Rotomac bank fraud case: Enforcement Directorate attaches Rs 177-cr assets

The agency said it has issued a provisional order yesterday under the Prevention of Money Laundering Act (PMLA) for attachment of properties "owned by Ms Rotomac Global Private Limited and its directors located at Kanpur (Uttar Pradesh), Dehradun (Uttarakhand), Ahmedabad and Gandhi Nagar (Gujarat) and Mumbai (Maharashtra) valuing Rs 177 crore."

The Enforcement Directorate (ED) today said it has attached assets worth Rs 177 crore in connection with its money laundering probe against Kanpur-based Rotomac group in an alleged bank loan fraud of Rs 3,695 crore.

The agency said it has issued a provisional order yesterday under the Prevention of Money Laundering Act (PMLA) for attachment of properties "owned by Ms Rotomac Global Private Limited and its directors located at Kanpur (Uttar Pradesh), Dehradun (Uttarakhand), Ahmedabad and Gandhi Nagar (Gujarat) and Mumbai (Maharashtra) valuing Rs 177 crore."

It alleged that these assets were the "proceeds of crime" of the illegal act of money laundering.

The ED probe revealed, the agency said in a statement, that Ms Rotomac Global Private Limited "indulged in merchanting trade with limited number of buyers and sellers and it used to receive back the discounted LC (letters of credit) amount from the overseas beneficiary after deduction of 1.5-2 per cent commission by them either directly into the accounts of Rotomac group companies or into the accounts of overseas companies controlled by owner Vikram Kothari."

This discounted LC amount, it said, thereafter has been used by the firm for "other business activities" such as FDR (fixed deposit receipts), iron ore purchase and investment in real estate.

It said the oversall modus operandi to perpetrate this alleged bank fraud was that the accused, in guise of merchanting trade, without having any genuine business transactions defaulted in meeting their payments obligation to the bank by "diverting and siphoning off the funds."

The ED had filed a criminal case under the PMLA in this instance in February, based on a CBI FIR.

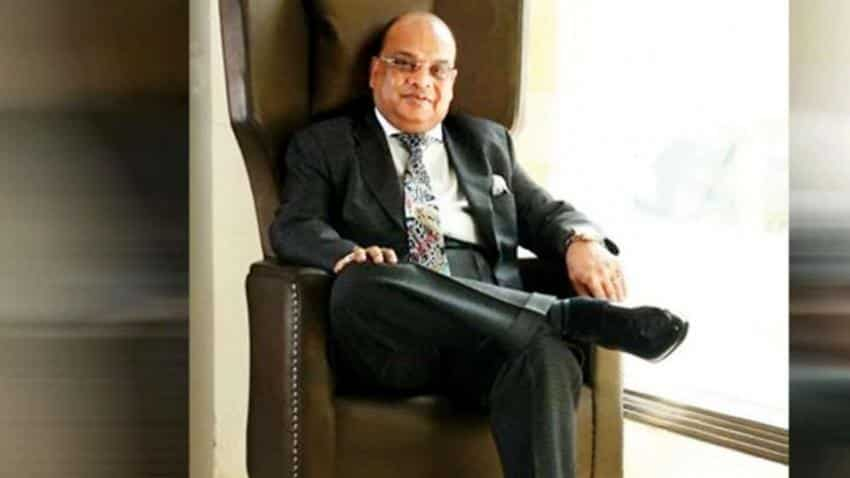

The ED-CBI case has been registered against firm director and owner Vikram Kothari, his wife Sadhna Kothari, son Rahul Kothari and unidentified bank officials on a complaint from the Bank of Baroda.

WATCH ZEE BUSINESS VIDEO

The bank had alleged that the conspirators had cheated a consortium of banks to the tune of Rs 3,695 crore, including the interest component.

The principal amount involved is Rs 2,919 crore.

The ED probe was aimed at finding out if the funds obtained through the alleged fraud were laundered and if the proceeds of the crime were subsequently used by the accused to create illegal assets and black money.

This is the second major bank fraud to surface in the recent past after the sensational over USD 2 billion Punjab National Bank (PNB) fraud, allegedly committed by diamond merchant Nirav Modi and his uncle Mehul Choksi, the promoter of the Gitanjali Group of companies.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

02:14 PM IST

Rotomac scam: I-T dept files six prosecution cases against Vikram Kothari

Rotomac scam: I-T dept files six prosecution cases against Vikram Kothari  Bank fraud: After CBI, ED; I-T dept tightens noose around Rotomac Group

Bank fraud: After CBI, ED; I-T dept tightens noose around Rotomac Group Know more about Vikram Kothari and his modus operandi

Know more about Vikram Kothari and his modus operandi Loan default: Shares of BoB, BOI among others banks fall over 6%

Loan default: Shares of BoB, BOI among others banks fall over 6% CBI raids several premises of Rotomac in Kanpur

CBI raids several premises of Rotomac in Kanpur