Union Budget 2019-20 likely to spell out roadmap for banking sector reforms, consolidation

So, fit candidates for acquisition of small lenders would be Punjab National Bank, Canara Bank, Bank of India and Union Bank of India with some capital support, the sources added.

The Union Budget for 2019-20 is likely to spell out roadmap for banking reforms, including consolidation of the state-owned lenders, with a view to enable the sector to play a pivotal role in pushing India towards USD 5 trillion economy, sources said.

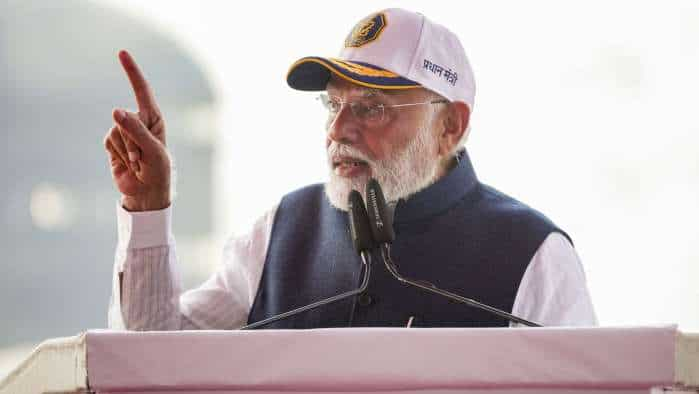

The first Budget of Modi 2.0 government is scheduled to be presented on July 5 by Finance Minister Nirmala Sitharaman on the backdrop of India's economy hitting 5-year low growth of 6.8 per cent in 2018-19.

The banking sector has an important role in the reinvigorating sagging economy, the sources said, adding the Budget speech of the Finance Minister will contain roadmap for the reforms in the sector.

The upcoming Budget would also provide direction to the consolidation journey in the public sector banking space, started last year by effecting first three-way merger, they added.

As part of this exercise, erstwhile Vijaya Bank and Dena Bank were merged with Bank of Baroda (BoB) effective April 1 to create the third-largest lender of the country.

According to the sources, the journey will continue broadly on the same lines of merger of smaller banks with big lenders.

So, fit candidates for acquisition of small lenders would be Punjab National Bank, Canara Bank, Bank of India and Union Bank of India with some capital support, the sources added.

It is to be noted that the government infused Rs 5,042 crore in BoB to enhance its capital base to meet additional expense due to amalgamation of Dena Bank and Vijaya Bank.

The maiden three-way amalgamation is the first step in the consolidation of the public sector banking industry, recommended in 1991 by the Narasimham Committee report. Through this merger, the government has created an institution of global scale and size, thereby providing significant benefit to all stakeholders.

The consolidated entity started the operation with a business mix of over Rs 15 lakh crore on the balance sheet, with deposits and advances of Rs 8.75 lakh crore and Rs 6.25 lakh crore, respectively.

BoB, the second-largest public sector lender after State Bank of India, now has over 9,500 branches, 13,400 ATMs, and 85,000 employees to serve 12 crore customers.

Prior to BoB merger, the government only had experience of State Bank which had merged five of its associate banks - State Bank of Patiala, State Bank of Bikaner and Jaipur, State Bank of Mysore, State Bank of Travancore and State Bank of Hyderabad and also Bhartiya Mahila effective April 2017.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

04:07 PM IST

Budget: Where does Centre spend every 1 rupee earned?

Budget: Where does Centre spend every 1 rupee earned? Budget: Where does Centre collect every 1 rupee of revenue from?

Budget: Where does Centre collect every 1 rupee of revenue from? Budget 2025: The Legacy of Sir C.D. Deshmukh – The first Indian RBI Governor turned Finance Minister

Budget 2025: The Legacy of Sir C.D. Deshmukh – The first Indian RBI Governor turned Finance Minister 55th GST Council Meeting: No GST payable on penal charges levied & collected by banks & NBFCs from borrowers for non-compliance, says Nirmala Sitharaman

55th GST Council Meeting: No GST payable on penal charges levied & collected by banks & NBFCs from borrowers for non-compliance, says Nirmala Sitharaman  GST Council postpones decision on slashing tax on life, health insurance

GST Council postpones decision on slashing tax on life, health insurance