Three days left for e-filing of TDS; Here’s what you need to know

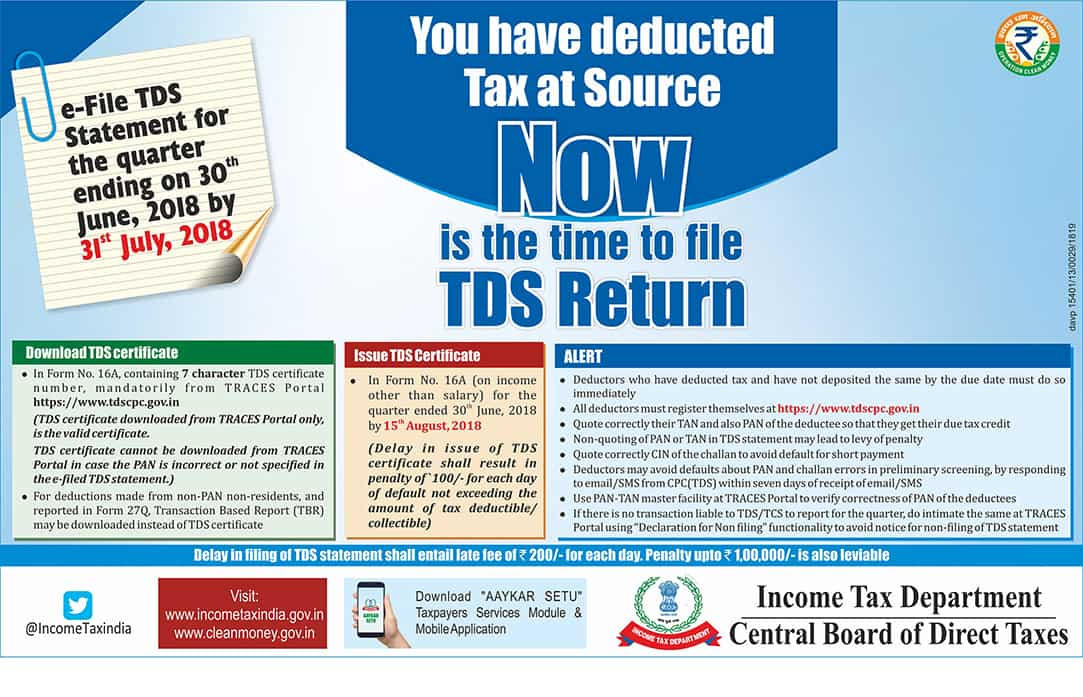

The Income Tax Department has launched an advertisement for taxpayers who are required to file TDS by July 31. There are only three days left for filing of TDS for the quarter ending June 30, 2018. The department has released a list of guidelines for taxpayers to remember while filing their TDS. As per Section 206 of Income Tax Act all corporate and government deductors are compulsorily required to file their TDS return on electronic media (i.e. e-TDS returns). However, for other Deductors, filing of e-TDS return is optional.

In the latest advertisement, the department has stated that, in form No No.16A (on income other than salary) for the quarter ended June 30, 2018 file it before August 15, 2018. For the ones who delay in issue of TDS certificate shall result in penalty of Rs 100 for each day of default not exceeding the amount of tax deductible or collectible.

Further the department also issued few alert points to remember for TDS taxpayers. Some of them are:

- Deductors who have deducted tax and have not deposited the same by the due date must do so immediately.

- All deductors must register themselves at www.tdscpc.gov.in

- Quote correctly their TAN and also PAN of the deductee so that they get their due tax credit/

- Non-quoting of PAN or TAN in TDS statement lead to levy of penalty.

- Quote correctly CIN of the challan to avoid default for short payment.

- Deductors may avoid default about PAN and challan errors in preliminary screening, by responding to email/SMS within seven days of receipt of email/SMS.

- Use PAN-TAN master facility at TRACES portal to verify corrections of PAN of the deductees.

- If there is no transaction liable to TDS/TCS to report for the quarter, do not intimate the same at TRACES portal using 'Declaration for non filing' functionality to avoid notice for non-filing of TDS statement.

An e-TDS return should be filed under Section 206 of the Income Tax Act in accordance with the scheme dated 26.8.03 for electronic filing of TDS return notified by the CBDT for this purpose. CBDT Circular No.8 dated 19.9.03 may also be referred.

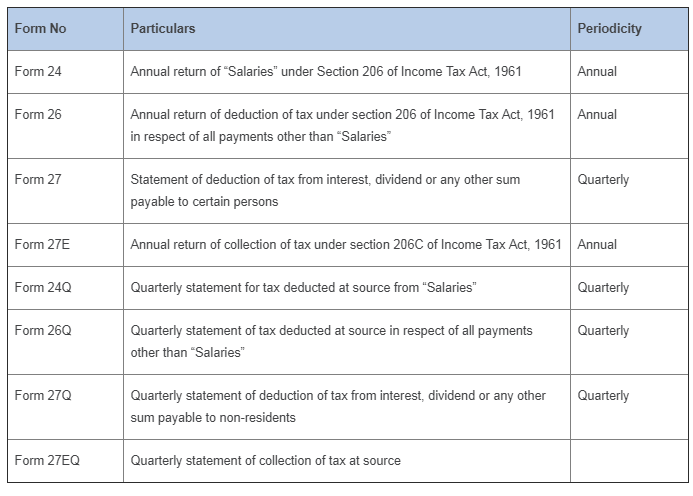

Following are the returns for TDS and TCS and their periodicity:

Moreover, form 16/ 16A is the certificate of deduction of tax at source and issued on deduction of tax by the employer on behalf of the employees. These certificates provide details of TDS / TCS for various transactions between deductor and deductee. It is mandatory to issue these certificates to Tax Payers.

Here's how to file TDS.

Step 1: In e-Filing Homepage, Click on "Login Here"

Step 2: Enter User ID (TAN), Password, and Captcha. Click Login.

Step 3: Post login, go to TDS - Upload TDS.

Step 4: In the form provided, select the appropriate statement details.

Step 5: Click Validate to Validate Statement details.

Step 6: “Upload TDS ZIP file”: Upload the TDS/TCS statement (Prepared using the utility downloaded from tin-NSDL Website).

Step 7: “Attach the Signature file” Upload the signature file generated using DSC Management Utility for the uploaded TDS ZIP file. For further details on generating Signature file click here. Navigate to Step by Step Guide for Uploading Zip File (Bulk Upload).

Step 8: Click on “Upload” button.

Once the TDS is uploaded, success message will be displayed on the screen. A confirmation mail is sent to the registered email id.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

LIC Saral Pension Plan: How to get Rs 64,000 annual pension on Rs 10 lakh one-time investment in this annuity scheme that everyone is talking about

Gratuity Calculation: What will be your gratuity on Rs 45,000 last-drawn basic salary for 6 years & 9 months of service?

Rs 1,500 Monthly SIP for 20 Years vs Rs 15,000 Monthly SIP for 5 Years: Know which one can give you higher returns in long term

Income Tax Calculations: What will be your tax liability if your salary is Rs 8.25 lakh, Rs 14.50 lakh, Rs 20.75 lakh, or Rs 26.10 lakh? See calculations

8th Pay Commission Pension Calculations: Can basic pension be more than Rs 2.75 lakh in new Pay Commission? See how it may be possible

SBI Revamped Gold Deposit Scheme: Do you keep your gold in bank locker? You can also earn interest on it through this SBI scheme

Monthly Pension Calculations: Is your basic pension Rs 26,000, Rs 38,000, or Rs 47,000? Know what can be your total pension as per latest DR rates

07:48 PM IST

A step-by-step guide to apply for PAN using Form 49A, check all details

A step-by-step guide to apply for PAN using Form 49A, check all details What is TAN in income tax? Key questions answered

What is TAN in income tax? Key questions answered GST on online gaming, gambling: Experts say predictable, progressive taxes key to make India global gaming hub

GST on online gaming, gambling: Experts say predictable, progressive taxes key to make India global gaming hub ITR filing: How to file Income Tax Return without Form 16 - Explained

ITR filing: How to file Income Tax Return without Form 16 - Explained  Virtual Digital Assets: VDAs to attract 1% TDS from today; know what CBDT says about new norms

Virtual Digital Assets: VDAs to attract 1% TDS from today; know what CBDT says about new norms