This is the best time to buy a house & structural demand for housing will continue to grow: Keki Mistry, HDFC

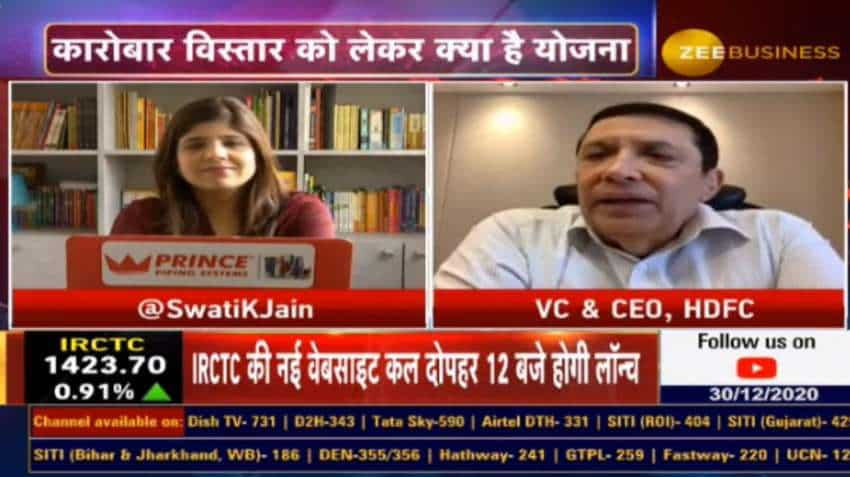

Keki M. Mistry, Vice Chairman and CEO, Housing Development Finance Corporation (HDFC) talks about his expected growth in the real estate sector both in residential and commercial segments, RBI’s draft guidelines for NBFC and interest rates among others during a candid chat with Swati Khandelwal, Zee Business.

Keki M. Mistry, Vice Chairman and CEO, Housing Development Finance Corporation (HDFC) talks about his expected growth in the real estate sector both in residential and commercial segments, RBI’s draft guidelines for NBFC and interest rates among others during a candid chat with Swati Khandelwal, Zee Business. Edited Excerpts:

Q: A good momentum is visible in the real estate sector and a strong recovery has been seen. Do you think that the momentum will continue in 2021, if yes, then what will be the main reasons for it? What is your outlook for the sector for the next year 2021?

A: In all my 40 years of career, I have not seen that housing is as affordable as it is today. Because interest rates are at the all-time low, the interest rates have never been below 7%, this is the first time, where we are seeing the interest rates for the housing loans are below 7%. Secondly, the property prices have not moved up in the last 3-4 years, if anything has happened, then property prices have come down. Income levels have kept rising. So, the affordability has got better and better with every passing year. So with low-interest rates and affordability being better, in my view, this is the best time to buy a house. I feel, the chances of property prices going down are very low and reduction of the interest rates is also very low. In terms of actual timing, this is the best time and due to this, since July we are seeing that month after month demand base is getting better and better.

See Zee Business Live TV Streaming Below:

Q: You are bullish on residential but what is your view on commercial and what is your outlook on that front in 2021?

A: In residential, I am very bullish and in the commercial also I am reasonably bullish. What happened with commercial is that commercial never showed a dip. It has consistently been growing but residential did see a dip for two or three years. So, there was growth but the growth rate has declined a bit in the last 2-3 years. Growth was happening even this year, last year and the year before last year and so and so but the growth rate has diminished. I think, little more focus on residential, little more optimism on residential is what I would say. Also given the fact that there has been a lot of fence-sitters as people in the last 2-3 years have been holding back thinking the property prices will go down more and then we will buy a house and something of that sort. Now people are not postponing the decision.

Q: Government has a lot of expectations from the NBFC sector and even RBI has issued some draft guidelines for the sector. How do you see those guidelines and how your company will leverage it?

A: RBI is going to come out with more comprehensive regulations or master circular for the housing finance companies. We will have a look at what the circular says and then we will be able to talk about it. Generally, structurally, housing demand will always be there for various reasons (i) affordability has improved a lot, (ii) penetration level of mortgages is very low in India and mortgage GDP ratio in India is only 10% and if it is compared with the western countries then it stands at around 50%, 60% and even 70% but it is just 10% in India. There is a young population in India and two-thirds of our population is below 35 years in age. So, all these younger people will get to an age when they will need housing. So, structural demand for housing will continue to grow and regulators will ensure that the sector grows smoothly and grows in a manner in which it facilitates growth in an overall environment. So, I think structural demand for housing will continue to grow.

Q: What is your outlook on interest rates particularly in 2021?

A: Interest rates have come down a lot. As I said you that I never in my have seen the housing loan interest rate below 7% as we are seeing now. In my view, the ability or willingness of RBI to drop rates going forward is very limited because the whole economy is growing and everyone has changed their growth forecasts making it more optimistic. The deficit people were projecting at very high levels in March and April but it has been brought down. If the economy that is picking up and would continue then that at some point of time will lead to a little bit of inflation. If that inflation will come in the future, maybe a bit, then in the face of the inflation, I don’t think that RBI will be looking at dropping the interest rates. So, we are at the bottom of the interest rate cycle, according to me. So, the possibility of lowering the interest rate from here is very less.

Q: What kind of targets do you have for HDFC for 2021 and what kind of growth is expected? Please share your outlook for HDFC with us?

A: We can’t speak about the targets in advance but this is something which we will keep evaluating on a consistent basis. We always try to grow at a certain pace that is double-digit.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

04:44 PM IST

HDFC Bank raises lending rate by 5 bps on select maturity

HDFC Bank raises lending rate by 5 bps on select maturity  SBI 3-Year FD vs HDFC 3-Year FD vs ICICI Bank 3-Year FD: Which FD will offer the highest return on an investment of Rs 3 lakh?

SBI 3-Year FD vs HDFC 3-Year FD vs ICICI Bank 3-Year FD: Which FD will offer the highest return on an investment of Rs 3 lakh? HDB Financial Services files draft papers with Sebi for Rs 12,500 crore IPO

HDB Financial Services files draft papers with Sebi for Rs 12,500 crore IPO HDFC Standard Life buys PNB Housing Finance shares worth Rs 90 crore

HDFC Standard Life buys PNB Housing Finance shares worth Rs 90 crore HDFC Bank shares slip post Q2 business update

HDFC Bank shares slip post Q2 business update