RBI's new P2P lending norms good for honest borrowers, but needs more clarity

RBI notified the peer-to-peer lending platform has been notified as an NBFC under section 45I (f) (iii) of the Reserve Bank of India Act, 1934. Master directions of RBI as been taken as credit positive by many analysts.

The much-awaited guidelines for Peer-to-Peer (P2P) lending institutions as non-banking financial companies (NBFC) has been finally layed out by the Reserve Bank of India (RBI).

RBI notified P2P lending platform as NBFC during a time when this industry is catching fancy globally and in India as well. This platform has already been growth drivers in developed nations like US, UK and China.

Faircent earlier in its report mentioned that P2P lending market places has helped bringing down the interest rates the world over and has also become an alternate asset class to earn high returns.

Among few of the guidelines displayed by RBI were.

- NBFC-P2P shall commence or carry on P2P business after obtaining a Certificate of Registration (hereinafter referred to as “CoR”) from the Bank

- Existing NBFC-P2Ps shall apply within three months from the issuance of these Directions,

- NBFC-P2P shall maintain a Leverage Ratio not exceeding 2. Aggregate exposure of a lender to all borrowers at any point of time, across all P2Ps, shall be subject to a cap of Rs 10 Lakh.

- Exposure of a single lender to the same borrower, across all P2Ps, shall not exceed Rs 50,000. Meanwhile maturity of the loans shall not exceed 36 months.

Senthil Natarajan Co-founder and Chief Executive Officer, OpenTap said, “We welcome the decision of RBI to regulate P2P lenders as non-banking finance companies. While on the one hand, it gives us the official seal of recognition and approval, it also reposes faith in customers with the knowledge that they are dealing with a regulated financial institution. This is much needed reassurance in the big bad world of lending.”

Natarajan stated that the list of fairly exhaustive guidelines - most of which are beneficial for the industry on the whole. That said, there are some regulatory requirements that need clarity and perhaps a relook.

According to OpenTap, the requirement of minimum net owned fund of Rs 2 crore would certainly hamper innovation in more ways than one and may need a relook. While the cap of Rs 10 lakh on lenders across all platform is a bit of an anomaly.

OpenTap mentioned, "This is not an amount worthy of conversation for serious players in the financial world."

On the other hand, the the cap of exposure to a borrower of not more than Rs 50,000 works in protecting the interests of the borrower.

While i2iFunding.com in its report earlier said as the bank deposits are turning unattractive due to falling interest rates, investors have been exploring better investment opportunities. So far, many of them were sitting on the fence waiting for the sector to come under strict regulations.

It added, "NBFC status to P2P Lending platforms will address all trust-related concerns of investors. Since P2P Lending platforms open up a window of unsecured credit to borrowers with limited access to formal credit facilities, regulations will act as a confidence booster for them."

Overall, as per Natarajan there are no major surprises, or should we say ‘shockers’ in the guidelines. Most of the regulations are on expected lines. However, clarity on some guidelines, especially on the cap / lender and leverage ratio will certainly help.

Why do we need P2P lending?

P2P lending is a form of crowd-funding used to raise loans which are paid back with interest. It can be defined as the use of an online platform that matches lenders with borrowers in order to provide unsecured loans.

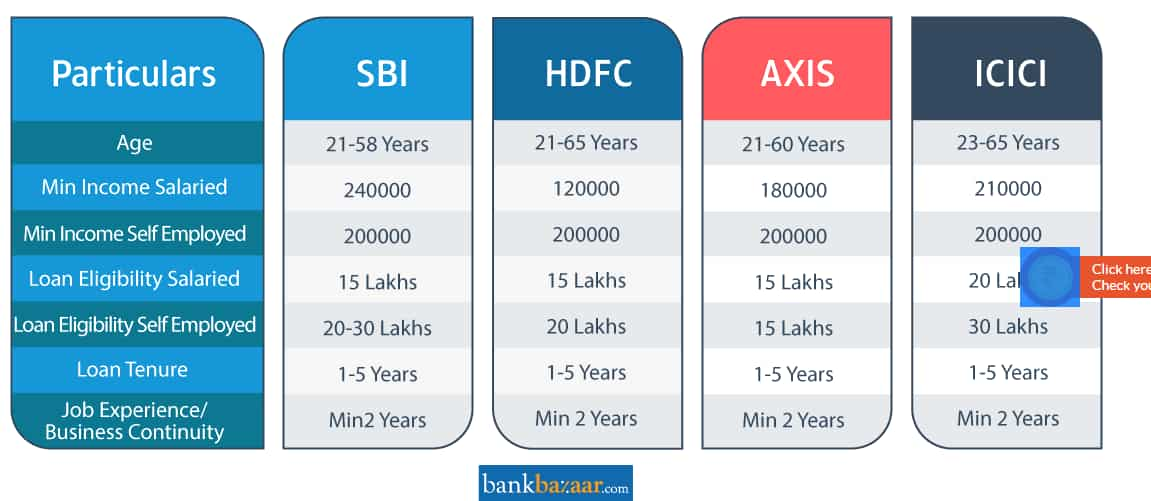

Banks and NBFCs usually offer personal loans to a salaried employees having minimum income salaried between Rs 1.20 lakh - to Rs 2.40 lakh with loan eligibility salaried between Rs 15 lakhs and Rs 20 lakhs.

However P2P lending, works differently; it comparatively uses multiple parameters to determine credit-worthiness of borrowers.

P2P credit models traverses beyond the salary of individuals; and fortunately, it does not decline the loan application even if the borrower’s salary is considerably low.

Rajat Gandhi, Founder & CEO, Faircent.com said, "With deposit rates under pressure Individual lenders are looking at such alternative lending platforms since they not only give much higher returns than deposits but also establish direct connect with the borrowers and are much more transparent and hassle free than other lending institutions. This would put additional pressure on the interest rates charged by traditional lenders."

As per a KPMG report, globally this sector is poised to register a CAGR growth of 60% to USD 1 trillion by 2025 from USD 9 Billion in 2014. The growth potential in Indian market is huge as there are about 57.7 million small businesses in the country.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

EPFO Pension Schemes: Early pension, retirement pension, nominee pension and 4 other pension schemes that every private sector employee should know

SBI Guaranteed Return Scheme: Know how much maturity amount you will get on Rs 2 lakh, 2.5 lakh, 3 lakh, 3.5 lakh and Rs 4 lakh investments under Amrit Vrishti FD scheme

SIP+SWP: Rs 10,000 monthly SIP for 20 years, Rs 25 lakh lump sum investment, then Rs 2.15 lakh monthly income for 25 years; see expert calculations

Power of Compounding: How soon will monthly SIP of Rs 6,000, Rs 8,000, and Rs 10,000 reach Rs 5 crore corpus target?

SIP vs PPF: How much corpus you can build in 15 years by investing Rs 1.5 lakh per year? Understand through calculations

02:54 PM IST

RBI, Maldives Monetary Authority sign pact to promote use of local currencies

RBI, Maldives Monetary Authority sign pact to promote use of local currencies RBI cautions public about 'deepfake' video of governor being circulated on social media

RBI cautions public about 'deepfake' video of governor being circulated on social media RBI cancels licence of Vijayawada-based Durga Co-op Urban Bank

RBI cancels licence of Vijayawada-based Durga Co-op Urban Bank  Consumer inflation worsens to 6.21% in October from 5.49% in previous month

Consumer inflation worsens to 6.21% in October from 5.49% in previous month Nearly 98% of Rs 2000 banknotes returned; Rs 6,970 crore worth notes still with public

Nearly 98% of Rs 2000 banknotes returned; Rs 6,970 crore worth notes still with public