Sebi not in favor of tax incentives for market investments

Sebi is having a relook at incentives that are given to mutual fund companies for going to tier-2 and tier-3 cities.

The Securities and Exchange Board of India (Sebi) on Sunday said it is not in favor of tax incentives for market investments. Sebi chairman Ajay Tyagi said that if financial awareness increases there won't be a need to give incentives for investments, according to a Bloomberg report.

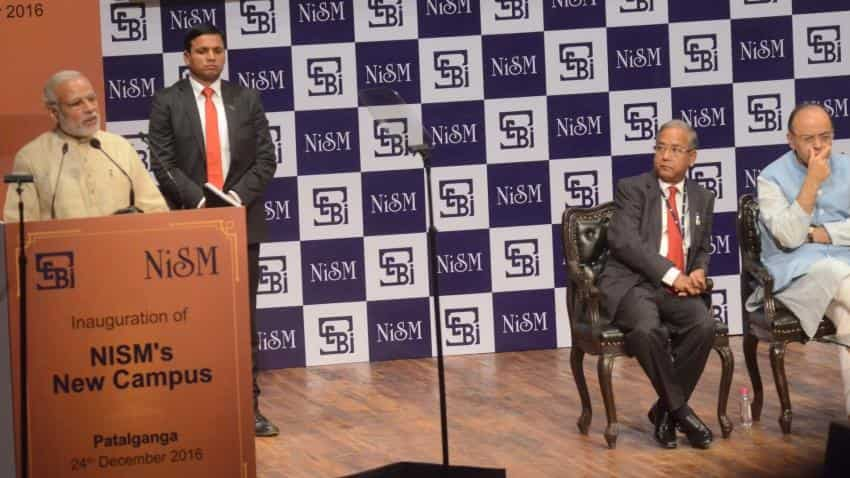

Speaking at NISM Campus in Patalganga, Maharashtra Tyagi said financial education is needed for deepening of capital markets in India. He further said that Sebi is having a relook at incentives that are given to mutual fund companies for going to tier-2 and tier-3 cities.

Underlining the importance of financial education, Tyagi said that financial literacy has become important in the present day context, with many financial products available for investors. Products are also becoming increasingly complex, he added.

Financial education and awareness helps individuals to do planning to achieve their financial goals, understand the risks involved in various financial products, ultimately contributing to their financial wellbeing. Financial education also helps investors to keep away from ponzi schemes, Tyagi added.

Financial education has become even more important due to increase in digital transactions post demonetisation, he said. A number of different ‘app’ and alternative instruments have come-up and more and more options are emerging. It is extremely important to keep pace with the developments with a view to reaping the benefits of technology.

As part of its education initiatives, SEBI has taken Financial Education to about 550 districts in the country with its unique Resource Person Model. More than 50,000 programmes have been conducted by SEBI since 2010 targeting students, executives, women, retired persons, etc. reaching over 37 lakh individuals.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

02:52 PM IST

Sebi chief Tyagi takes inclusive path for market reform

Sebi chief Tyagi takes inclusive path for market reform Sebi asks Mutual Funds to explain promoter group exposure to AUMs

Sebi asks Mutual Funds to explain promoter group exposure to AUMs SpiceJet stocks up nearly 3% in early trade after chief Ajay Singh settles case with Sebi

SpiceJet stocks up nearly 3% in early trade after chief Ajay Singh settles case with Sebi  Have a strong case against Sebi order, says RIL

Have a strong case against Sebi order, says RIL Reliance Industries to challenge Sebi order in RPL case

Reliance Industries to challenge Sebi order in RPL case