Small Saving Schemes Interest Rates - Check how it benefits you as compared to banks like SBI, HDFC Bank, ICICI Bank

The government revises the interest rates on the small saving schemes every financial quarter.

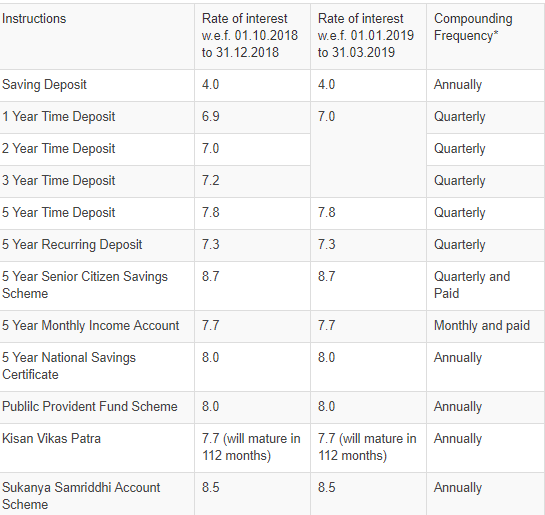

The first financial quarter of FY 2019-20 has begun and the Government of India has made no amendment in the interest rates that are levied on small saving schemes. The government revises the interest rates on the small saving schemes every financial quarter. Since the schemes are by the government, it is more attractive than the interest rates offered by public and private banks. Moreover, the risk associated are low with good returns. The rate of interest on various small saving schemes for the first financial quarter starting from April 1, 2019, and ending on June 30 will be as follows,

The interest rate on annual saving deposit remains at 4%.

Government of India

In case of quarterly compounding deposits, the interest rates fall between 7% to 7.8%, for a term duration between 1 years to 5 years.

Public and Private banks:

Meanwhile, the State Bank of India is giving interest rates ranging between 6.70% to 6.85% on term deposits up to 10 crores, for a term duration of between 1 year to 10 years. HDFC on the other hand , is providing with interest rates starting from 7.30% for 1 year to 6.50% for a term duration between 5-10 years, for deposits below 1 crore. Private lender ICICI, with minimum deposit of 10,000, is levying an interest rate between 6.90% to 7% for term duration between 1 year to 10 years.

Comparison: If one deposits Rs 10,000 a month, for a duration of say 5 years, the small saving scheme will yield Rs 14,714.47, SBI will yield Rs 14,009.38, HDFC will yield Rs 14,357.82 and ICICI will yield Rs 14,322.61. As clearly seen, one benefits more from the small saving scheme interest rates.

The quarterly recurring deposit for a term duration of 5 year has an interest rate of 5% levied on it while the 5 year monthly income account has 7.7%. An interest rate of 8% is put on the 5 year national savings certificate.

Government of India:

For the senior citizens, the interest rates touch 8.7%.

Public and private banks:

SBI offers and interest rate between 7.20% to 7.35%. Interest rate between 7% to 7.80% is levied by HDFC while ICICI gives its senior citizens customers interest rates varying from 7.40% to 8%.

Comparison: For a deposit of say Rs 10,000 for maturity duration of 5 years, small scheme will mature it to Rs 15,377.75, SBI to Rs 14,357.82, HDFC and ICICI will give Rs 14,678.43, in case of senior citizen customers.

The Public Provident Fund (PPF) scheme interest rates remain unchanged at 8%per annnum . Meanwhile, the Kisan Vikas Patra has an interest rate of 7.7%, with maturity period of 112 months.

The Sukanya Samriddhi Account scheme too has an unchanged interest rate of 8.5% p.a .

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

03:42 PM IST

From income tax slab to saving schemes - what has Budget 2023 done to Personal Finance? Here are the top 10 pointers

From income tax slab to saving schemes - what has Budget 2023 done to Personal Finance? Here are the top 10 pointers Kisan Vikas Patra scheme offers 6.9 pct interest; Which other schemes are offering HIGHER INTERESTS - Know here

Kisan Vikas Patra scheme offers 6.9 pct interest; Which other schemes are offering HIGHER INTERESTS - Know here SCSS Vs PPF Vs Sukanya Samriddhi – which savings scheme gives you HIGHEST RETURNS? Compare and find out yourself

SCSS Vs PPF Vs Sukanya Samriddhi – which savings scheme gives you HIGHEST RETURNS? Compare and find out yourself SCSS, PPF and Sukanya Samriddhi – 3 savings schemes with highest returns; Know features, benefits here

SCSS, PPF and Sukanya Samriddhi – 3 savings schemes with highest returns; Know features, benefits here Top small savings schemes interest rates: From NSC, PPF recurring deposit, Senior Citizens Savings Scheme, time deposit and more

Top small savings schemes interest rates: From NSC, PPF recurring deposit, Senior Citizens Savings Scheme, time deposit and more