Stock Market HIGHLIGHTS: Sensex closes 200 points up, Nifty above 18200; Britannia gains over 8%

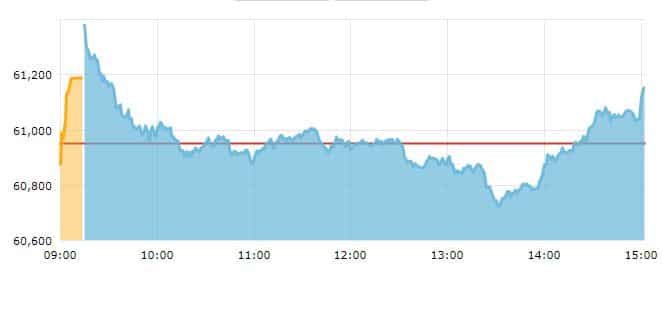

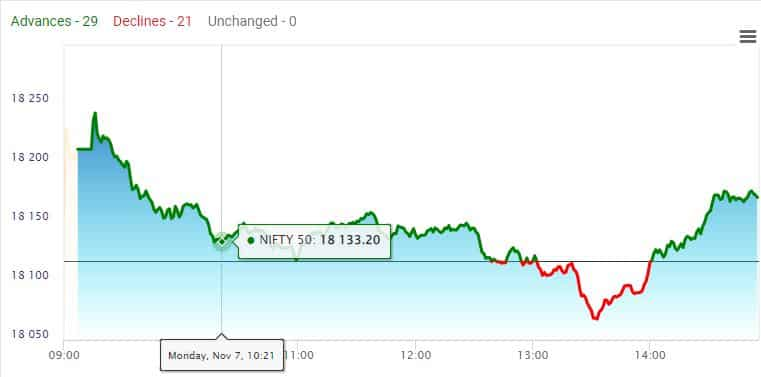

Stock Market HIGHLIGHTS: Bulls regained control of the street after conceding grounds on a day which was marked by volatility. After opening positively, frontline indices narrowed gains and later dropped in the red. The recovery over the last hour helped them finish in the green. BSE Sensex ended at 61,185.15, up by nearly 234.79 points or 0.39 per cent. Meanwhile, Nifty50 closed at 18,202.80, up by 85.65 points 0.47 per cent.

In the 30-stock Sensex, 19 stocks settled positively against 11 losers. Meanwhile, there were 34 advances against 29 declines and one stock remained unchanged.

Key Highlights:

1) The session was relatively volatile than Friday as India VIX closed at 15.59, down 0.44 per cent. It was up nearly 3 per cent intraday.

2) The trading session was action packed with frontline indices recovering strongly after slipping in the red.

3) Out of the 15 sectoral indices, PSU bank were the clear winners today with Nifty PSU Bank gaining almost 4 per cent. Nifty Bank, Nifty Auto, Nifty Realty and Nifty Oil & Gas were also in the green and ended with over 1 per cent gains, each. The top laggards were pharma and healthcare stocks as both Nifty Pharma and Nifty Healthcare Index were the worst performing indices.

4) On Nifty 50, top gainers were Britannia Industries, SBI and BPCL. The FMCG major Britannia closed with 8 per cent gains. Divi's Lab was the worst loser and was down over 8 per cent followed by Asian Paints, Cipla and Sun Pharmaceuticals.

5) Broader markets also witnessed significant action. NIFTY MID CAP 100 closed 31,963.60, up 0.81 per cent while, NIFTY SMALLCAP 100 settled at 9,836.30, up 0.83 per cent,

6) Rupee was trading with strength around this time and that was reflected in USDINR futures which were down Rs 0.3875 or 0.20 per cent and trading at 82.0575 minutes before the equity markets closing time. The currency markets end at 5 pm.

7) In the commodity markets, MCX December Gold Futures were trading at Rs 51001 per 10 gram and were up by Rs 135 or 0.47 per cent from the Friday closing price. The December Silver futures were tradng with a negative bias at Rs 60687 per kg and were down by Rs 149 or 0.25 per cent.

Catch all the updates here!

Stock Market HIGHLIGHTS: Bulls regained control of the street after conceding grounds on a day which was marked by volatility. After opening positively, frontline indices narrowed gains and later dropped in the red. The recovery over the last hour helped them finish in the green. BSE Sensex ended at 61,185.15, up by nearly 234.79 points or 0.39 per cent. Meanwhile, Nifty50 closed at 18,202.80, up by 85.65 points 0.47 per cent.

In the 30-stock Sensex, 19 stocks settled positively against 11 losers. Meanwhile, there were 34 advances against 29 declines and one stock remained unchanged.

Key Highlights:

1) The session was relatively volatile than Friday as India VIX closed at 15.59, down 0.44 per cent. It was up nearly 3 per cent intraday.

2) The trading session was action packed with frontline indices recovering strongly after slipping in the red.

3) Out of the 15 sectoral indices, PSU bank were the clear winners today with Nifty PSU Bank gaining almost 4 per cent. Nifty Bank, Nifty Auto, Nifty Realty and Nifty Oil & Gas were also in the green and ended with over 1 per cent gains, each. The top laggards were pharma and healthcare stocks as both Nifty Pharma and Nifty Healthcare Index were the worst performing indices.

4) On Nifty 50, top gainers were Britannia Industries, SBI and BPCL. The FMCG major Britannia closed with 8 per cent gains. Divi's Lab was the worst loser and was down over 8 per cent followed by Asian Paints, Cipla and Sun Pharmaceuticals.

5) Broader markets also witnessed significant action. NIFTY MID CAP 100 closed 31,963.60, up 0.81 per cent while, NIFTY SMALLCAP 100 settled at 9,836.30, up 0.83 per cent,

6) Rupee was trading with strength around this time and that was reflected in USDINR futures which were down Rs 0.3875 or 0.20 per cent and trading at 82.0575 minutes before the equity markets closing time. The currency markets end at 5 pm.

7) In the commodity markets, MCX December Gold Futures were trading at Rs 51001 per 10 gram and were up by Rs 135 or 0.47 per cent from the Friday closing price. The December Silver futures were tradng with a negative bias at Rs 60687 per kg and were down by Rs 149 or 0.25 per cent.

Catch all the updates here!

Latest Updates

Pidilite Q2FY23 Results: The company today posted its September quarter results where net profit was down 7 per cent at Rs 348 crore versus Rs 375 crore because of margin pressure on account of higher crude oil prices. The share was trading at Rs 2,620.05, down by Rs 27.95 or 1.06 per cent on the NSE

Revenues were at Rs 3095 crore vs Rs 2626 crore, up 18 per cent YoY.

EBITDA was down 4 per cent at Rs 527crore vs Rs 550 cr

Margins at 17 per cent versus 21 per cent

Gold is tading at 4 week's high level on MCX while Silver is at a 5-week high, said commodity and currency expert Anuj Gupta. His strategy in Gold and Silver is a buy on precious metal futures.

Gupta suggested a Buy on gold at Rs 50700 with a stop loss of Rs 50450 and price target of Rs 51400. As for Silver Futures, buying is recommended in Silver futures at Rs 60000 with a stop loss at Rs 59400 and target at Rs 61500.

In the 3,556 stocks that were trading on the BSE, 2,061 stocks advanced while 1,306 declined and 189 remained unchanged. Out of this 267 hit upper circuit and 156 hit lower circuit.

SBI share price jumps 4% on JP Morgan, Goldman Sachs upgrades, strong September quarter results

Sen sex and Nifty were off the day's highs after opening strongly mainly dragged by pharma and healthcare stocks. However, PSU Banks, private banks and auto stocks ensure bulls maintain a grip over bears.

Nifty PSU Bank Index was trading with gains of nearly 4 per cent followed by Nifty Auto index which was up 0.70 per cent around 11:15 am.

Action was seen even in the broader markets with NIFTY MIDCAP 100 trading at 31,869.45, up by 0.51 per cent. Nifty Small Cap 100 was trading at 9,820.80, up 0.67 per cent around this time.

Rupee opens with 33 paise gains against the dollar. It opened at 82.26, appreciated by 0.20 per cent.

"As China continues with its Zero Covid Policy the Chinese Yuan gave up some of its gains and was at 7.21 as against 7.16 it had attained last Friday. Dollar index also gained a bit to 111 levels while brent oil was a bit down to $ 97.50 per barrel. Rupee to open at 82.20 and be within a range of 81.80 to 82.50 for the day as oil companies step in to purchase dollar and ensure that rupee does not appreciate much thus hurting our exports. The US NFPR on Friday came above expectations but also indicated a slowing economy. The US mid term elections are due tomorrow in which Republicans could take both the House and the Senate from Democrats. The US 10 year hovered around 4.15% still indicating a biddish dollar. As rupee strengthens exporters may wait to sell $ while importers can buy the dips as uncertainties in global market continue with a recession looming over western economies," Anil Kumar Bhansali, Head of Treasury at Finrex Treasury Advisors LLP said.

Traders Diary: Know Buy, Sell or Hold strategy on SBI, Titan, IRCTC, Tata Motors, Indigo and others

(Disclaimer: The views/suggestions/advises expressed here in this article is solely by investment experts. Zee Business suggests its readers to consult with their investment advisers before making any financial decision.)

Source: BSE

Source: BSE

Source: NSE

Source: NSE Source: BSE

Source: BSE