Urjit Patel led RBI keeps key rates unchanged

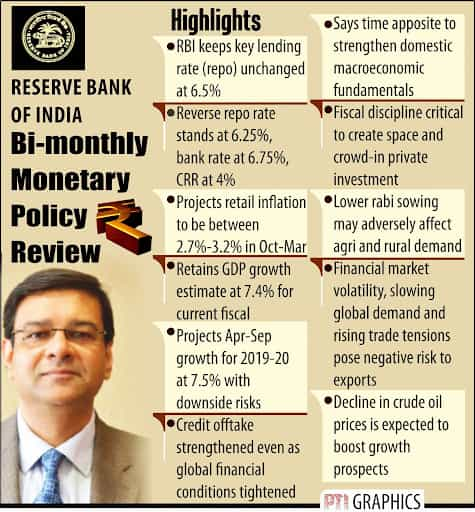

The Reserve Bank of India (RBI) Wednesday expectedly kept interest rates unchanged but held out a promise to cut them if the upside risks to the inflation do not materialise. It also coaxed banks to lend more in order to support the slowing economy. With all the six member of the monetary policy committee (MPC) voting for a hold on rates, the RBI kept benchmark repurchase (repo) rate at 6.5 per cent.

Having raised rates twice this year, the central bank retained its 'calibrated tightening' policy stance.

"Even as inflation projections have been revised downwards significantly and some of the risks pointed out in the last resolution have been mitigated, especially of crude oil prices, several uncertainties still cloud the inflation outlook," it said in a statement.

While the statement was silent on future outlook on interest rates, RBI Governor Urjit Patel at the customary post MPC meeting press conference held out hope of a reduction if upside risks to inflation did not materialise.

"If the upside risks we have flagged do not materialise or are muted in their impact as reflected in incoming data, there is a possibility of space opening up for commensurate policy actions by the MPC," Patel said.

He sid the MPC retained its stance at calibrated tightening "so as to buy time to pause, reflect and undertake future policy action with more robust inflation signals".

The RBI lowered inflation forecast for the second half of the fiscal year that ends in March 2019 to 2.7-3.2 per cent from a range of 3.9-4.5 per cent. The projection is below the medium-term target of 4 per cent.

Inflation in October eased to a 13-month low of 3.31 per cent. It retained GDP growth forecast for the current fiscal year at 7.4 per cent.

In a bid to boost lending by banks by freeing up resources, the RBI lowered the reserves lenders are compulsorily required to hold in the form of government securities. Starting first quarter of 2019 calendar year, it would begin to lower banks' mandatory bond holding ratios by 25 basis points each quarter until it reaches 18 per cent of deposits. The statutory liquidity ratio (SLR) currently stands at 19.50 per cent and the move to lower the ratio is expected to prod banks to lend more rather than park their cash in safe-haven government securities.

"...It is proposed to reduce the SLR by 25 basis points every calendar quarter until the SLR reaches 18 per cent of NDTL. The first reduction of 25 basis points will take effect in the quarter commencing January 2019," the RBI said in a separate statement. The current SLR is 19.5 per cent of Net Demand and Time Liabilities (NDTL). The RBI had raised repo rate to 6.25 per cent in June and followed it up by another hike to 6.5 per cent in August. It kept the rates unchanged in October and shifted stance to 'calibrated tightening' from neutral.

"The MPC also noted that even as escalating trade tensions, tightening of global financial conditions and slowing down of global demand pose some downside risks to the domestic economy, the decline in oil prices in recent weeks, if sustained, will provide tailwinds," the statement said. It further said the acceleration in investment activity also bodes well for the medium-term growth potential of the economy.

While the decision on keeping the policy rate unchanged was unanimous, Ravindra H Dholakia, one of the six members in the MPC voted to change the stance to neutral. The MPC noted that the benign outlook for headline inflation is driven mainly by the unexpected softening of food inflation and collapse in oil prices in a relatively short period of time. Excluding food items, inflation has remained sticky and elevated, and the output gap remains virtually closed.

Image source: PTI

"The time is apposite to further strengthen domestic macroeconomic fundamentals. In this context, fiscal discipline is critical to create space for and crowd in private investment activity," the MPC said. International crude oil prices have declined sharply since the last policy in October. The price of Indian crude basket collapsed to below USD 60 a barrel by end-November after touching USD 85 a barrel in early October.

In a separate statement, the RBI said the lending rate for retail and MSE borrowers would be benchmarked to external rates with effect from April 1. These could be repo rate or treasury bill yield or any other external benchmark market interest rate. The proposal is aimed at ensuring greater transparency in lending rates by banks, the RBI said, adding final guidelines would be issued in this regard later this month.