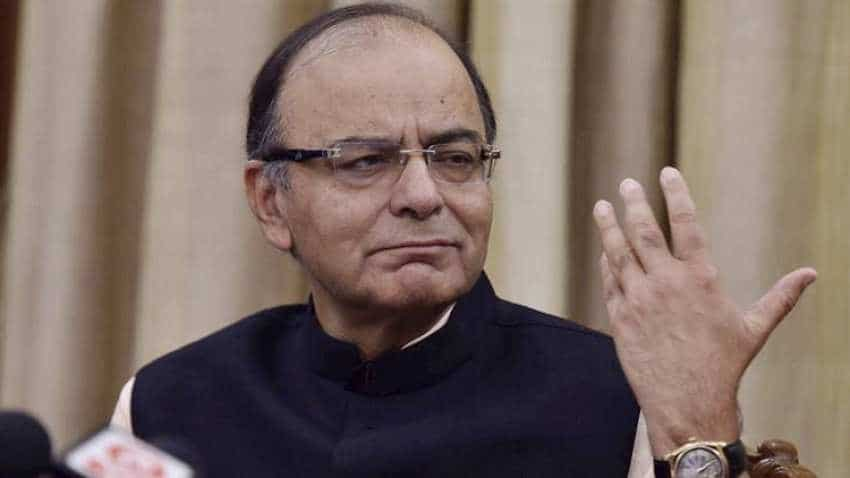

What will reduce poverty in India? Arun Jaitley reveals

Union finance minister Arun Jaitley on Thursday said that a high rate of economic growth is necessary to pull people out of poverty and to improve quality of life.

Union finance minister Arun Jaitley on Thursday said that a high rate of economic growth is necessary to pull people out of poverty and to improve quality of life. Jaitley was addressing the 25th World Congress of Savings and Retail Banks here in the national capital.

“Economies like ours need a high rate of growth. We want to use growth as a mechanism to pull the maximum number of people out of poverty, improve upon quality of life, but we are conscious of the fact that dangers of development and progress benefiting a few and leaving many others out of inclusion system are also there,” he said.

He also said an aspirational society cannot wait indefinitely for the benefits of growth to improve the quality of life of the poor.

He said that the ultimate objective of Jan Dhan, the government’s financial inclusion programme, was to bank the unbanked, secure the unsecured, fund the unfunded and service the unserviced areas.

Banks, especially public sector banks, opened 33 crore accounts under the Pradhan Mantri Jan Dhan Yojana (PMJDY) in a few months, he said.

Initially, people said they had no money to put in the account and it was zero balance accounts and gradually people started putting in money.

An overdraft facility was provided to incentive them, he said.

The government offered insurance at very affordable premium as part of the social security system through the PMJDY account to the uninsured and unpensioned, he said. “As many as 14.1 crore people have

been enrolled under accident insurance while 5.5 crore have availed life insurance under the scheme,” he said.

This article first appeared in DNA Money as ‘High growth will reduce poverty’

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

03:39 PM IST

Intention of Centre to levy GST on petrol, diesel; states will have to decide on rate: Finance Minister

Intention of Centre to levy GST on petrol, diesel; states will have to decide on rate: Finance Minister Arun Jaitely 70th birth anniversary: A peek into the life of BJP's original Chanakya and trouble-shooter

Arun Jaitely 70th birth anniversary: A peek into the life of BJP's original Chanakya and trouble-shooter Arun Jaitley death anniversary: Remembering the architect of GST and BJP's trusted troubleshooter

Arun Jaitley death anniversary: Remembering the architect of GST and BJP's trusted troubleshooter PM Modi remembers former Finance Minister Arun Jaitley on death anniversary, says ‘miss my friend a lot’

PM Modi remembers former Finance Minister Arun Jaitley on death anniversary, says ‘miss my friend a lot’  Budget 2020: Nirmala Sitharaman pays homage to Arun Jaitley

Budget 2020: Nirmala Sitharaman pays homage to Arun Jaitley