RBI Governor ZEE BIZ EXCLUSIVE INTERVIEW: What Shaktikanta Das said about new bank licenses and consolidation of small banks

Calling the financial sector the "backbone of the economy", the RBI Governor stated that financial stability is the first priority. Also, making robust banking back a robust economy has been a prime focus.

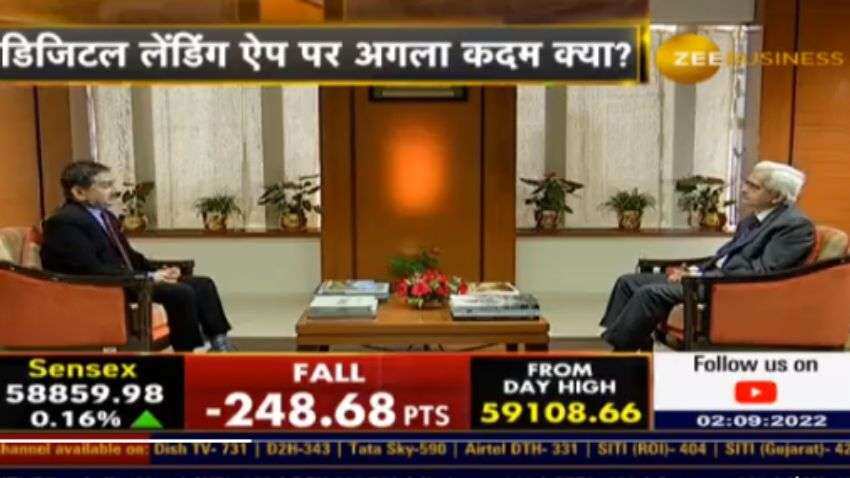

In an exclusive interview with Zee Business Managing Editor Anil Singhvi, Reserve Bank of India (RBI) Governor Shaktikanta Das said that keeping the banking sector, the financial system robust and strong has been a focus of RBI.

"RBI has always aimed to keep the banking sector and financial system robust and strong. Attempts to fulfill the same have always been taken and will be taken in the future," the RBI Governor said.

"To make the financial sector stronger and meet the need of emerging requirements, RBI has taken steps in the recent past such as new regulatories being introduced for NBFCs ; introduction of new governance framework for banks. New regulatory framework for urban cooperative bank framework has been introduced as well as new regulatory framework has been announced for digital lending, recently," he added.

RBI गवर्नर शक्तिकांता दास का #EXCLUSIVE हिंदी इंटरव्यू#AzadiKaAmritMahotsav के समय में कैसी है बैंकिंग सिस्टम?

बैंकिंग सिस्टम को और मजबूत करने के लिए RBI की क्या है योजना?

देखिए @AnilSinghvi_ के साथ...

पूरा इंटरव्यूhttps://t.co/L4gNUuTpyH@RBI @DasShaktikanta pic.twitter.com/NkOUuxbFd2

— Zee Business (@ZeeBusiness) September 2, 2022

Calling the financial sector the "backbone of the economy", the RBI Governor stated that financial stability is the first priority. Also, making robust banking back a robust economy has been a prime focus.

Talking about the banking license, the RBI Governor said that applicants fulfilling the 'fit and proper test' will receive the license from RBI.

Highlighting the importance of the 'fit and proper test' and calling the process a sacred function, the RBI Governor said that to give the license, analysis is done carefully to keep the trust of depositors intact in the financial system. Applicants should fully fill the requirement of 'fit and proper test' in order to get the license.

RBI गवर्नर शक्तिकांता दास का #EXCLUSIVE हिंदी इंटरव्यू

देश में कुल कितने बैंक होने चाहीए?

क्या बैंकों में कंसोलिडेशन की जरूरत? जानिए RBI गवर्नर की क्या है राय...

देखिए @AnilSinghvi_ के साथ...

पूरा इंटरव्यूhttps://t.co/L4gNUuTpyH@RBI @DasShaktikanta pic.twitter.com/KcQRLwLHO3

— Zee Business (@ZeeBusiness) September 2, 2022

Commenting on small bank mergers, the RBI Governor said that if a small bank wishes to merge with a large bank, then there are provisions in law that are to be followed. After the boards of both banks decide, and the 'fit and proper test' conditions are met, then the outcome of the merger is analyzed by RBI.

"There is no mindset to encourage or discourage applicants, RBI will examine the application with an open mind," he concluded.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

04:29 PM IST

Market guru Anil Singhvi explains 5 investment lessons from Mahatma Gandhi's life

Market guru Anil Singhvi explains 5 investment lessons from Mahatma Gandhi's life Zee Business wins 'Commodity Public Policy Influencer Award' at Wheat Summit

Zee Business wins 'Commodity Public Policy Influencer Award' at Wheat Summit Budget Bonanza on Zee Business: Check winners name and how to participate

Budget Bonanza on Zee Business: Check winners name and how to participate Sula Vineyard IPO Review by Anil Singhvi: Subscribe or avoid? Check recommendation here

Sula Vineyard IPO Review by Anil Singhvi: Subscribe or avoid? Check recommendation here Five Star Business Finance IPO review by Anil Singhvi: Subscribe or avoid? Check recommendation here

Five Star Business Finance IPO review by Anil Singhvi: Subscribe or avoid? Check recommendation here