This is how govt will have additional Rs 15,000 crore in FY18

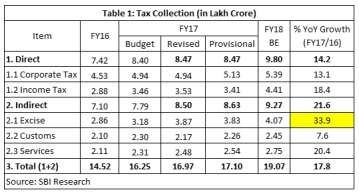

In February, Finance Minister Arun Jaitley while presenting the Union Budget of FY17-18, had revised the estimate of tax collection for FY17 to Rs 16.97 lakh crore.

The government will begin FY18 with an additional amount of Rs 15,000 crore.

This is how.

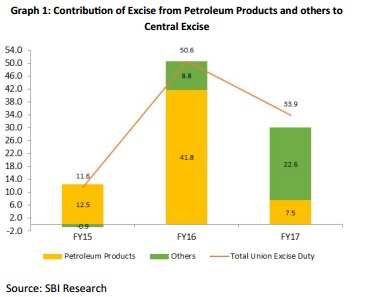

The taxes from non petroleum contributed a significant 22.6% to the union excise growth of 33.9% during FY17. This has helped the provisional figures of tax collection in financial year 2017 increase by 18% to Rs 17.10 lakh crore.

ALSO READ: India's FY17 tax collection reaches Rs 17.10 lakh crore

The amount is highest in last six years.

According to SBI Ecoflash report, in FY16, the petroleum contribution in union excise was higher, as Government has increased excise tax a number of times to get the benefits of falling crude oil prices.

However, this has since then declined in FY17, reflecting that the buoyancy in excise tax collections is indeed attributed to growth of additional components. This is contrary to market perception that oil is the primary lubricator of this jump in excise, the report said.

In February, Finance Minister Arun Jaitley while presenting the Union Budget of FY17-18, had revised the estimate of tax collection for FY17 to Rs 16.97 lakh crore from last year's Budget estitmate (BE) of Rs 16.25 lakh crore.

What led to rise of Rs 15,000 crore tax collection?

Dr. Soumya Kanti Ghosh, Group Chief Economic Adviser, State Bank of India, in a report titled 'Rs 15,000 Crore Fiscal Bonanza For FY18' said, "Based on the petrol and diesel consumption trends in Apr’16-Feb’17, we estimate that excise duty collected from petroleum products may have registered a growth of 12%.

If this is so, the recent spurt in excise duty collections is also due to some other components other than petro products and possibly some other reasons other than petroleum products (the growth rate of such is well in excess of 50%), Ghosh added.

Thus, the tax numbers provides leeway for FY18. This is because the government has already exceeded the tax collection figures or Rs 16.97 lakh crore. So, if disinvestment receipts are also added, the government will begin the FY18 with an additional revenue of Rs 15,000 crore.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

07:45 PM IST

Net direct tax kitty grows 16.45% to Rs 15.82 lakh crore till December 17

Net direct tax kitty grows 16.45% to Rs 15.82 lakh crore till December 17 Net direct tax collection grows almost 20% to Rs 18.90 lakh crore till March 17 in FY 2023-24

Net direct tax collection grows almost 20% to Rs 18.90 lakh crore till March 17 in FY 2023-24  Government to stick to Rs 33.61 lakh crore tax collection target in revised estimate, no case for fuel tax cut: Official

Government to stick to Rs 33.61 lakh crore tax collection target in revised estimate, no case for fuel tax cut: Official Net direct tax collection reaches 83% of revised estimate to Rs 13.73 lakh crore for FY23

Net direct tax collection reaches 83% of revised estimate to Rs 13.73 lakh crore for FY23 Gross direct tax collection surges 24% to Rs 15.67 lakh crore, net mop-up touches 79% of revised estimates

Gross direct tax collection surges 24% to Rs 15.67 lakh crore, net mop-up touches 79% of revised estimates