These 10 IPOs of 2017 have returned handsome returns; are you invested?

A total of 24 companies have launched their IPOs and cumulatively raised about Rs 21,560 crore through the route.

Key Highlights:

- 10 companies gave return between 50% - 300% after IPO launch

- Three IPOs best performer since 2000

- Avenue Supermart best performer on stock exchanges after IPO launch

A total of 24 companies have launched IPOs and the retail portion has seen over-subscription in the range of 1 to 24 times. Together these companies have raised Rs 21,560 crore via IPOs.

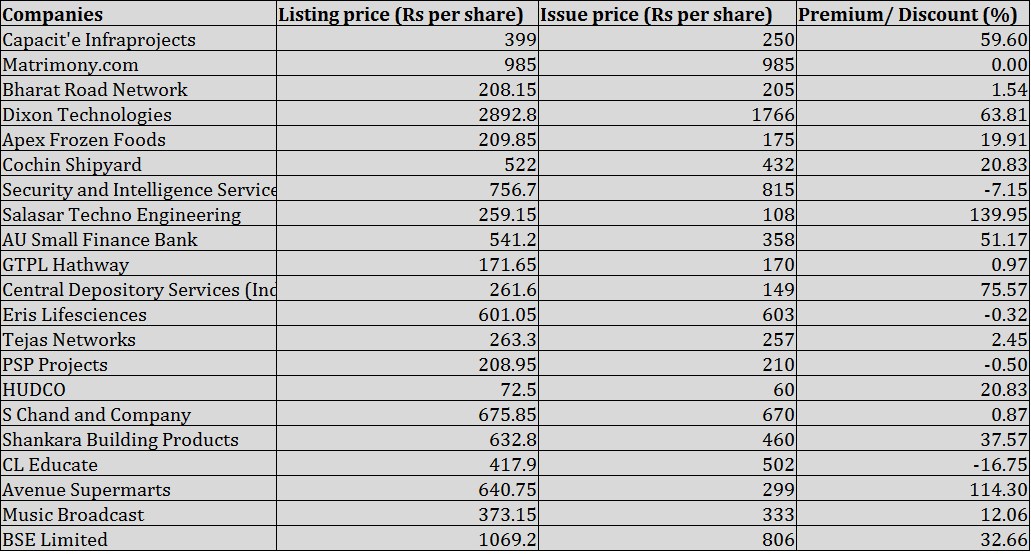

Among the total, 22 companies are now listed but there are ten companies which gave return in the range of 50% to 300% from their issue price.

D-Marts' parent Avenue Supermarts (ASL) has gained the most -- 307%. The company's share price has touched a high of Rs 1218 per share so far.

Shankara Building Products which gained by nearly 230%, followed by BSE-owned Central Depository Services (India) Limited (CDSL) increasing by 226.17%, Salasar Techno Engineering by 209.26%, Apex Frozen Food by 102.86% and AU Small Finance Bank by 102.65%.

Others in list were also PSP Project which rose almost 78%, Bharat Road Network Limited by 71.02%, state-owned HUDCO by 70.50% and Capacit'e Infraprojects by 59.60%.

Apart from this, other listed companies have given return in the range of 4% - 47%. CL Educate is trading 5% lower than its issue price.

Market Debut:

Matrimony.com, which got listed last week, would be the first company to get listed at its issue price.

Companies like GTPL Hathway, Eris Lifescience, PSP Projects and S Chand & company received tepid responses at their respective debuts.

IPO performance:

Three companies have already become highest-ever to get over 150 times subscription since the year 2000.

Salasar was the first IPO to receive over 270-times subscription in 17 years. This was followed by Capacit'e which received oversubscription of 183.03 times and CDSL with 170.16-times subscription.

ASL and Dixon Technologies were also not faraway as they bagged subscription of 104.59 and 117.83 times, respectively.

Lowest subscription was seen in GTPL Hathway (1.53 times), Bharat Road Network (1.81 times), CL Educate (1.90 times), ICICI Lombard General Insurance (2.98 times) and SBI Life Insurance (3.58 times).

Vish Dhingra, executive director, EY Global, said, "With positive macroeconomic factors, continuing regulatory and tax reforms and a robust investor and business sentiment, 2017 promises to be a healthy IPO year."

ICRA in its report mentioned that positive sentiments in IPO market can push revenues of broking industry is expected to touch Rs 18,000-Rs 19,000 crore, a rise of 15-20% in FY18.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

12:55 PM IST

Senores Pharmaceuticals IPO opens for subscription: Should you bid for the issue?

Senores Pharmaceuticals IPO opens for subscription: Should you bid for the issue? Hamps Bio shares debut at 90% premium on BSE SME platform

Hamps Bio shares debut at 90% premium on BSE SME platform Jungle Camps makes a strong market debut; shares list at 90% premium

Jungle Camps makes a strong market debut; shares list at 90% premium Dhanlaxmi Crop Science soars nearly 100% on NSE SME debut

Dhanlaxmi Crop Science soars nearly 100% on NSE SME debut Blackstone-backed International Gemmological garners Rs 1,900 crore from anchor investors

Blackstone-backed International Gemmological garners Rs 1,900 crore from anchor investors