Stock Alert! 12 PSBs make investors richer by 5% to 19%; know why

PSBs like PNB, Syndicate Bank, Bank of India, Bank of Maharashtra, Union Bank of India, Central Bank of India, Andhra Bank, Allahabad Bank, UCO Bank, Indian Overseas Bank, United Bank of India and Corporation Bank rose in the range of over 5% to nearly 19% on Dalal Street, making many investors rich.

The benchmark indices like Sensex and Nifty 50 were trading on a slight cautious note on Thursday’s trading session, but interestingly it was a treat to watch performance in 12 public sector banks (PSB) where investors made heavy buyings. PSBs like PNB, Syndicate Bank, Bank of India, Bank of Maharashtra, Union Bank of India, Central Bank of India, Andhra Bank, Allahabad Bank, UCO Bank, Indian Overseas Bank, United Bank of India and Corporation Bank rose in the range of over 5% to nearly 19% on Dalal Street, making many investors rich. Reason behind investors upbeat in these stocks is due to their capital infusion plan announced by government. If you own any of these stocks, then a good day has arrived on your investment. Let’s find out, why these 6 PSBs have outperformed indexes.

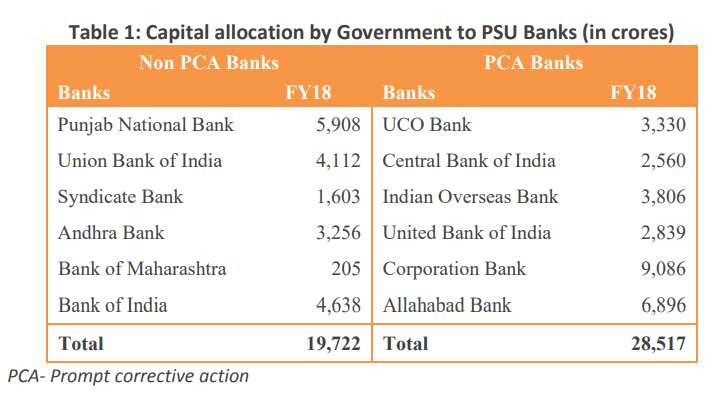

It was Corporation Bank who gained the most, as it surged by nearly 19% after clocking an intraday high of Rs 30.30 per piece. At around 1251 hours, the stock is trading at Rs 29.20 per piece up by 14.51% on BSE. Infusion in this bank is highest set at Rs 9,086 Crore

Going further, United Bank of India gained by nearly 15%, as it clocked an intraday high of Rs 11.50 per piece on BSE in early hours. Currently, the stock price is trading at Rs 10.75 per piece up by 7.39%. Government will infuse Rs 2,839 crore in the bank.

Similar trend was continued in UCO Bank, as it rose by nearly 14% on intraday high of Rs 19.5 per piece. At present, the bank is trading at Rs 18.55 per piece up by 8.16% on BSE. Here, capital infusion of Rs 3,330 crore will be made by government.

Going forward, shares of Indian Overseas Bank, Allahabad Bank, Central Bank, Bank of Maharashtra and Andhra Bank jumped between 9% to 11% on BSE. The government will allocate capital worth Rs 3,806 crore, Rs 6,896 crore, Rs 2,560 crore, Rs 205 crore and Rs 3,256 crore.

After Corporation, next maximum capital infusion by government will be made in PNB and Bank of India. The stocks of these two bank have also climbed by over 5% and 8% respectively. Infusion of Rs 5,908 crore and Rs 4,638 crore will be made in PNB and BOI.

Other lenders like Syndicate Bank and Union Bank have also jumped between 5% to over 6% respectively. Here, the government will infuse Rs 1,603 crore and Rs 4,112 crore respectively.

In total, the government has approved recapitalisation of Rs 48,239 crore - among which Rs 28,517 crore will be infused in UCO, Central Bank, IOB, United Bank, Corporation and Allahad which currently are under RBI Prompt Corrective Action (PCA) framework. Infusion, will help better functioning in these banks, and might as well motivate RBI to remove their current status.

However, economists at CARE Rating said, "Despite being out of the PCA framework, infusion of funds in Bank of India and Bank of Maharashtra has been approved to help them remain above PCA triggers as per the centre."

Talking about the new recapitalisation, CARE stated that, it is to be seen as to where will the funds be allocated from. It could be from the interim dividend announced a couple of days back or could be provided for through the RBI reserves where a decision will be taken next month.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

02:16 PM IST

Budget 2019: Rs 70,000 crore capital for PSBs; FM Sitharaman says will 'boost credit for a strong impetus to the economy'

Budget 2019: Rs 70,000 crore capital for PSBs; FM Sitharaman says will 'boost credit for a strong impetus to the economy' Interest rates war in offing? "Winners will be larger banks," says S. Sridhar, Chairman, IMC BFSI Committee

Interest rates war in offing? "Winners will be larger banks," says S. Sridhar, Chairman, IMC BFSI Committee  Budget 2019 expectations: From recapitalization to mergers, here is what IMC BFSI Committee Chairman Sridhar wants for banking sector

Budget 2019 expectations: From recapitalization to mergers, here is what IMC BFSI Committee Chairman Sridhar wants for banking sector Lok Sabha Elections 2019: Modi govt retains power, focus shifts to NBFCs, banks - Liquidity, loans, recapitalization, deposits key factors

Lok Sabha Elections 2019: Modi govt retains power, focus shifts to NBFCs, banks - Liquidity, loans, recapitalization, deposits key factors Government's bank recap drive not enough for PSBs, Fitch reveals massive amount needed

Government's bank recap drive not enough for PSBs, Fitch reveals massive amount needed