States have capacity and must cut duty on petrol: NITI

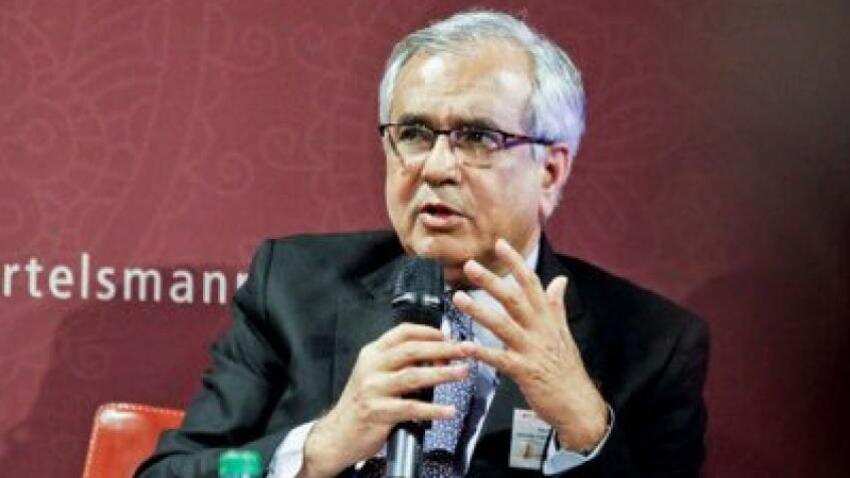

As regards the Centre, NITI Aayog vice chairman Rajiv Kumar said they have the fiscal space and need to create more to deal with the problem of rising oil prices. "The centre has fiscal space and it can create more fiscal space on the non-tax revenue side. Because last year we did very well. We exceeded the Budget target. May be this year also we can do that," Kumar asserted.

States have the capacity and must reduce the duty on petrol, while the Centre should create fiscal space to deal with the impact of spurt in oil prices, NITI Aayog vice chairman Rajiv Kumar said today. The rising crude prices in the international market prompted state-owned oil companies to raise domestic prices for 11th day in a row. Petrol costs Rs 77.47 a litre in Delhi and diesel Rs 68.53 a litre.

"There is merit in reducing the duties but both by the states and and the Centre. More so for the states as they tax the oil on ad valorem basis ... So states can take that cut much more and better than the Union government," Kumar told PTI in an interview.

He further said that it is important for them (states) to agree 10-15 per cent duty cut and take home the same amount of tax revenue as budgeted. "Not doing that means being exceptionally greedy at the cost of not just the people but also the economy," Kumar added. The states, he said, on an average tax petrol at 27 per cent.

As regards the Centre, the NITI Aayog vice chairman said they have the fiscal space and need to create more to deal with the problem of rising oil prices. "The centre has fiscal space and it can create more fiscal space on the non-tax revenue side. Because last year we did very well. We exceeded the Budget target. May be this year also we can do that," Kumar asserted.

He further said the centre could consider reducing the additional excise duty on petrol. It should not temper with infrastructure cess which is being directly used for developmental activities, Kumar added.

He also opined that not only petrol but electricity should also be brought under the Goods and Services Tax (GST).

Petrol and diesel prices were raised for the 11th day in succession today as the state-owned oil firms gradually passed on to the consumer the increased cost of international oil that had accumulated since a 19-day freeze was imposed just before Karnataka elections.

The government raised excise duty nine times between November 2014 and January 2016 to shore up finances as global oil prices fell, but then cut the tax just once in October last year by Rs 2 a litre. The Centre levies Rs 19.48 as excise duty on a litre of petrol.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Tamil Nadu Weather Alert: Chennai may receive heavy rains; IMD issues yellow & orange alerts in these districts

Fundamental picks by brokerage: These 3 largecap, 2 midcap stocks can give up to 28% return - Check targets

SIP vs PPF: How much corpus you can build in 15 years by investing Rs 1.5 lakh per year? Understand through calculations

SIP+SWP: Rs 10,000 monthly SIP for 20 years, Rs 25 lakh lump sum investment, then Rs 2.15 lakh monthly income for 25 years; see expert calculations

Top 7 Mutual Funds With Highest Returns in 10 Years: Rs 10 lakh investment in No 1 scheme has turned into Rs 79,46,160 in 10 years

SBI Senior Citizen Latest FD Rates: What senior citizens can get on Rs 7 lakh, Rs 14 lakh, and Rs 21 lakh investments in Amrit Vrishti, 1-, 3-, and 5-year fixed deposits

07:36 PM IST

India needs 2,500 universities to accommodate 50% students: NITI Aayog CEO

India needs 2,500 universities to accommodate 50% students: NITI Aayog CEO Size of Indian economy can easily double by 2030: NITI CEO

Size of Indian economy can easily double by 2030: NITI CEO India-UK FTA within finger-touching distance: NITI Aayog CEO

India-UK FTA within finger-touching distance: NITI Aayog CEO NITI Aayog calls for guidelines, E-KYC to check background of PMMY loan applicants

NITI Aayog calls for guidelines, E-KYC to check background of PMMY loan applicants Union Minister Ashwini Vaishnaw launches NITI Aayog's digital public infra platform

Union Minister Ashwini Vaishnaw launches NITI Aayog's digital public infra platform