Sustaining markets valuation depend on future earnings, economic rebounds: Economic Survey

With market boom, many firms have taken advantage of reduced cost of capital by issuing more equity publicly and to utilize them for new investment projects.

The Economic Survey 2018 tabled in Parliament today also talked about the current stock market boom in India.

Over the past two-fiscal, the benchmark indices have continued to surge, clocking new heights with Sensex at 36,406.88-mark and Nifty at 11,163.55-level.

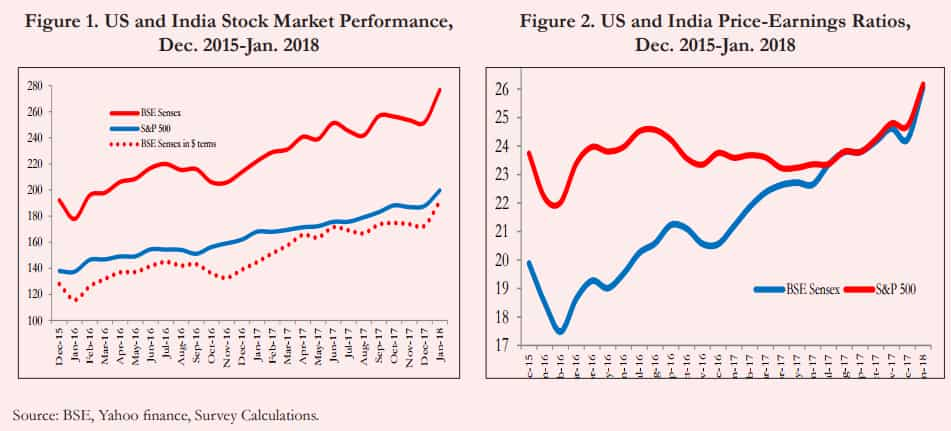

The S&P has surged 45%, while the Sensex has surged 46% in rupee terms and 52% in dollar terms, said the survey.

“This has led to a convergence in the price-earnings ratios of the Indian stock market to that of the US at a lofty level of about 26. Yet over this period the Indian and US economies have been following different paths. So what explains the sudden convergence in stock markets?,” the added, while explaining the paths of Indian and US economies in three different ways.

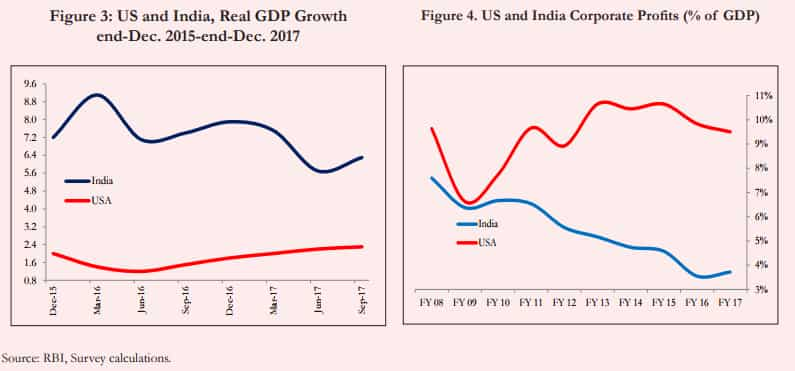

Firstly, the Indian stock market surge concided with a decelaration in economic growth, whereas the US growth has accelerated.

Secondly, India’s corporate earnings/GDP ratio has been sliding since the Global Financial Crisis, falling to just 3.5%, while profits in the US have remained a healthy 9% of GDP.

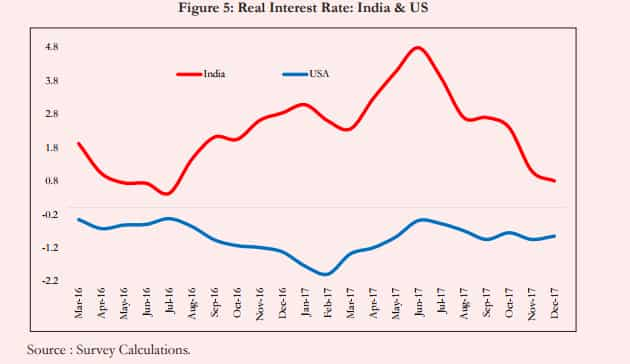

Thirdly, the real interest rates have diverged substantially. Rates in the US have persisted at negative levels, while those in India have risen to historically high levels.

Over the period of the boom, the US real rates have averaged -1%, compared to India’s 2.2% - which would be a difference of 3.2 percentage points.

Now from the above mentioned factors one can understand that both Indian and US economy are on opposite direction, so what explains the stock market convergence.?

In India, two factors seem to be the key for markets. They are- expectations of earnings growth are much higher in the country, and secondly would be demonetisation.

So what has happened in early 2016-17, as signs emerged that the long slide in the corporate profits/GDP ratio might finally be coming to an end.

Investors reacted to the news with eagerness, bidding up share prices in anticipation of a recovery they hoped lay just ahead. Accordingly, the ratio of prices to current earnings rose sharply, said the survey.

By 2017-18, signs began to assemble that recovery in India Inc is not around the corner. Then came in the picture of demonetisation.

The survey explains that price of an asset is not solely determined by the expected return on that asset. It is also determined by the returns available on other assets.

During last year’s Economic Survey, the government’s campaign against illicit wealth over the past few years—exemplified by demonetisation—has in effect imposed a tax on certain activities, specifically the holding of cash, property, or gold.

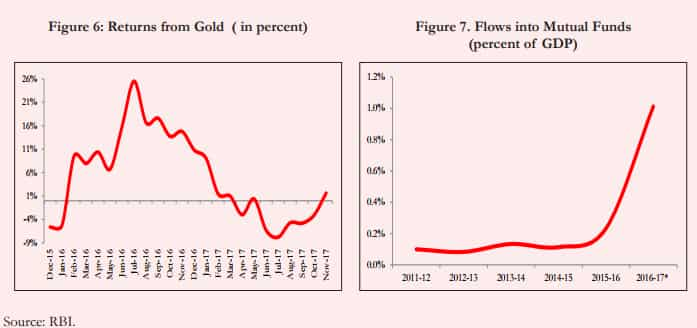

Also, cash transaction were regulated, reporting requirements for the acquisition of gold and property have been stiffened. While rupee returns to holding gold have plunged since mid-2016, turning negative since mid-2017.

Additionally, previously stock prices had suffered because reporting requirements were higher on shares than purchases of other asset. However, the survey said, “But the attack on illicit wealth has helped to level the playing field.”

Thus, all of this once again bagged investors’ attention towards the stock.

“Investors have accordingly reallocated their portfolios toward shares, with inflows through stock mutual funds, in particular, amounting in 2016-17 to five times their previous year’s level. Accordingly the equity risk premium (ERP, the extra return required on shares compared with other assets) has fallen,” the survey said.

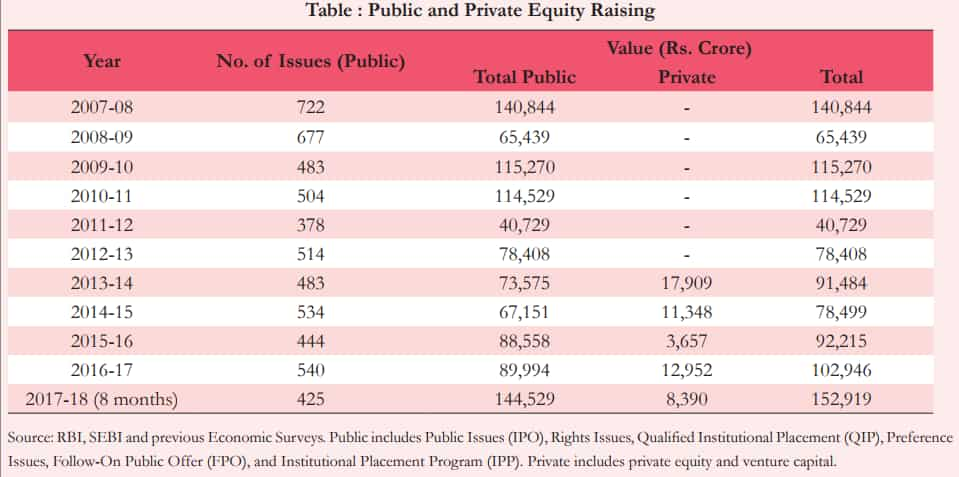

Moreover, with market boom, many firms have taken advantage of reduced cost of capital, by issuing more equity publicly and to utilize them for new investment projects.

Such method took place in mid-2000s and again around 2010.

Interestingly, in the last two years, especially in the first eight months of 2017, there has once again been a pick-up in equity-raising activity.

The survey says, “If current trends continue, the number of issues and their value could double the levels recorded in the previous six years.”

Therefore, the survey believes that Indian stock market surge is different from that in advanced economies in three ways: growth momentum, level and share of profits, and critically the level of real interest rates.

But for sustaining these valuations, the survey says, "will require future growth in the economy and earnings in line with current expectations, and require the portfolio re-allocation to be semi-permanent. Otherwise, the possibility of a correction in them cannot be ruled out."

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

02:26 PM IST

GDP growth rate will be even better: EaseMyTrip co-founder Rikant Pitti on Economic Survey projections

GDP growth rate will be even better: EaseMyTrip co-founder Rikant Pitti on Economic Survey projections India's renewable energy sector to attract investments worth Rs 30.5 lakh crore by 2030: Economic Survey

India's renewable energy sector to attract investments worth Rs 30.5 lakh crore by 2030: Economic Survey Economic Survey asks states to expedite implementation of labour codes

Economic Survey asks states to expedite implementation of labour codes Economic Survey caution against sensitive food commodities in futures trading

Economic Survey caution against sensitive food commodities in futures trading