LIC IPO Subscription on last day: Issue subscribed 2.95 times; retail portion booked nearly 2 times, policy holder over 6 times

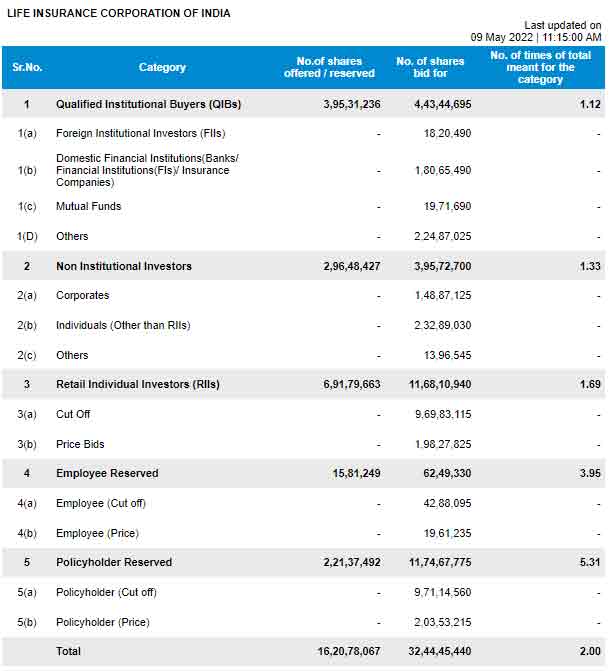

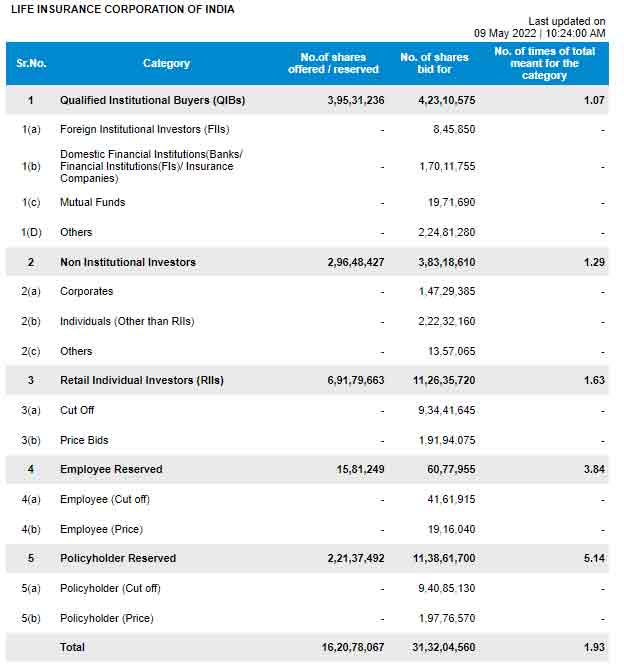

LIC IPO latest news: Initial Public Offering of Life Insurance Corporation of India's (LIC) was subscribed 1.79 times on Sunday on Day 5. The issue closes today after remaining open on the weekend. Except for the portion reserved for qualified institutional buyers (QIBs), the issue was oversubscribed across all categories till May 8, showed data with the exchanges. As per the data, the investors bid for 29.08 crore shares till Sunday, against the offer size of 16.2 crore shares.

Policyholders portion was booked 5.04 times, the quota reserved for employees saw bidding for 3.79 times and retail investors bid for 1.59 times. Similarly, NIIs portion was booked 1.24 times and QIBs portion, which saw bidding of 67% against its quota of shares, was yet to be fully subscribed.

LIC IPO में पैसा लगाने का आज आखिरी मौका...

कमजोर बाजार के बाद भी IPO को अच्छा रिस्पॉन्स क्यों?

अनिल सिंघवी ने क्यों कहा- जरूर लगाओ पैसा?#LICIPO #LIC @AnilSinghvi_ pic.twitter.com/YdmPU7eIf4

— Zee Business (@ZeeBusiness) May 9, 2022

Earlier, the government fixed the price band of LIC IPO at Rs 902-949 per equity share. The retail investors and eligible employees will get a discount of Rs 45 per equity share and policyholders will get a discount of Rs 60 per share. The government aims to raise Rs 20,557 crore at the upper end of price band by diluting through 3.5 per cent stake in the public insurer.

LIC IPO latest news: Initial Public Offering of Life Insurance Corporation of India's (LIC) was subscribed 1.79 times on Sunday on Day 5. The issue closes today after remaining open on the weekend. Except for the portion reserved for qualified institutional buyers (QIBs), the issue was oversubscribed across all categories till May 8, showed data with the exchanges. As per the data, the investors bid for 29.08 crore shares till Sunday, against the offer size of 16.2 crore shares.

Policyholders portion was booked 5.04 times, the quota reserved for employees saw bidding for 3.79 times and retail investors bid for 1.59 times. Similarly, NIIs portion was booked 1.24 times and QIBs portion, which saw bidding of 67% against its quota of shares, was yet to be fully subscribed.

LIC IPO में पैसा लगाने का आज आखिरी मौका...

कमजोर बाजार के बाद भी IPO को अच्छा रिस्पॉन्स क्यों?

अनिल सिंघवी ने क्यों कहा- जरूर लगाओ पैसा?#LICIPO #LIC @AnilSinghvi_ pic.twitter.com/YdmPU7eIf4

— Zee Business (@ZeeBusiness) May 9, 2022

Earlier, the government fixed the price band of LIC IPO at Rs 902-949 per equity share. The retail investors and eligible employees will get a discount of Rs 45 per equity share and policyholders will get a discount of Rs 60 per share. The government aims to raise Rs 20,557 crore at the upper end of price band by diluting through 3.5 per cent stake in the public insurer.

Latest Updates

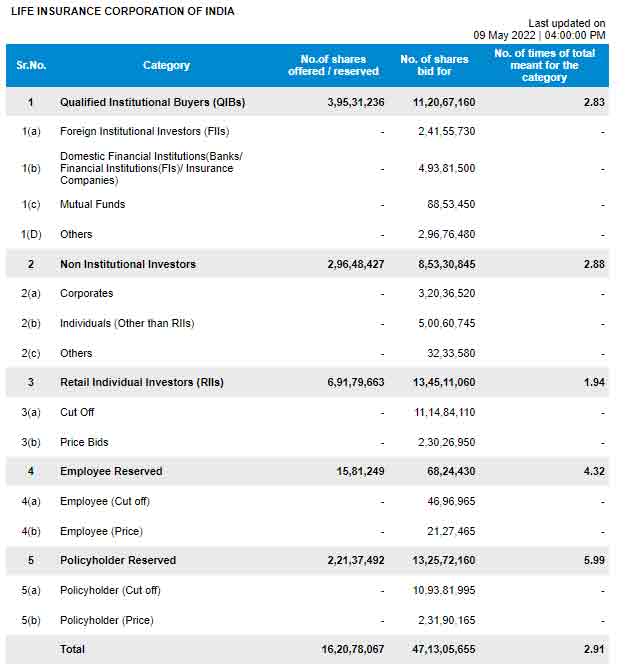

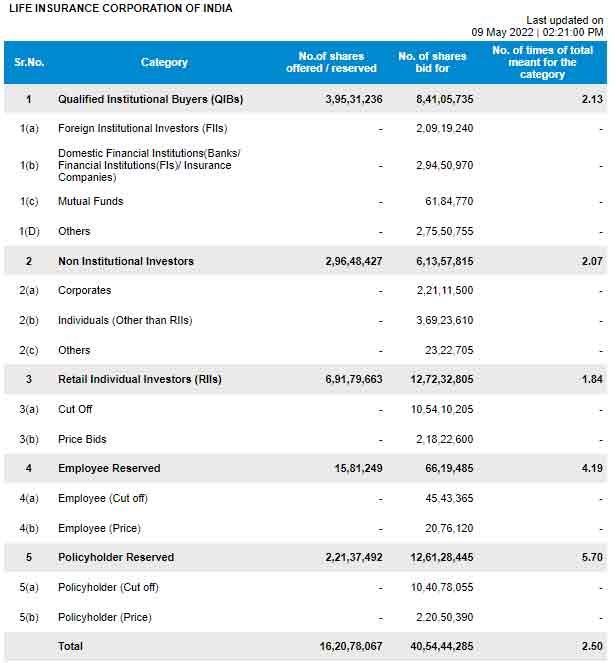

LIC IPO: The public issue of the Life Insurance Corporation of India ended on Monday. The issue was subscribed 2.95 times. The state-run insures received 47,83,67,010 share bids against 16,20,78,067 shares availabe for subscription. The Policy holders subscribed it over 6 times. In the employee category, the issue was subscribed 4.4 times. As for Retail Individual Investors (RIIs), Non-institutional Investors and Qualified Institutional Buyers (QIBs), the share bids received were 1.99 times, 2.91 times and 2.83 times respectively. The data was sourced brom BSE website and was last updated at 7 pm.

LIC IPO Ki Pathshala Part 2: UPI limit has increased to 5 lakhs, so should I apply for 5 lakhs? Get all answers from Anil Singhvi | FAQ | Anil Singhvi

LIC IPO interesting facts:

LIC was formed by merging and nationalising 245 private life insurance companies on September 1, 1956, with an initial capital of Rs 5 crore. Its product portfolio comprises 32 individual plans (16 participating and 16 non-participating) and seven individual optional rider benefits. The insurer's group product portfolio comprises 11 group products.

The market continues to correct amid volatility. What to do with LIC IPO in falling market? Should you apply or skip? Here is what Anil Singhvi suggests investors should do with issue of India's largest IPO.

Full Details: What to do in LIC IPO? How to mange risks? Anil Singhvi explains

5 biggest IPOs before LIC and worst performers

Reliance Power, which was the third largest IPO after Paytm and Coal India before LIC IPO launch, is the worst performer of all in terms of correction on issue price. Reliance Power has corrected 96.8% on its issue price as on April 2. Here is how other biggest IPOs have performed

Company Issue Price (cr) Performance

Paytm `2150 -72%

Coal India `245 -23.7%

Reliance Power `450 -96.8%

General Insurance `912 -85.4%

SBI Card `755 +8.6%

Note: The data is as on May 4