Will RBI's 25 basis points repo rate cut impact your home loan EMIs?

RBI trimmed down policy repo rate to 6% from 6.25% which is expected to boost housing sector.

Key Highlight:

- Policy repo rate at 6% from previous 6.25%

- Statutory Liquidity Ratio at 20%

- RBI maintains neutral stance

In line with market expectation, the Reserve Bank of India (RBI) during its third bi-monthly monetary policy review, maintained a neutral stance but brought down repo rate by 25 basis points to 6%.

Repo rate is the interest rate at which the central bank charges the commercial banks for lending funds. While borrowing from RBI, banks will have to pay a lending rate which brings repo rate in picture. When this benchmark rate is lower, banks find it as a good option to borrow from RBI then.

Ravindra Pai, MD, Century Real Estate Holdings Pvt Ltd said, “It is a welcome move, especially to combat the odds industry was seeing in recent times. Cheaper home loan definitely will boost positive sentiments amongst the home buyers and in turn will help the developers to gain the momentum.”

Narasimha Swamy N, Head of Sales, Marketing & Customer service, VBHC said, “The lowering of the Repo rate by 25 bps will help curb to some extent the negative sentiments in the real estate sector. The move which aims to drive growth is expected to infuse more liquidity in the system; a much needed relief for the real estate sector.''

Data published by RBI showed that housing loan stood at Rs 8,58,800 crore in May 2017, rising by 12.07% compared to Rs 7,66,300 crore in the similar month of the previous year. Between, April – May 2017, housing loan stands at Rs 17,16,600 crore.

Housing loan growth in FY17 stood at Rs 8.20 lakh crore, rising 9.80% from Rs 7.46 lakh crore in FY16.

After the demonetisation move, analysts have been estimating banks overall credit growth to reach at 10% by FY18 due to performance in housing loan.

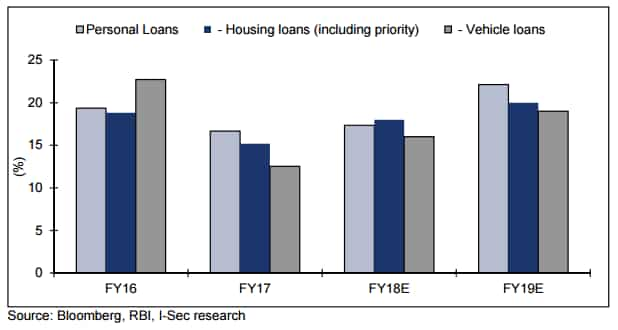

ICICI Securities in its earlier report said, “We expect retail credit demand to be driven by home loans, given the increased affordability on falling product rates, favorable demographic drivers (nuclear families, internal migration) and government incentivisation (upfront interest subvention in affordable housing)."

According to BankBazaar, under the new MCLR regime, the repo rate and the EMI might have a stronger relationship than in the past.

Banks are required to publish new MCLR rates every month for at least 5 tenures. Also, there are tighter regulations on the spread they can apply to their base rate.

Usually when the RBI slashes its repo rates, it means the cost of funds becomes lower for banks. Such indicates that banks can lend at lower rates to customers.

This means lower EMIs as the interest payable will be lesser.

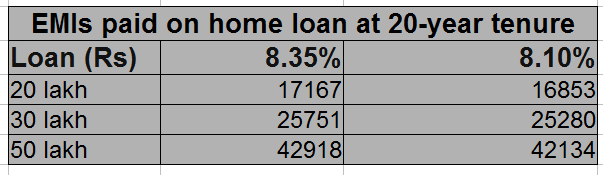

Currently most of the banks have been charging home loan rates at 8.35%. Let see how will your home loan rates come down with the 25 basis point rate cut.

State Bank of India (SBI) in an exclusive interview with ZeeBiz told, "In October there might be another rate cut as inflation numbers stay below the current level on the back of good monsoon factors. Then there is a possibility for further cut in MCLR."

Dhaval Kapadia, Director - Portfolio Strategist, Morningstar said, "If banks transmit the lower rates to borrowers it could result only in a slight improvement in consumption demand, since the rate reduction by Banks and other lenders might be limited to 10 to 20 basis points.”

Many analysts still believe there is more room for more MCLR cut and this will prompt existing bank borrowers to shift from base rate system to new MCLR mechanism as will help reduce repayment cost.

A Jefferies report earlier stated that a 60-90 basis points reduction in one-year bank funding rate could shift the marginal volume from a non-bank to a bank.

Shifting from base rate to new MCLR rate means your EMIs will come down.

Housing loans, as a percentage of total loan book, is 12% of the total credit disbursed by banks in the country.

Also, RBI has maintained the Statutory Liquidity Ratio at 20% which will drive housing loan.

Chanda Kochhar, MD and CEO, ICICI Bank in June policy said, "The SLR cut and reduction in risk weights for housing loans are positive moves that will support bank liquidity and encourage growth in housing loans.”

Lastly, Narasimha added, "We can look forward to more than improved sentiment and better sales. Lower interest rates will also help developers of real estate in India who have seen rising debt in the past few years."

ALSO READ:

- RBI cuts repo rate by 25 basis points; lowest since 2010

- RBI's SLR cut may help bring down your EMIs

- Bi-monthly monetary policy: RBI says MCLR performance not 'entirely satisfactory'

- An era of low bank loan growth to India Inc may be here

- Bi-Monthly monetary policy: RBI pushes for affordable housing but will interest rates come down?

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

03:59 PM IST

Electricity distribution companies continue to remain a burden on state finances: RBI

Electricity distribution companies continue to remain a burden on state finances: RBI Rupee hits all-time low; RBI intervenes to curb further losses

Rupee hits all-time low; RBI intervenes to curb further losses Rupee slumps to record closing low of 84.88 vs dollar

Rupee slumps to record closing low of 84.88 vs dollar Bank stocks rally up to 2% after RBI cuts CRR to 4%

Bank stocks rally up to 2% after RBI cuts CRR to 4% RBI raises retail inflation estimate for FY25 to 4.8% amid rising food prices

RBI raises retail inflation estimate for FY25 to 4.8% amid rising food prices