Who is Porinju Veliyath, the small-cap czar who apologised to investors after this stock crashed 44%?

Investing and giving tips in equities is a tough task. One has to be wise enough to deal with transformative changes that are risky and volatile. That applies to everyone, but many receive setbacks. The person who is under the spotlight is Porinju Veliyath. He is the founder of Equity Intelligence and his company’s wealth eroded by a whopping 44% and that too due to just one stock! The impact was such that now Veliyath is apologizing to investors whom he recommended this stock to. It was LEEL Electricals Ltd (formerly Lloyd Electric & Engineering) that has become a massive mistake for Veliyath and he has admitted to his investors that it was a ‘flawed investment’.

A copy of Veliyath’s letter to investors was with IANS, in which he said the damage has already been done through the "flawed investment" and that attempting to liquidate the investment now would only lower the realizable value and won't make any material positive impact to NAVs.

This brings the question to why has LEEL Electricals become the major cause of concern for Veliyath.

How would you feel, if you began an investment in a stock which was almost near Rs 300-level a year ago, and by end of that respective year all you have is no gains but a tragic loss. The emotions would be unexplainable as no one enjoys or stays calm when an investment in equity turns out to be an utter blunder.

This was the case for Veliyath whose company invested heavily in LEEL Electricals since December 2017. The burden further lies with Veliyath as he even recommended this stock to many investors.

In his letter, Veliyath reportedly stated that, he continued to hold the stock amid a sell-off triggered by the company arbitrarily writing back the profit from sale of its Consumer Durable division to Havells in May, 2018 "to the shock of entire minority shareholders", including Equity Intelligence, in the hope of a better exit, eventually given the value in company's operations and assets, illiquidity at the counter and the portfolio's significant holding in the company.

From October 2017 till mid 2018, there were many buy calls on LEEL Electricals.

A tweet from Varindra Bansal, MD of Pantomath Assets in October 2017, called LEEL Electricals as one of the pataka stocks. Many other news agency recommended LEEL stocks.

SP TULSIAN – PATAKA STOCKS

Dalmia Bharat Sugar Target 245

Eon Electric Target 130

Leel Electricals Target 440

Indian Toners Target 400— Varinder Bansal (@varinder_bansal) October 13, 2017

During Budget 2018, Veliyath spoke about at length about his own set of top stocks that were likely to be money making magnets, one of which was LEEL Electricals.

#BudgetWithETNOW | #Budget2018 | Here are the top #BudgetPicks by ace investor Porinju Veliyath (@porinju). Keep an eye on these stocks & stay tuned to ET NOW to catch Porinju LIVE with his market analysis of the Big Budget at 10:00 am today! @nikunjdalmia @AyeshaFaridi1 pic.twitter.com/Gpg1w2n1Ke

— ET NOW (@ETNOWlive) February 1, 2018

However, time has changed.

Let’s understand why LEEL Electricals has erased investors wealth.

A year ago on January 12, 2018, LEEL Electricals level was at Rs 298.3 per piece, and the stock has even plunged to Rs 44 intraday low today. Hence, this company has dropped by a whopping 85% in just 1 year, making many investors, poorer by massive amounts, including Veliyath.

Today, on Sensex, the stock is trading at Rs 44.05 per piece down by 3.19% at around 1123 hours.

Also, the year 2019 began in LEEL with directors resigning from the company, which is another cause of concern for investors.

Firstly, it was Anita K. Sharma, Company Secretary & Compliance Officer of the Company, who tendered her resignation with effect from close of the business hours of December 31, 2018.

Later, Ramesh Kumar Vasudeva resigned due to personal reasons as Non-Executive Independent Director of the Company with effect from January 07, 2019. Further, Achin Kumar Roy has resigned due to his personal reasons as Wholetime Director of the Company with effect from January 08, 2019

Coming to Veliyath, as per Sebi’s data, it was known that, Equity Intelligence continued to hold this stock, meanwhile, its portfolio plunged by nearly 44% by end of 2018. The data showed that, Veliyath’s company first saw a drop of nearly 12% in LEEL during May 2018, the loss extended to another 12.3% in June 2018 and further to 20% in September 2018 and its no mystery to what happened by end of December 2018.

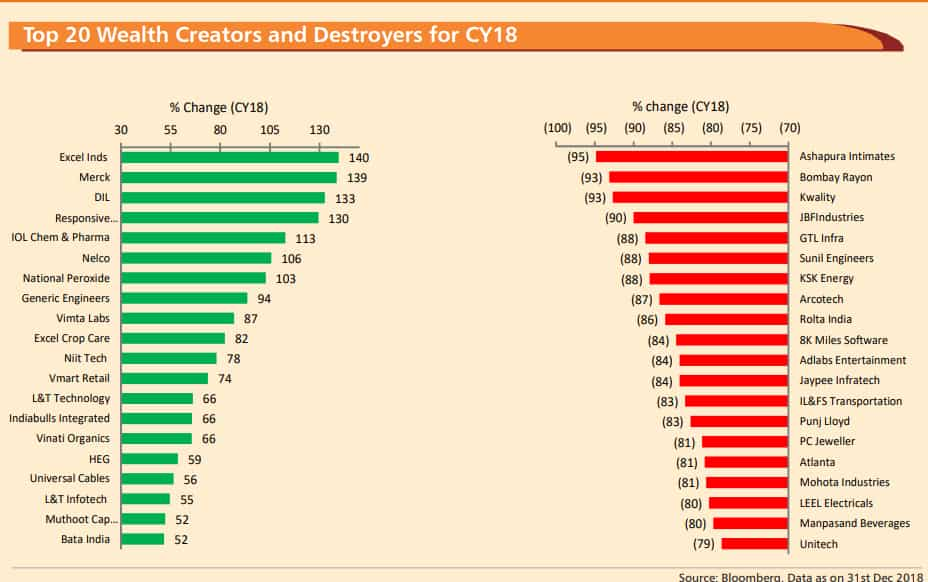

Even Motilal Oswal has included LEEL among top 20 stocks that were wealth destroyers in the year 2018.

According to TrendLyne.com data, Veliyath began investing in LEEL from December 2017, where his holding stood at just 5.52%. But the year, the optimism was such that the investor raised his holding to 8.19% by end of March 2018. However, after selling few stocks in June 2018 quarter in LEEL, the investor took his holding in the company lower to 7.90%. But in September 2018, when stock markets were in bearish mode, the investor once again bought into LEEL and took his holding up to 8.38%, which is the current investment.

Surely a journey of a midcap stock to penny stock, has became a lesson for many investors who have burned their hands in LEEL.

Who is Porinju Veliyath?

Porinju has been called a small-cap czar by The Economic Times. Born on June 6, 1962, Porinju has been on board of major companies and is a famous investor and fund manager. He is also seen among top investors like Rakesh Jhunjhunwala, Dolly Khanna, others.

He began his career as a floor trader with Kotak Securities in 1990, and within four years time he joined Parag Parikh Securities in 1994, working as research analysts and fund manager.

Later in 2002, Porinju launched his own fund management firm in the name of Equity Intelligence. He is also director of Arya Vaidya Pharmacy, which with Hindustan Unilever Limited (HUL) has created a range of Ayurvedic personal care products under the ‘Lever Ayush’ brand.

His ideas, opinions and views in regards to stock market investments are featured in Value Investing.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Power of Compounding: In how many years, investors can achieve Rs 6.5 cr corpus with monthly salaries of Rs 20,000, Rs 25,000, and Rs 30,000?

SBI Green Rupee Deposit 2222 Days vs Canara Bank Green Deposit 2222 Days FD: What Rs 7 lakh and Rs 15 lakh investments will give to general and senior citizens; know here

5X15X25 SIP Strategy: Is it possible to create Rs 1,64,20,369 corpus with Rs 5,000 monthly SIP investment?

SBI 400-day FD vs Bank of India 400-day FD: Where will investors get higher returns on investments of Rs 4,54,545 and Rs 6,56,565?

11:37 AM IST

Porinju Veliyath-backed small-cap stock jumps 18%; know what’s fueling rally in counter

Porinju Veliyath-backed small-cap stock jumps 18%; know what’s fueling rally in counter Aurum Porptech shares hit 20% upper circuit after Porinju Veliyath picks stake in company via bulk deal

Aurum Porptech shares hit 20% upper circuit after Porinju Veliyath picks stake in company via bulk deal Bulk Deals: Porinju V. Veliyath buys stake in Aurum Proptech; Fino Payments witness maximum buzz

Bulk Deals: Porinju V. Veliyath buys stake in Aurum Proptech; Fino Payments witness maximum buzz