Sebi picks 12 companies for forensic audit, other suspected firms get clean chit

As many as 12 companies got relief from the Securities Appellate Tribunal (SAT), which then sought details about 36 firms to verify credentials and fundamentals.

A total of 331 suspected shell companies were banned from trading on stock exchanges three months ago, but the market regulator, Securities and Exchange Board of India (Sebi), has decided to probe merely 10-12 firms through forensic audit.

The stock exchanges have examined the credentials provided by these firms and submitted the report to the market regulator, said the Business Standard report.

The report said that Sebi after analysing the report has picked two companies from 48 suspected firms listed on the National Stock Exchange (NSE) and 8 more companies from the Bombay Stock Exchange (BSE). The remaining suspected firms are reportedly being given clean chit from the market regulator.

On August 07, 2017, Sebi had asked stock exchanges to halt trading in 331 suspected shell companies for the month of August. Of these identified shell companies, 162 were active trading firms on the BSE, while 48 were on the NSE and the remaining have already been suspended by the respective stock exchanges due to irregularities.

It may be noted that as many as 12 companies got relief from the Securities Appellate Tribunal (SAT), which then sought details about 36 firms to verify credentials and fundamentals.

This action came in after the Ministry of Corporate Affairs (MCA) shared a database of 331 listed companies suspected to be shell firms.

Shell Company is an entity without any active business operations or significant assets. They are often created to avoid taxes and many big companies create such firms to avoid taxes without attracting legal actions.

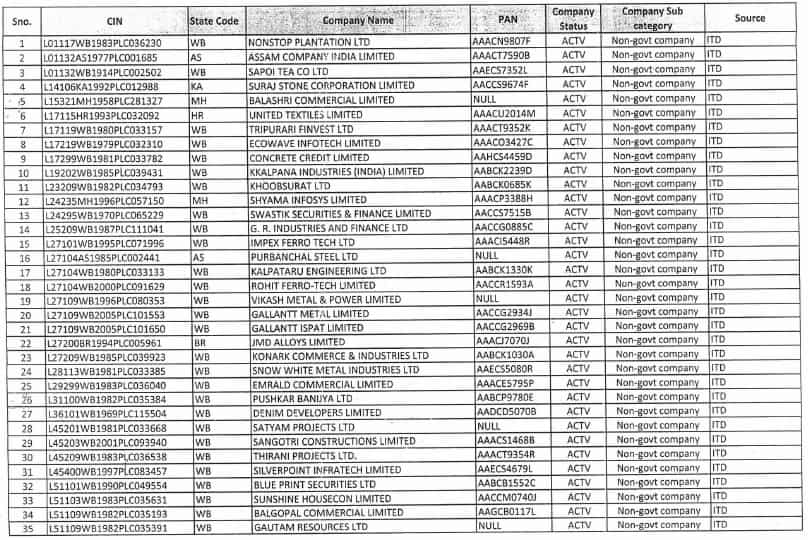

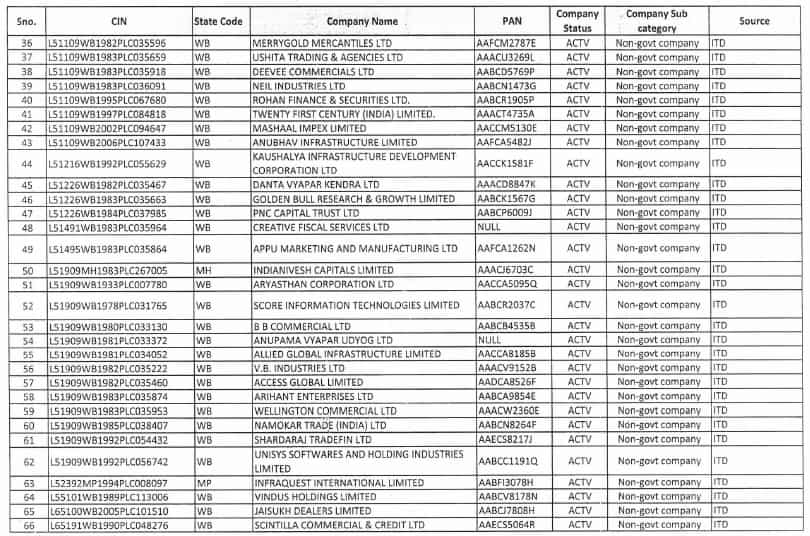

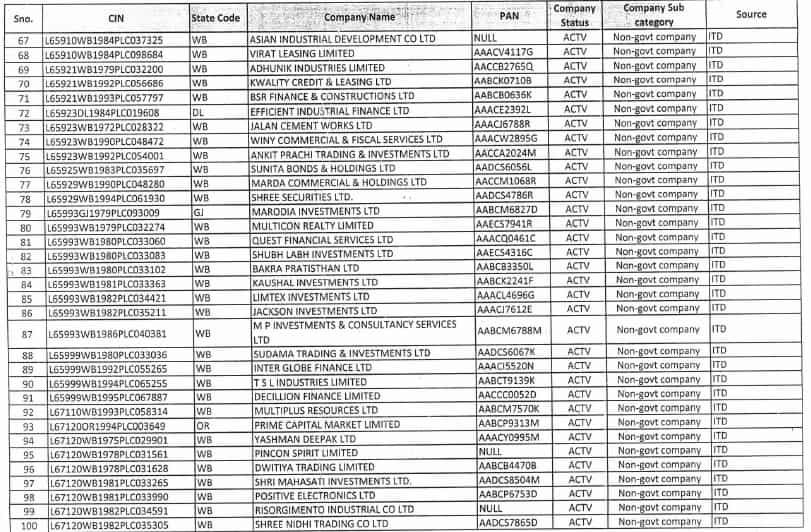

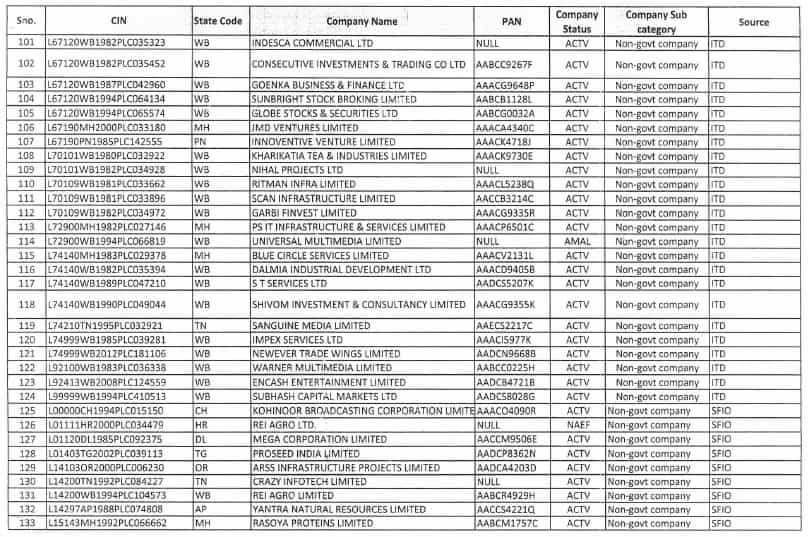

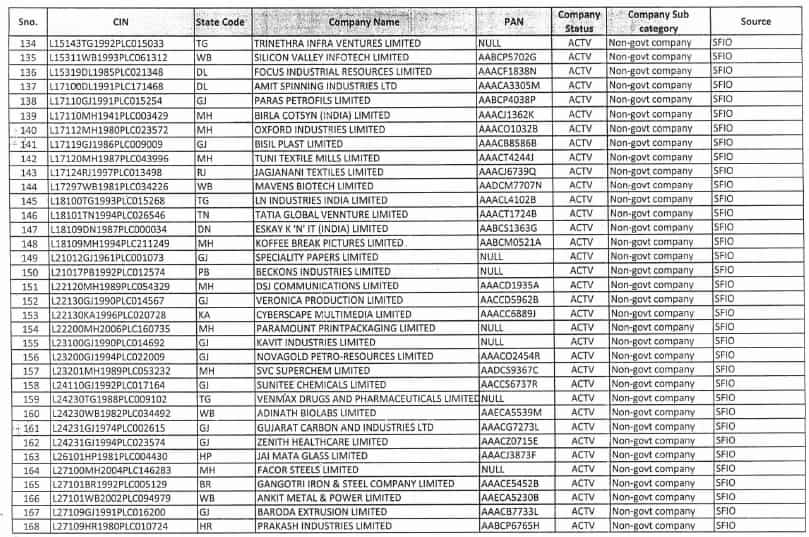

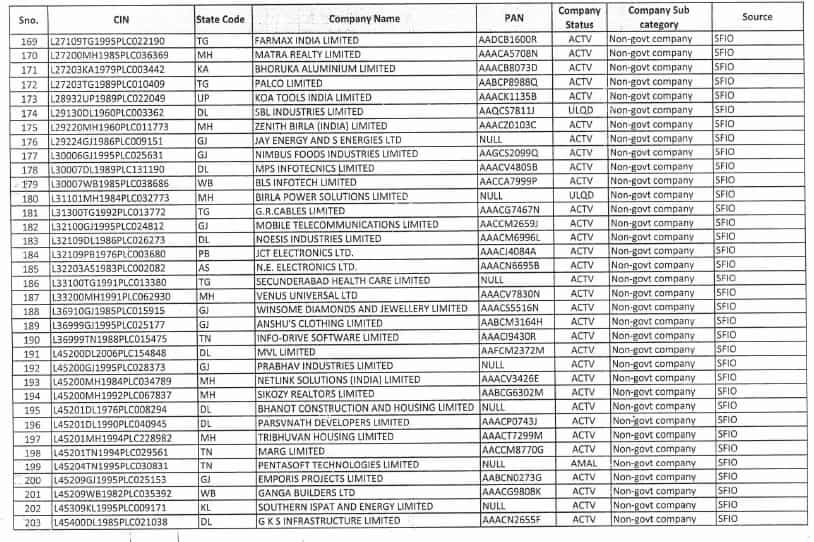

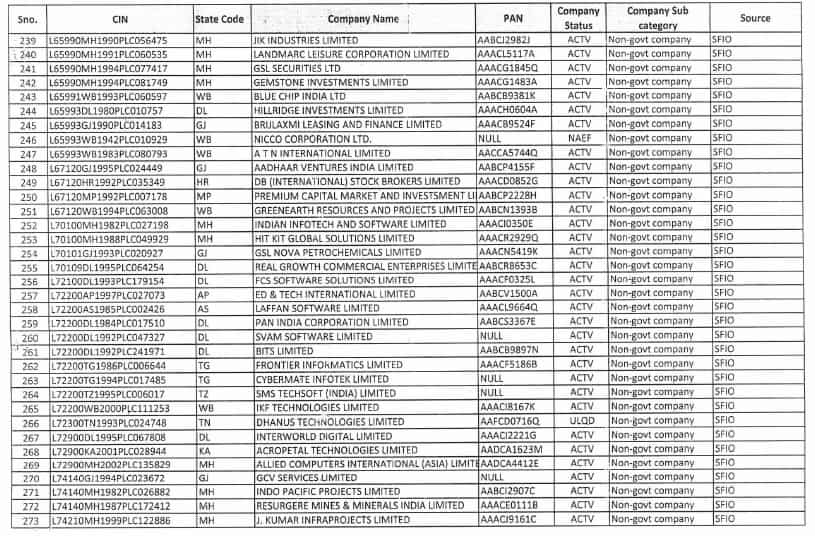

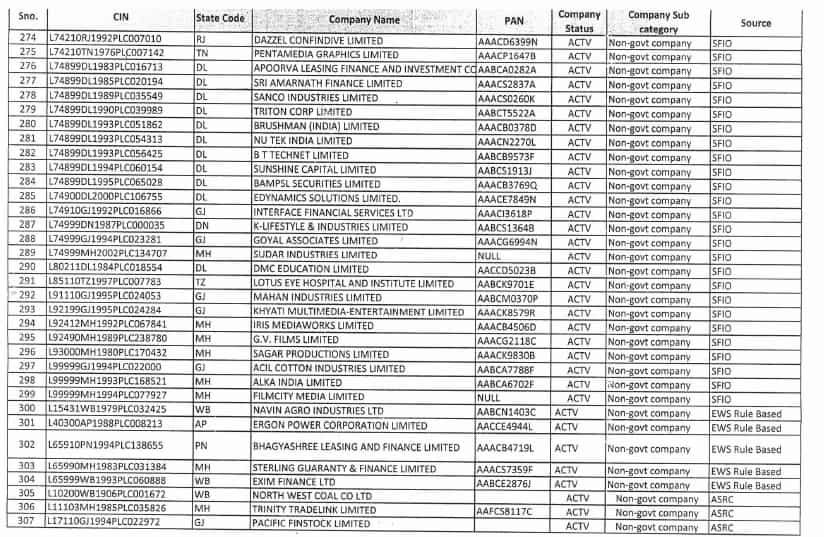

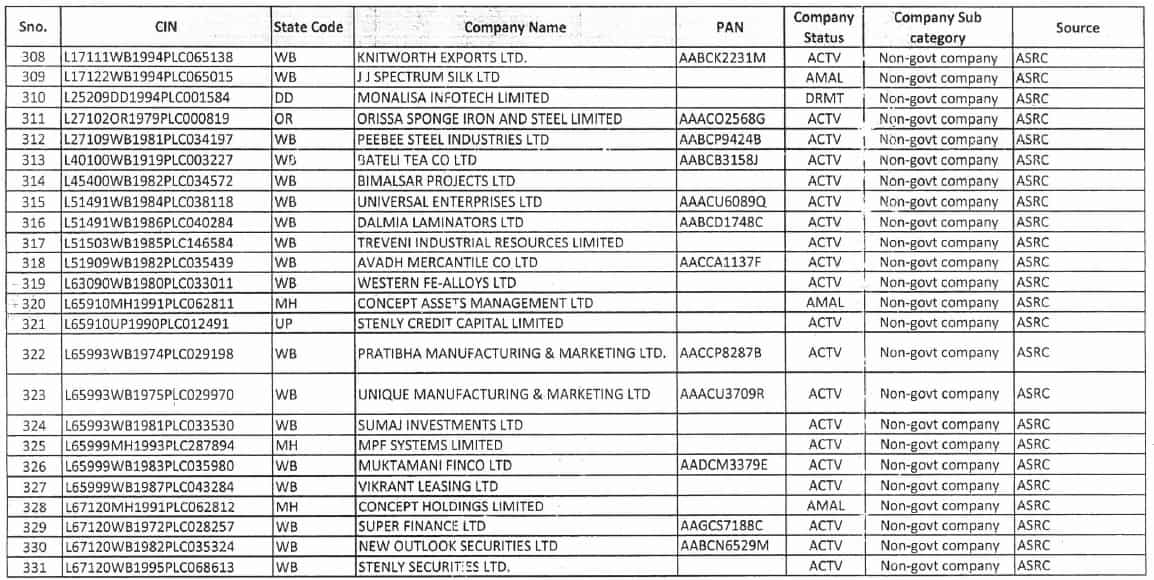

Here's a list of the companies which were banned from trading.

The government has stepped up its fight against black money. The finance ministry has struck off a total of 2,24,000 companies resulting in disqualification of about 3,09,000 directors.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

04:22 PM IST

Massive Action on Chinese Firms! MCA busts the racket of shell companies

Massive Action on Chinese Firms! MCA busts the racket of shell companies Rs 250 crore black income detected by I-T department after raids on Kolkata business group

Rs 250 crore black income detected by I-T department after raids on Kolkata business group Black Money: 2.25 lakh companies to be struck-off by FY19, all details here

Black Money: 2.25 lakh companies to be struck-off by FY19, all details here  PNB fraud: 200 shell firms, benami assets under ED, I-T dept scanner

PNB fraud: 200 shell firms, benami assets under ED, I-T dept scanner Disqualified directors of shell companies may soon get relief

Disqualified directors of shell companies may soon get relief