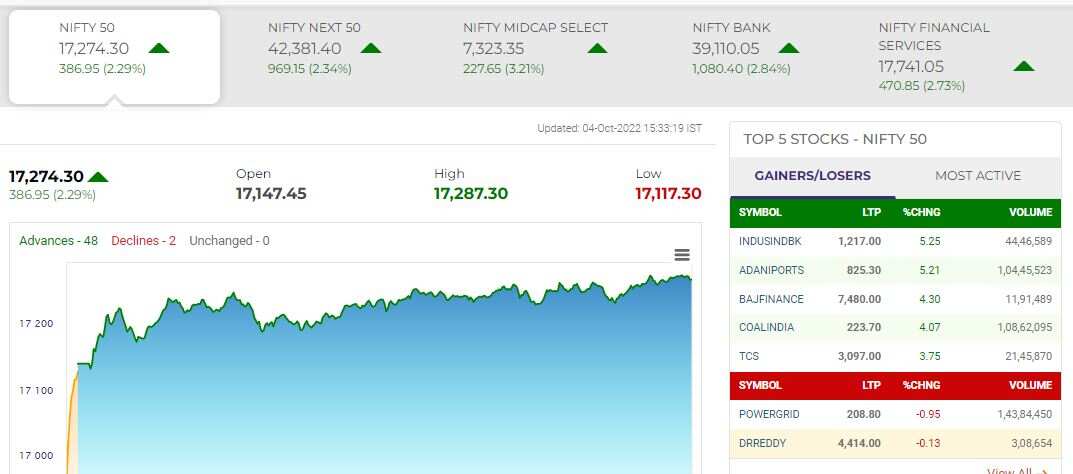

At the market close, the BSE Sensex gained 1,276 points or 2.25 per cent to 58,065 while Nifty50 surged by 386 points or 2.29 per cent to 17,274 levels on Tuesday. Even the broader markets soared, as the Nifty mid-cap jumped over 2.5 per cent and small-cap was up over 1.5 per cent at the close.

As many as 47 stocks have advanced and 3 declined on the Nifty50 index at the close. IndusInd Bank continued to be a top Nifty gainer on the whole session today, up over 5 per cent, followed by Adani Ports up over 4.5 per cent along with Bajaj Finance up nearly 4.5 per cent on the NSE at the close.

While other Nifty heavyweights such as Coal India, Hero Moto, UPL, TCS, Hindalco, Bajaj Finserv, and JSW Steel each up between 3-4 per cent, similarly, Tata Steel, HDFC, Grasim, L&T, Wipro, HDFC Bank, Axis Bank, Eicher Motor, Infosys, HDFC Life, Adani Ent each gained between 2-2.5 per cent at the close.

On the contrary, Dr Reddy’s, Power Grid, and Sun Pharma were the only losers during today’s gaining market, each down between 0.05-1 per cent at the close on the NSE.

“Indices surged over 2% buoyed by positive global cues and encouraging quarterly updates on advances and collections from Banks during the second quarter,” S Ranganathan, Head of Research at LKP securities said in his market comment.

Ahead of the festive season, the street is optimistic on retail demand across segments, and we saw Financials lead from the front today, the market expert added.

Ranganathan further stated, “Participation of the IT sector today lent ammunition to the Bulls as almost all sectoral indices ended in the green. Positive Tailwinds at Home amidst gloom elsewhere in the globe left Bears stranded today as the Sensex vaulted past 58,000.”

"While today’s bounce is in line with the global bounce in equity assets, India continues to exhibit strength on both an absolute and relative basis. With the world-beating expected GDP growth of 7%+ in the current financial year, 14%+ consensus Nifty earnings CAGR over the next 2 years, system credit growth at 9-year highs of 16%+ and lower inflation than the US & UK for 18 straight months, we believe India stands tall in terms of an investment destination," said Alok Agarwal, Portfolio Manager, Alchemy Capital Management.

Stock Market Live Updates: The Indian markets reversed yesterday’s losses to gain over 2 per cent on the back of positive global cues. Almost all frontline indices witnessed a massive buying interest today as Sensex zoomed almost 1300 points and Nifty50 settled nearly 17300-mark at the close.

At the market close, the BSE Sensex gained 1,276 points or 2.25 per cent to 58,065 while Nifty50 surged by 386 points or 2.29 per cent to 17,274 levels on Tuesday. Even the broader markets soared, as the Nifty mid-cap jumped over 2.5 per cent and small-cap was up over 1.5 per cent at the close.

As many as 47 stocks have advanced and 3 declined on the Nifty50 index at the close. IndusInd Bank continued to be a top Nifty gainer on the whole session today, up over 5 per cent, followed by Adani Ports up over 4.5 per cent along with Bajaj Finance up nearly 4.5 per cent on the NSE at the close.

While other Nifty heavyweights such as Coal India, Hero Moto, UPL, TCS, Hindalco, Bajaj Finserv, and JSW Steel each up between 3-4 per cent, similarly, Tata Steel, HDFC, Grasim, L&T, Wipro, HDFC Bank, Axis Bank, Eicher Motor, Infosys, HDFC Life, Adani Ent each gained between 2-2.5 per cent at the close.

On the contrary, Dr Reddy’s, Power Grid, and Sun Pharma were the only losers during today’s gaining market, each down between 0.05-1 per cent at the close on the NSE.

“Indices surged over 2% buoyed by positive global cues and encouraging quarterly updates on advances and collections from Banks during the second quarter,” S Ranganathan, Head of Research at LKP securities said in his market comment.

Ahead of the festive season, the street is optimistic on retail demand across segments, and we saw Financials lead from the front today, the market expert added.

Ranganathan further stated, “Participation of the IT sector today lent ammunition to the Bulls as almost all sectoral indices ended in the green. Positive Tailwinds at Home amidst gloom elsewhere in the globe left Bears stranded today as the Sensex vaulted past 58,000.”

"While today’s bounce is in line with the global bounce in equity assets, India continues to exhibit strength on both an absolute and relative basis. With the world-beating expected GDP growth of 7%+ in the current financial year, 14%+ consensus Nifty earnings CAGR over the next 2 years, system credit growth at 9-year highs of 16%+ and lower inflation than the US & UK for 18 straight months, we believe India stands tall in terms of an investment destination," said Alok Agarwal, Portfolio Manager, Alchemy Capital Management.

Latest Updates

Nifty Technical Outlook:

The Nifty has seen a smart recovery on October 04, post a steep decline in the previous session. On October 03, the index had gone down to retrace nearly 78.6% of the rise seen on September 30. The key Fibonacci level acted as a spring board, resulting in a swift up move today. On the way up, the Nifty has crossed the swing high of 17187 & has entered into a gap area that was created during the decline in the last month. Going ahead, 17300 is the immediate barrier to watch out for. Unless that is crossed on a closing basis the index is likely to witness short term consolidation. However, if the bulls manage to surpass 17300 on a closing basis then the index can stretch till 17500. Near term support shifts higher to 17000.

- Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas

HCL Tech, Wipro, Infosys In Focus

IT sector will now come under the spotlight as three large cap companies will be announcing their Q2FY23 results next week. IT bellwether Tata Consultancy Services (TCS), HCL Technologies, Wipro and Infosys will be announcing their results on 10, 12 and 13 October 2022. Full Report

Cochin Shipyard, Triveni Turbine And Oracle Financial Shares: Buy, Sell Or Hold?

Shares of Cochin Shipyard traded around one per cent higher, Triveni Turbine gained more than five per cent and Oracle Financial Services Software rose around two and half per cent in BSE intraday trade on Tuesday. Full Report

Easy Trip Planners Share Price Jumps 9% - Here’s Why?

Easy Trip Planners' share price zoomed over 9 per cent on Tuesday to touch the day’s high of Rs 418 apiece on the BSE intraday after the company announced plans to issue bonus and split its shares in an exchange filing. Full Report

Gold Price Today:

The yellow metal gold has recorded two months high on the domestic market amid festive seasons. Gold Futures on Multi Commodity Exchange (MCX) crossed 51,000 per 10-gram mark and reached to Rs. 51,275 early in the trade on Tuesday. The gold futures surged 0.22 per cent by 115 points.

Nykaa Share Rally Continues On Bonus Issue

Nykaa share on Tuesday, October 4, continued its rally on account of the bonus issue. The stock price jumped nearly 3.5 per cent to Rs 1349.6 and 1348.95 per share on the BSE and NSE intraday, respectively. Full Report

Electronics Mart India IPO Subscription Day 1

Retail and non-institutional investors queue most to subscribe for Electronics Mart India IPO. Around 0.22 times subscription was seen at around 11:21 AM. Against 6,25,00,000 shares on offer, bids were received for 1,84,34,558 equity shares. The retail portion was filled over 0.54 times and NII quota was booked 0.13 times. Full Report

Stocks To Buy: Mandi Vinashak Shares

Route Mobile: CMP Rs 1376 TGT Rs 1800 in a year – Rationale: high growth potential, 5G Rollout, Debt free

Exide: CMP Rs 154 TGT Rs 225 – Rationale: Auto sector in focus, Recent bhoomi pujan for giga factory in Bengaluru for lithium-ion batteries

Patanjali Foods: CMP Rs 1345 TGT Rs 2000 in a year – Rationale: strong growth expected, attractive valuations, aggressive management, food business transferred at throwaway prices

Varun Beverages: CMP Rs 1070 TGT Rs 1400 – Rationale: Pepsico bottler - presence in 6 countries - India, Srilanka, Nepal, Morocco, Zambia & Zimbabwe, strong financials

Anand Rathi Wealth: CMP Rs 666 TGT Rs825 – Rationale: solid business model, Aggressive Mgmt, Attractive Valuation

CAMS: CMP Rs 2475 TGT Rs 3250 – Rationale: demat of insurance policies & other financial products, growth of retail investors, new demat accounts

Blue Dart: CMP Rs 9070 TGT Rs 11000 – Rationale: leader in online logistics, highly reliable services, recent price hikes, strong online business growth

RITES: CMP Rs 339 TGT Rs 450 – Rationale: strong financials, dvd yld 5%, govt’s railway focus, huge opportunity

Accelya Solutions: CMP Rs 1140 TGT Rs 1500 – Rationale: travel & tourism sector rocking, presence in 11 countries, air cargo supply chain solutions, strong growth expected

Data Patterns: CMP Rs 1125 TGT Rs 1500 – Rationale: defence play, electronic solutions provider, govt focus, make in india, strong order book

Rupee Gains 31 Paise To 81.51 On Weak Dollar

Indian Rupee has jumped by 31 paise to 81.51 against the US dollar in early trade on Tuesday, tracking weakness in the greenback in overseas markets and a rally in domestic equities. However, rising crude price in the international market restricted the rupee, forex traders said. Full Report

Q2 Update: IndusInd, HDFC, M&M Fin Shares Gain Up To 12%

Shares of IndusInd Bank, HDFC, Mahindra and Mahindra Financial Services, and Bank of Maharashtra gained up to 12 per cent amid a strong Q2 update. Bank and Financial Services stocks were on roll during Tuesday’s session as they aided the market the most. Full Report

Stock Market Top Gainers And Losers On 04 Oct

Almost all sectoral indices were gaining in the early morning trade. Metal reversed its yesterday’s loss by gaining over 3 per cent, followed by Bank and Financials each up over 2 per cent. All 50-stocks on Nifty and 30-share on Sensex were in the green minutes after the market open today – Hindalco, IndusInd Bank, Larsen and Toubro were among the top gainers on Tuesday.

Anil Singhvi's Strategy On 04 October

Zee Business Managing Editor Anil Singhvi said that the short-term trend of the Indian market will remain positive on Tuesday, October 04, 2022, amid positive global markets, negative foreign institutional investors (FIIs), neutral domestic institutional investors (DIIs), positive future and options, and neutral sentiment. Full Report

#MarketStrategy | निफ्टी और बैंक निफ्टी पर अनिल सिंघवी की दमदार स्ट्रैटेजी #Nifty #BankNifty @AnilSinghvi_ | #ZeeBusiness | #StockMarket

देखिए #ZeeBusiness LIVE यहां https://t.co/OhJI5bVOID pic.twitter.com/uo1Tvqn799

— Zee Business (@ZeeBusiness) October 4, 2022