RBI raises NACH mandate limit for TReDS settlement to 3 cr to meet growing liquidity needs of MSME

The Reserve Bank of India on February 10, increased the NACH mandate limit for TReDS settlement to Rs 3 crore.

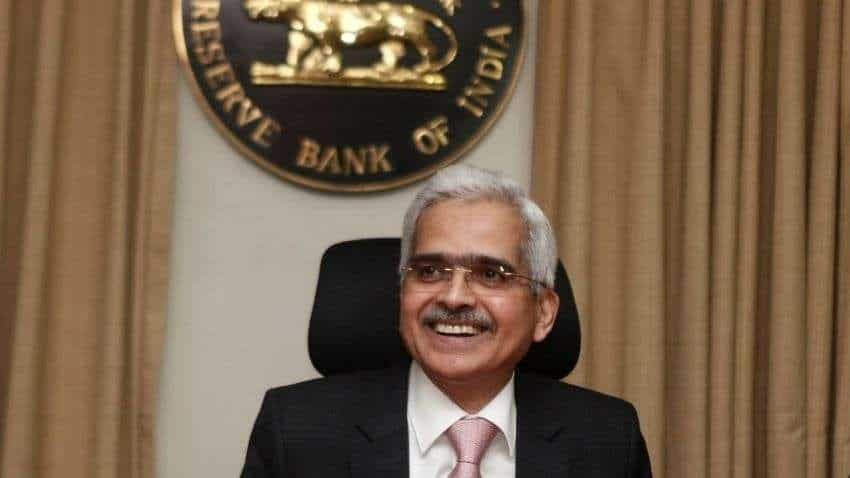

RBI Monetary Policy February 2022: The Reserve Bank of India on February 10, increased the NACH mandate limit for TReDS settlement to Rs 3 crore. The announcement was made by RBI Governor Shaktikanta Das during his Monetary Policy speech on Thursday.

The Indian Central Bank has taken this decision in view of the growing liquidity requirements of the MSMEs and the requests received from the Trade Receivables Discounting System (TReDS) platforms, the Governor said. In addition, the RBI also enabled better infrastructure for MSME receivables financing.

RBI, back in October 2019, introduced 'On-tap' authorisation of TReDS operators to encourage innovation and competition through increased participation.

TReDS facilitates discounting /financing of receivables of Micro, Small, and Medium Enterprises (MSMEs). Its settlements are carried out through mandates in the National Automated Clearing House (NACH) system.

Presently, the amount of the NACH mandate is capped at Rs 1 crore.

"Effective July 1, 2020, the Central Government has revised the definition of MSMEs with linkage to their annual turnover as well," the bank said.

It is recommended that the NACH mandate limit for TReDS settlements be increased to 3 crores, in light of the escalating liquidity needs of MSMEs and demands from TReDS platforms.

"Keeping in view the growing liquidity requirements of the MSMEs and the requests received from the TReDS platforms, it is proposed to increase the NACH mandate limit to ₹3 crore for TReDS settlements," the bank added.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

02:40 PM IST

Electricity distribution companies continue to remain a burden on state finances: RBI

Electricity distribution companies continue to remain a burden on state finances: RBI Rupee hits all-time low; RBI intervenes to curb further losses

Rupee hits all-time low; RBI intervenes to curb further losses Rupee slumps to record closing low of 84.88 vs dollar

Rupee slumps to record closing low of 84.88 vs dollar Bank stocks rally up to 2% after RBI cuts CRR to 4%

Bank stocks rally up to 2% after RBI cuts CRR to 4% RBI raises retail inflation estimate for FY25 to 4.8% amid rising food prices

RBI raises retail inflation estimate for FY25 to 4.8% amid rising food prices