RBI holds neutral stance, raises inflation target to 5.1% in Q4FY18

RBI kept the policy repo rate under the liquidity adjustment facility (LAF) unchanged at 6%.

The Reserve Bank of India (RBI) maintained a status quo for the third time for the FY18.

In sixth bi-monthly monetary policy, RBI kept the policy repo rate under the liquidity adjustment facility (LAF) unchanged at 6%.

Consequently, the reverse repo rate under the LAF remains at 5.75%, and the marginal standing facility (MSF) rate and the Bank Rate at 6.25%.

Decision of the MPC is consistent with the neutral stance of monetary policy in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4% within a band of +/- 2 per cent, while supporting growth.

Consumer Price Index (CPI) inflation has already reached to 17-month high of 5.21% in December 2017, primarily driven by vegetables, house rent and fuel.

source: tradingeconomics.com

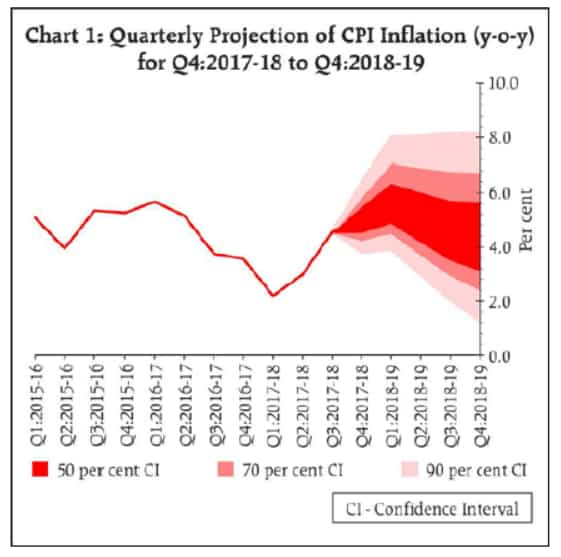

RBI in this policy stated that the December bi-monthly resolution projected inflation in the range of 4.3-4.7% in the second half of 2017-18, including the impact of increase in HRA. In terms of actual outcomes, headline inflation averaged 4.6% in Q3, driven primarily by an unusual pick-up in food prices in November.

RBI said, "Though prices eased in December, the winter seasonal food price moderation was less than usual. Domestic pump prices of petrol and diesel rose sharply in January, reflecting lagged pass-through of the past increases in international crude oil prices."

Considering the above mentioned factors, RBI now estimate inflation to be at 5.1% in Q4, including the HRA impact.

According to RBI, the inflation outlook beyond the current year is likely to be shaped by several factors.

Firstly, international crude oil prices have firmed up sharply since August 2017, driven by both demand and supply side factors.

Secondly, non-oil industrial raw material prices have also witnessed a global uptick. Firms polled in the Reserve Bank’s IOS expect input prices to harden in Q4. In a scenario of improving economic activity, rising input costs are likely to be passed on to consumers.

Thirdly, the inflation outlook will depend on the monsoon, which is assumed to be normal.

Taking these factors into consideration, CPI inflation for 2018-19 is estimated in the range of 5.1-5.6% in H1, including diminishing statistical HRA impact of central government employees, and 4.5-4.6 per cent in H2, with risks tilted to the upside.

Projected moderation in inflation in the second half is on account of strong favourable base effects, including unwinding of the 7th CPC’s HRA impact, and a softer food inflation forecast, given the assumption of normal monsoon and effective supply management by the government, as per RBI.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

02:52 PM IST

Electricity distribution companies continue to remain a burden on state finances: RBI

Electricity distribution companies continue to remain a burden on state finances: RBI RBI imposes penalties on IndusInd Bank and Manappuram Finance for non-compliance of certain norms

RBI imposes penalties on IndusInd Bank and Manappuram Finance for non-compliance of certain norms Forex reserves drop $2 billion to $652.86 billion

Forex reserves drop $2 billion to $652.86 billion RBI flags rising subsidies by states as incipient stress

RBI flags rising subsidies by states as incipient stress Wholesale inflation eases to 1.89% in November from 2.36% in previous month

Wholesale inflation eases to 1.89% in November from 2.36% in previous month