RBI slashes GVA growth for FY17 to 7.1%

RBI said, “Outlook for GVA growth has turned uncertain after the unexpected loss of momentum by 50 basis points in Q2 and the effects of the withdrawal of SBNs (specified bank notes) which are still playing out.”

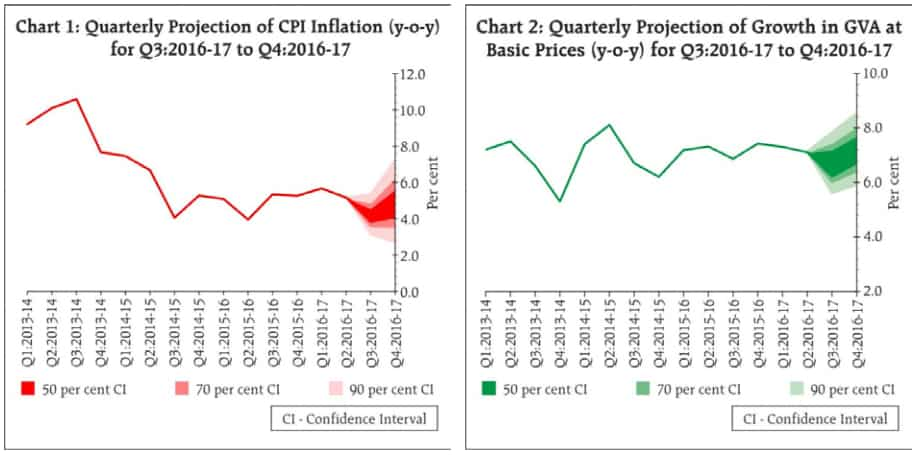

While announcing the fifth bi-monthly monetary policy, the Reserve Bank of India revised the gross value added (GVA) to 7.1% from earlier 7.6%.

RBI said, “Outlook for GVA growth has turned uncertain after the unexpected loss of momentum by 50 basis points in Q2 and the effects of the withdrawal of SBNs (specified bank notes) which are still playing out.”

It explained two major channels which would affect the GVA growth in FY17.

Firstly, short-run disruptions in economic activity in cash-intensive sectors such as retail trade, hotels & restaurants and transportation, and in the unorganised sector. And secondly, aggregate demand compression associated with adverse wealth effects.

RBI said, "Impact of the first channel should, would further abate with the progressive increase in the circulation of new currency notes and greater usage of non-cash based payment instruments in the economy, while the impact of the second channel is likely to be limited."

In October 2016, GVA growth in H2 was projected at 7.7% and for the full year at 7.6%

Expected loss of growth momentum in Q3, waning effects in Q4 alongside the boost to consumption demand from higher agricultural output and the implementation of the 7th CPC award pushed RBI to trim down GVA growth.

GVA is output minus intermediate consumption.

Following demonetisation, many analysts have trimmed India's GDP.

ALSO READ: Demonetisation impact: GDP growth may fall to three-year lows

RBI kept repo rate unchanged at 6.25%.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

06:02 PM IST

Manufacturing growth: India set to see a slowdown?

Manufacturing growth: India set to see a slowdown?  Indian economy likely to grow at 7.4% in FY19: NCAER

Indian economy likely to grow at 7.4% in FY19: NCAER India's real economy to expand by 7.6% in 2016-17: RBI survey

India's real economy to expand by 7.6% in 2016-17: RBI survey