Recapitalisation plan credit positive for all PSBs: Moody's

The government will provide material capital infusions for even weak PSBs since IDBI, CBI and IOB received amongst the highest capital allocations, said Moody's.

Global rating agencies have termed the government announcement on capital infusion for banking system as credit positive.

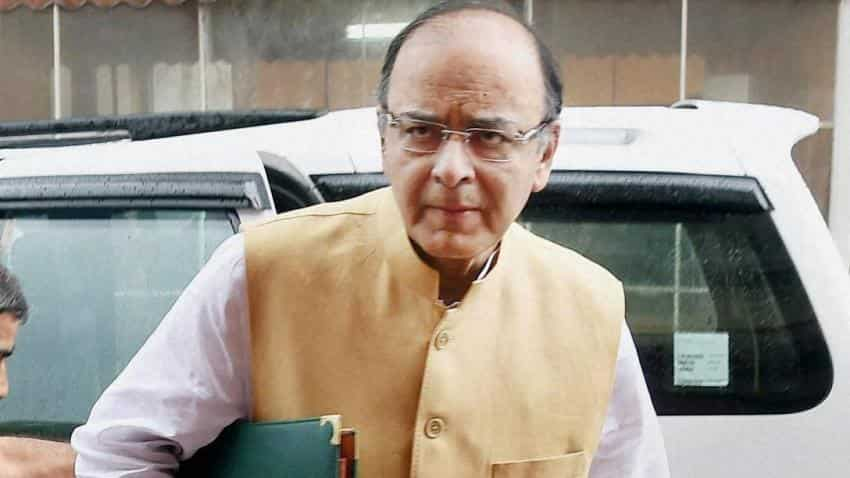

Announcing the capital infusion plan for the FY18, Finance Minister Arun Jaitley yesterday said the government has taken various steps to ensure that public sector banks (PSBs) follow higher standards.

The recapitalisation plan includes Rs 80,000 crore through recap bonds and Rs 8,139 crore as budgetary support.

“This announcement is a credit positive for all public sector banks, and especially the weaker ones, as the government has made it very explicit that it will ensure that all such banks meet minimum regulatory capital requirements,” said Srikanth Vadlamani, Moody's Vice President and Senior Credit Officer.

Vadlamani said, “The government has announced various reforms for public sector banks, but we currently do not believe these reforms are meaningful enough to address the structural corporate governance issues facing these entities.”

According to Moody’s, the announcement signals that the government will provide material capital infusions for even weak PSBs since IDBI, CBI and IOB, which have the lowest baseline credit assessments (BCA) among rated PSBs, received amongst the highest capital allocations.

Each of these banks will receive enough capital to enable them to meet minimum capital norms, after factoring in provisioning requirements for non-performing loans as well as any requirements emanating from a transition to IFRS 9 accounting standards, the report said.

The 'healthy' banks -- defined as those banks not placed under prompt corrective action by the Reserve Bank of India -- will receive additional capital so as to support overall credit growth. "However, some of these changes, while positive, seem to be largely fine tuning and calibrating some core internal processes at these banks," Vladlamani said.

"For instance, it is now envisaged that a bank's board will monitor the bank's performance on key metrics on a more frequent basis and there should be a performance management system to incentivize and fast track good performers," Vladlamani said, adding "Banks will also have to more closely monitor corporate exposures beyond a certain size."

Meanwhile, Fitch Ratings also believed the move is positive for the PSBs.

According to Fitch, while the capital infusion plan was less than half of its estimate of USD 65 billion needed for the sector, it will encourage banks to resolve their non-performing loan (NPL) stock faster as improved capital buffers bolster their ability to absorb potential large haircuts.

Apart from this, Fitch also believes that additional capital buffers will enhance the banks' ability to raise equity capital.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

02:58 PM IST

Five public sector banks account for nearly half of non-performing assets

Five public sector banks account for nearly half of non-performing assets