Your bank ATM will no longer be the same; this threat to cash makes RBI order a crackdown

After much concern was expressed over bank ATM functioning, especially regarding fake currency, action has finally been ordered by none other than RBI.

With the ongoing news related to bank ATM like fake currency dispensing, cash shortage, system errors and many more raising worries for the public, finally a solution has been ordered now. It is a very drastic change that has been ordered by RBI. The Reserve Bank of India (RBI) has asked banks to uninstall Microsoft Windows XP systems installed in bank ATM. Banks have been given strict guidelines to upgrade all ATM by June 2019. Much concern and worries have been expressed over ATM running on Windows XP system since last year itself. In fact, RBI had red flagged the matter way back in April 2017.

In a latest notification, RBI said, “As you may appreciate, the vulnerability arising from the banks ATM operating on unsupported version of operating system and non-implementation of other security measures, could potentially affect the interests of the banks’ customers adversely, apart from such occurrences, if any, impinging on the image of the bank.”

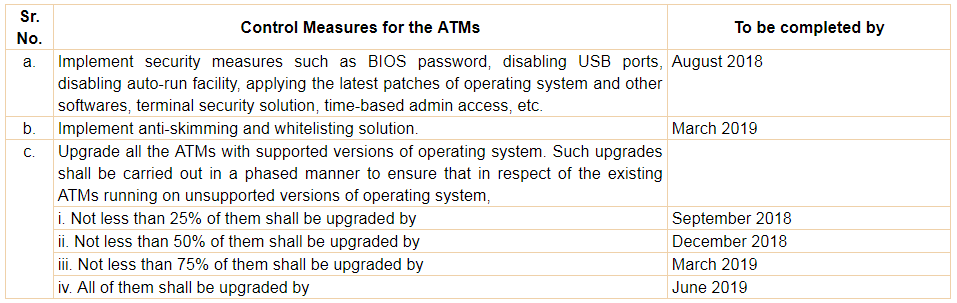

RBI stated that, in order to address these issues in a time-bound manner, banks and White-Label ATM Operators are advised to initiate immediate action in this regard and implement the following control measures as per the prescribed timelines indicated there against:

The central bank has asked Board-approved compliance/action plan in respect of aforesaid control measures by latest July 31, 2018.

RBI says, “The progress made in implementation of these measure should be closely monitored to ensure meeting the prescribed timelines.”

As the implementation of the foregoing control measures would also require field visit(s) to the ATMs, banks should plan and implement these measures in an optimal manner, as per RBI.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

04:38 PM IST

Paytm account holder? Alert! Do not download these Remote Apps, your bank account details may get leaked

Paytm account holder? Alert! Do not download these Remote Apps, your bank account details may get leaked Want refund from Zomato on canceled order? DON'T CALL! You may lose money

Want refund from Zomato on canceled order? DON'T CALL! You may lose money You are under Phishing email attack! Beware! You could be hit by debit, credit card fraud! Save yourself, here is how

You are under Phishing email attack! Beware! You could be hit by debit, credit card fraud! Save yourself, here is how Use bank ATMs? ALERT! Do not pay for these services at SBI, ICICI Bank, HDFC Bank, Axis Bank, others anymore

Use bank ATMs? ALERT! Do not pay for these services at SBI, ICICI Bank, HDFC Bank, Axis Bank, others anymore Fear losing money in bank ATM transactions? This will make you sit up and really pay attention

Fear losing money in bank ATM transactions? This will make you sit up and really pay attention