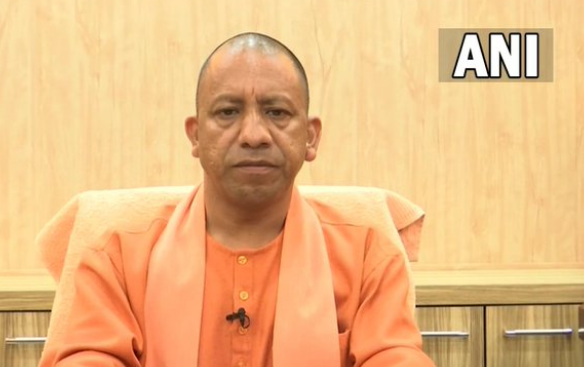

Target to increase UP's credit-deposit ratio to 65% next fiscal: Yogi Adityanath to bankers

Chief Minister Yogi Adityanath also called for enhancing CCTV coverage to bolster bank security and ensure seamless access to CCTV footage for law enforcement as needed.

)

Uttar Pradesh Chief Minister Yogi Adityanath on Wednesday expressed his satisfaction with the state's current credit-deposit (CD) ratio of 58.59 per cent. The Chief Minister has set an ambitious goal to elevate the CD ratio to 65 per cent in the next financial year and committed to offering all necessary support and security to facilitate this growth for banks. Furthermore, the Chief Minister emphasized the importance of adopting a mission-driven approach to expand digital banking and financial literacy across all 75 districts, according to an official statement."Banks have played a commendable role in our efforts to provide financial incentives in the form of loans to every needy and energetic youth.

This sequence of loan fairs should continue further. Do not hesitate in extending loans," he said in the meeting of the State Level Bankers Committee while reviewing the performance of the quarter ended December 2023. In each of its schemes, the government will ensure training and capacity building of the beneficiaries before providing loans, he added. Referring to the state government's ambitious scheme 'Family ID', he said that all the banks should provide complete data on beneficiaries of central and state government schemes so that the situation of every family in the state can be accurately assessed.

The Chief Minister also reviewed the progress of key social security programs, including the Atal Pension Yojana, Pradhan Mantri Jeevan Jyoti Bima Yojana, and Pradhan Mantri Jan Dhan Yojana. He highlighted that, in alignment with the Prime Minister's vision, the state has been successful in ensuring that every citizen benefits from these crucial social security schemes. Chief Minister Yogi Adityanath also called for enhancing CCTV coverage to bolster bank security and ensure seamless access to CCTV footage for law enforcement as needed.

He noted the significant growth of the banking sector in the state, with the business expanding from Rs 12.80 lakh crore in 2016-17 to over Rs 26.80 lakh crore presently, expressing optimism for the future. As part of the event, the Chief Minister distributed the state's share to Baroda-UP Gramin Bank and Aryavarta Gramin Bank, 1.10 lakh Kisan Credit Cards, and launched 1,111 new banking outlets. Reserve Bank of India CGM Nisha Nambiar also attended the meeting. She emphasized the expansion of digital banking. The Chief Minister also gave instructions to hold the meeting of the Bankers' Committee at the state level under the chairmanship of the Chief Secretary every three months and in the district every month.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

05:49 PM IST

UP bypolls: NDA candidates ahead in seven seats, SP leads in two

UP bypolls: NDA candidates ahead in seven seats, SP leads in two  378 stalled housing projects in Noida, Greater Noida, Ghaziabad, Lucknow, Agra: Property consultant

378 stalled housing projects in Noida, Greater Noida, Ghaziabad, Lucknow, Agra: Property consultant  UP CM Yogi Adityanath highlights state's achievement in his Independence Day address

UP CM Yogi Adityanath highlights state's achievement in his Independence Day address Flood in over 600 villages in UP; 19 killed in rain-related incident

Flood in over 600 villages in UP; 19 killed in rain-related incident  THIS state government announces full waiver of registration fee on hybrid cars | Can save up to Rs 3.5 lakh

THIS state government announces full waiver of registration fee on hybrid cars | Can save up to Rs 3.5 lakh