Stock Market HIGHLIGHTS: Sensex ends volatile day 170 pts higher, Nifty50 near 17,650; Adani Ent, Adani Ports, Ambuja, ACC rise, other group stocks in the red

Stock Market HIGHLIGHTS: Indian equity benchmarks halted a two-day losing streak on Monday with gains of 0.3 per cent each, rebounding from three-month lows hit in the previous session. Adani group stocks — Adani Enterprises, Adani Power, Adani Ports, Adani Total, Adani Green, Adani Transmission, Adani Wilmar, ACC and Ambuja — remained in focus throughout the volatile session.

Here are 10 things to know about the January 30 session on Dalal Street:

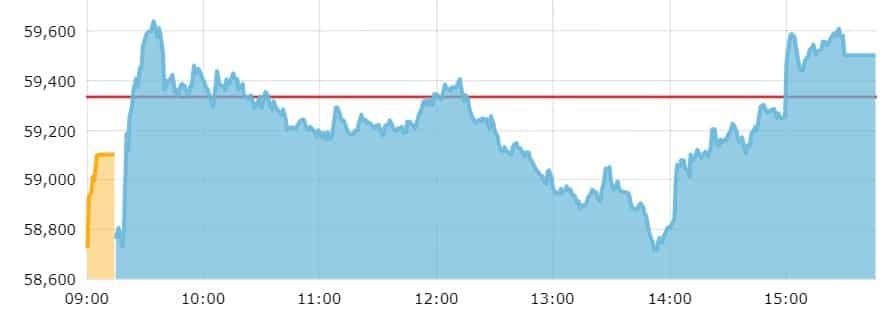

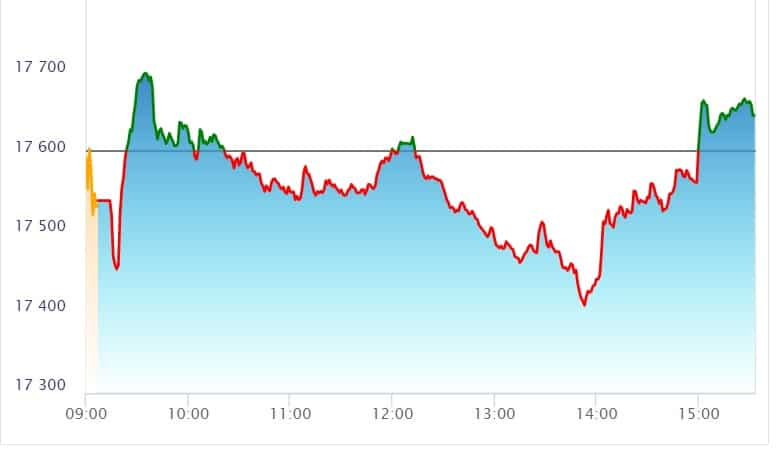

1) The Sensex gyrated in a 945-point range — between 58,699.2 and 59,644.2 — during the session before settling at 59,500.4 for the day. The Nifty50 broadly moved within the 17,400-17,750 band in intraday trade before ending one point shy of 17,650.

2) A total of 29 stocks in the Nifty50 basket finished higher, with Bajaj Finance, Bajaj Finserv, Adani Enterprises, UltraTech, Asian Paints, HCL Tech and NTPC being the top gainers, rising between 1.5 per cent and 4.6 per cent at the close.

3) On the other hand, PowerGrid, Bajaj Auto, IndusInd, Larsen & Toubro, JSW Steel, ONGC and Tata Steel were the top blue-chip laggards, ending around 2-3 per cent lower.

4) Infosys, Bajaj Finance and Reliance were the biggest boosts for both main gauges, contributing more than 150 points to the rise in Sensex. On the other hand, Larsen & Toubro, Hindustan Unilever and PowerGrid were the biggest drags.

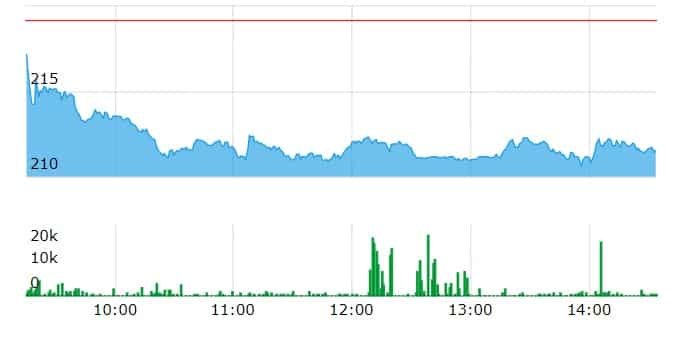

5) Overall market breadth was skewed in favour of the bears, with an advance-decline ratio of 4:5 as 1,553 stocks rose and 2,047 fell at the close on BSE.

6) Adani group stocks remained in focus during the session.

7) Investors awaited more of corporate earnings from India Inc for domestic cues, after Vedanta and Bajaj Finance reported their earnings last week.

8) The rupee inched higher to end at 81.50 against the US dollar.

9) European markets fell in early hours on Monday, in contrast to gains across Asia earlier in the day, as cautious investors anticipated a slew of hikes in benchmark interest rates by major central banks this week. The pan-European Stoxx 600 index was down 0.6 per cent at the last count.

10) S&P 500 futures were down 0.9 per cent, suggesting a gap-down opening ahead on Wall Street.

Catch highlights of the session, market commentary and analysis, financial results, expert views, investment and stock trading ideas, and much more, on Zeebiz.com's blog:

Stock Market HIGHLIGHTS: Indian equity benchmarks halted a two-day losing streak on Monday with gains of 0.3 per cent each, rebounding from three-month lows hit in the previous session. Adani group stocks — Adani Enterprises, Adani Power, Adani Ports, Adani Total, Adani Green, Adani Transmission, Adani Wilmar, ACC and Ambuja — remained in focus throughout the volatile session.

Here are 10 things to know about the January 30 session on Dalal Street:

1) The Sensex gyrated in a 945-point range — between 58,699.2 and 59,644.2 — during the session before settling at 59,500.4 for the day. The Nifty50 broadly moved within the 17,400-17,750 band in intraday trade before ending one point shy of 17,650.

2) A total of 29 stocks in the Nifty50 basket finished higher, with Bajaj Finance, Bajaj Finserv, Adani Enterprises, UltraTech, Asian Paints, HCL Tech and NTPC being the top gainers, rising between 1.5 per cent and 4.6 per cent at the close.

3) On the other hand, PowerGrid, Bajaj Auto, IndusInd, Larsen & Toubro, JSW Steel, ONGC and Tata Steel were the top blue-chip laggards, ending around 2-3 per cent lower.

4) Infosys, Bajaj Finance and Reliance were the biggest boosts for both main gauges, contributing more than 150 points to the rise in Sensex. On the other hand, Larsen & Toubro, Hindustan Unilever and PowerGrid were the biggest drags.

5) Overall market breadth was skewed in favour of the bears, with an advance-decline ratio of 4:5 as 1,553 stocks rose and 2,047 fell at the close on BSE.

6) Adani group stocks remained in focus during the session.

7) Investors awaited more of corporate earnings from India Inc for domestic cues, after Vedanta and Bajaj Finance reported their earnings last week.

8) The rupee inched higher to end at 81.50 against the US dollar.

9) European markets fell in early hours on Monday, in contrast to gains across Asia earlier in the day, as cautious investors anticipated a slew of hikes in benchmark interest rates by major central banks this week. The pan-European Stoxx 600 index was down 0.6 per cent at the last count.

10) S&P 500 futures were down 0.9 per cent, suggesting a gap-down opening ahead on Wall Street.

Catch highlights of the session, market commentary and analysis, financial results, expert views, investment and stock trading ideas, and much more, on Zeebiz.com's blog:

Latest Updates

Closing Bell | Sensex, Nifty50 rebound from three-month lows

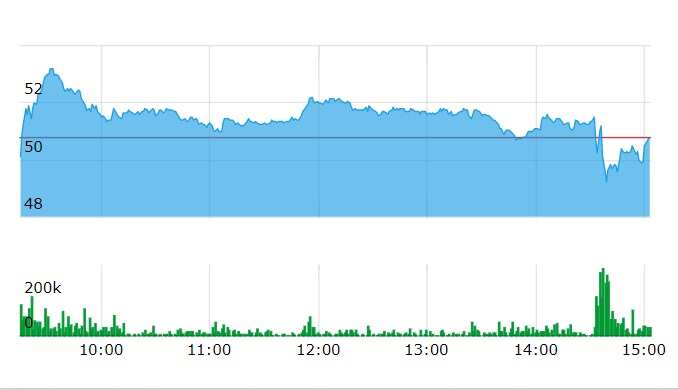

Both headline indices finish the volatile day 0.3 per cent higher. The Sensex ends with a gain of 169.5 points at 59,500.4, having gyrated in a range of 945 points during the session. The Nifty50 settles at 17,649, up 44.6 points from its previous close.

Here's how the Sensex moved today:

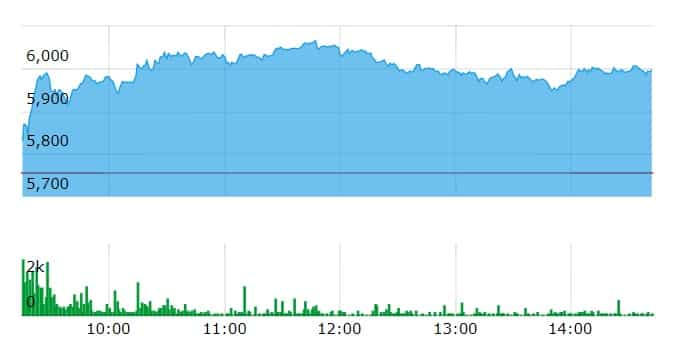

Nifty50

GAIL Q3 Results: Net profit plummets 90%

State gas utility GAIL reports a 90 per cent year-on-year fall in net profit to Rs 397.6 crore for the quarter ended December 2022. The company suffered losses in its petrochemical and natural gas marketing businesses during the three-month period.

Revenue from operations comes in at Rs 35,940 crore for the three-month period, as against Rs 26,175.6 crore for the year-ago period.

PNB Q3 Results | Net profit falls 44% to Rs 629 crore, misses analysts' estimates

Punjab National Bank — India's third largest PSU lender by market value — reports a net profit of Rs 628.9 crore for the quarter ended December 2022, missing analysts' estimates by a wide margin. The net profit falls 44.2 per cent on a year-on-year basis.

PNB's net interest income — or the difference between interest earned and interest paid — increases 17.6 per cent on a year-on-year basis to Rs 9,179.4 crore, according to a regulatory filing.

According to Zee Business research, PNB's quarterly net profit was estimated at Rs 1,410 crore and NII at Rs 8,750 crore.

Bajaj Finance woos Street with record Q3 profit; brokerages see up to 53% upside in stock

PowerGrid Q3 Results | Net profit likely to rise 9% to Rs 3,580 crore; margin may drop by 230 bps

PowerGrid will report its financial results on Tuesday, January 31. Here's what to expect:

According to Zee Business research, the state-run power transmission company's net profit is estimated to increase 8.7 per cent to Rs 3,580 crore for the October-December period compared with the corresponding period a year ago, with growth of 3.4 per cent in revenue to Rs 10,798 crore.

PowerGrid's margin, however, is estimated to decline by 230 basis points on a year-on-year basis to 85 per cent for the three-month period, according to the research.

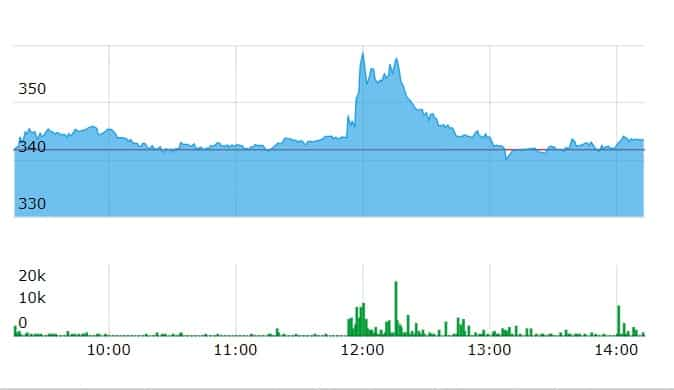

The PowerGrid stock continues to reel under pressure today.

PowerGrid shares have declined 3.4 per cent in the past six months, a period in which the Nifty50 has risen 1.2 per cent.

Adani Enterprises holds on to the green with 1% gain; all other Adani group stocks in the red

| Stock | Change (%) | CMP (in rupees) |

| Adani Enterprises | 1 | 2,790.6 |

| Adani Ports | -1.8 | 587.8 |

| Adani Power | -5 | 2,35.7 |

| Adani Transmission | 20 | 1,607.8 |

| Adani Green | -19.9 | 1,189 |

| Adani Total | -20 | 2,347.7 |

| Adani Wilmar | -5 | 491.5 |

| ACC | -1.5 | 1,856.5 |

| Ambuja | -4.6 | 363.7 |

5Paisa's Ruchit Jain positive on NTPC shares

Ruchit Jain of 5Paisa suggests going long on the NTPC stock for a target of Rs 179 with a stop loss at Rs 165.

NTPC shares have grown 19 per cent in value in the past one year, a period in which the Nifty50 has risen close to one per cent.

Buy Mahindra & Mahindra, sell Bank of Baroda: Motilal Oswal's Arpit Beriwal

Arpit Beriwal of Motilal Oswal has two stock calls:

- Buy M&M for a target of Rs 1,380 with a stop loss at Rs 1,295

- Sell Bank of Baroda for a target of Rs 150 with a stop loss at Rs 162

He also suggests selling Nifty Bank futures around 40,200 for a target of 39,750/39,650 with a stop loss at 40,500.

Buy ITC, Hindustan Aeronautics: JM Financial Services' Rahul Sharma

Rahul Sharma of JM Financial Services recommends a 'buy' on ITC and HAL shares at the current market price.

He suggests going long on HAL shares for a target of Rs 2,650/2,725 with a stop loss at Rs 2,400.

For ITC, he has a target of Rs 370 with a stop loss at Rs 340.

Expect relieft for income tax payers in Budget 2023: Geojit's VK Vijayakumar

VK Vijayakumar, Chief Investment Strategist at Geojit Financial Services, is of the view that the basic exemption limit of Rs 2.5 lakh crore needs to be revised. "Raising the exemption limit to Rs 4 lakh is likely. This relief is likely to be offered in the 'no exemption regime’ since the government wants this regime to take off," he says.

"Rationalisation of the capital gains tax regime is another expectation. The current system is complex with different tax rates and holding periods for different investments. This needs simplification," he adds.

Follow this space for Zeebiz.com's coverage on Union Budget 2023

Budget 2023 | Will government hike income tax deduction limit on home loan interest to Rs 5 lakh?

Under Section 24 of the Income Tax Act, taxpayers can claim deductions of up to Rs 2 lakh on the interest paid on home loans under current tax laws. Read more here

Follow this space for Zeebiz.com's coverage on Union Budget 2023

Buy Coforge, United Breweries: Angel One's Sneha Seth

Sneha Seth of Angel One suggests buying Coforge shares for a target price of Rs 4,540 with a stop loss at Rs 4,250.

Her other stock pick today is UBL, which she recommends for a target of Rs 1,634 with a stop loss at Rs 1,530.