Why are banks choosing to cut savings account interest rates?

Two banks namely Axis Bank and SBI have brought down their savings account interest rates by 50 basis points.

Key Highlights:

- Axis Bank offers 3.50% per annum interest up to Rs 50 lakh balance

- SBI offers 3.50% per annum interest up to Rs 1 crore

- Cut in savings account will cushion NIM

Interest rates on bank deposits saw reduction for the first time in six years after State Bank of India (SBI) on July 31, 2017, announced a two tier interest rate.

A person with savings account balance of Rs 1 crore will continue to earn interest rates at 4% per annum while a person holding balance below Rs 1 crore will only earn interest rate of 3.5% per annum.

SBI group has saving deposits of Rs 9.4 lakh crore – 90% is below Rs 1 crore accounts which would now be getting interest rate of 3.5% per annum.

Many analysts believe other banks will follow the suit. Veekesh Gandhi and Ashish Kumar research analysts at Bank of America Merrill Lynch said, “We believe that other banks may follow suit as the liquidity in the system continues to remain high amidst a tepid loan growth environment.”

Axis Bank has already announced that savings account balance up to Rs 50 lakh will get interest rate of 3.50% per annum - a cut of 50 basis points from previous rate.

Who decides savings deposit rates?

The Reserve Bank of India on October 25, 2011, deregulated the savings bank deposit interest rate. Since then banks have been deciding the interest rates they offer.

Banks since then are free to determine their savings bank deposit interest rate for resident Indians only with immediate effect subject to two conditions.

Firstly, each bank will have to offer a uniform interest rate on savings bank deposits up to Rs 1 lakh – irrespective of the amount in the account within this limit. Secondly, for balance above Rs 1 lakh – banks are allowed to provide differential rates of interest, if it so chooses, subject to the condition that banks will not discriminate in the matter of interest paid on such deposits, between one deposit and another of similar amount, accepted on the same date, at any of its offices.

Since then, banks have mostly increased the rates on savings account, while none reduced it. The interest rate has been 4% of most banks.

So why the reduction now?

Bringing savings account interest down was an outcome of large inflows in savings and current accounts during the demonetisation period between November – December 2016, as per SBI.

Surplus liquidity in the banking system was at peak of Rs 7.95 lakh crore as on January 4, 2017, reached to an average of Rs 6 lakh crore in February and later till Rs 4.80 lakh crore in March.

RBI in August monetary policy said, “Surplus liquidity conditions persisted in the system, exacerbated by front-loading of budgetary spending by the Government.”

But one of the major reasons of banks was the marginal cost of fund based lending rate (MCLR).

Bank of America Merrill said, “If a good part of deposits accrued on account of demonetization moves out over the following 3-6 months, banks will tend to either raise lending rates or alternatively cut deposit rates further. This is because we expected banks to focus on profitability in contrast to volumes. ”

Basically banks make money by lending money at rates that are higher than the cost of the money they lend. They collect interest on loans and interest payments from the debt securities they own and pay interest on deposits.

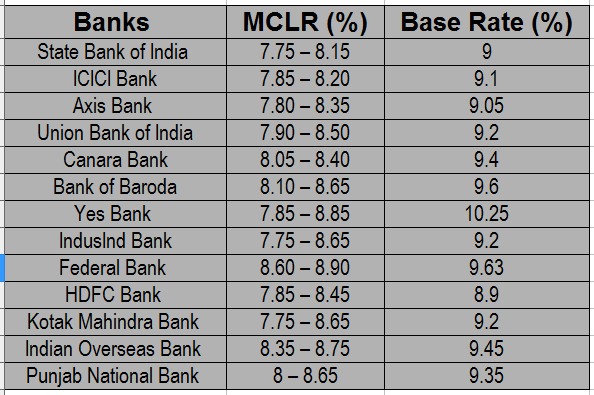

During January – March 2017 period, the base rate of banks came down from a range of 9.3 – 9.7% to 9.1% - 9.6% while the MCLR reduced from 8.95% to 7.75 – 8.20%.

Rajnish Kumar, Managing Director - National Banking Group, SBI said, “The revision in savings bank rate would enable us to maintain the MCLR at the existing rates, benefitting a large segment of retail borrowers in SME, agriculture & affordable housing segments.”

Analysts at Edelweiss Financial Services said, “We believe while this move will provide leg up to funding cost, we see lower lending yields on: a) transition to MCLR (eventually lower funding cost will be passed on to borrowers); b) lower credit offtake signifies intense competition, leading to lower spreads; and c) there might be some switch from savings to FDs (which are more sticky costs).”

One thing it will surely cushion the growth of net interest margin which is muted of the banking universe due to slowdown in credit growth.

Edelweiss said, “We expect this move to cushion NIMs at sector level (versus anticipation of decline) and earnings to bolster up to 2-6% for private banks & 15-20% for PSU banks (everything else remaining same) given transient asset recovery cycle which will keep credit costs elevated in near term. ”

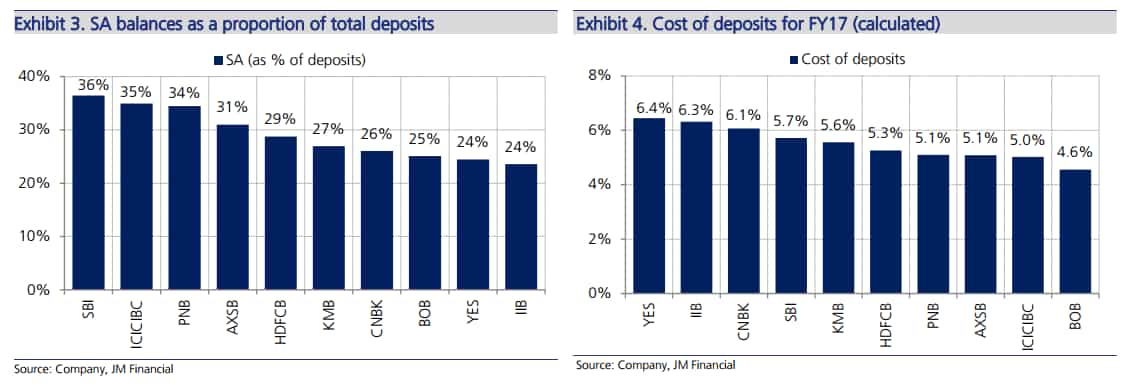

According to Bank of America Merrill, NIM impact will vary across banks due to 1) difference in SA (Savings Accounts) ratio- i.e. proportion of total deposits in savings accounts to total deposits, 2) proportion of saving deposits below Rs 1 crore.

Also this move is a negative for NBFCs (particularly HFCs) as banks will enjoy funding cost benefit, which they can pass on (lower lending rate or spreads) thus increasing competition.

Amidst all these, secondary benefit may also flow through to insurers/MFs as this will push customers to evaluate other avenues and park their savings in more productive financial asset classe, added Edelweiss.

ALSO READ:

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SIP Calculation at 12% Annualised Return: Rs 10,000 monthly SIP for 20 years, Rs 15,000 for 15 or Rs 20,000 for 10, which do you think works best?

FD Rates for Rs 10 lakh investment: Compare SBI, PNB, HDFC, ICICI, and Post Office 5-year fixed deposit returns

LIC Saral Pension Plan: How much should you invest one time to get Rs 64,000 annual pension for life?

SIP Calculation at 12% Annualised Return: Rs 1,000 monthly SIP for 20 years, Rs 4,000 for 5 years or Rs 10,000 for 2 years, which do you think works best?

UPS vs NPS vs OPS: Last-drawn basic salary Rs 90,000 and pensionable service 27 years? What can be your monthly pension in each scheme?

Monthly Pension Calculations: Is your basic pension Rs 26,000, Rs 38,000, or Rs 47,000? Know what can be your total pension as per latest DR rates

11:21 AM IST

Term deposits outpace CASA growth in September: RBI data

Term deposits outpace CASA growth in September: RBI data  Unity Bank elevates savings account interest rates and fixed deposit offerings

Unity Bank elevates savings account interest rates and fixed deposit offerings Is keeping too much money in savings account a bad financial decision?

Is keeping too much money in savings account a bad financial decision? Guide to building an emergency fund: Why it is needed, where should you invest?

Guide to building an emergency fund: Why it is needed, where should you invest? How much interest is your bank giving on your savings accounts? Compare rates of top lenders here

How much interest is your bank giving on your savings accounts? Compare rates of top lenders here