PNB fraud case: CBI approaches Interpol to locate Nirav Modi

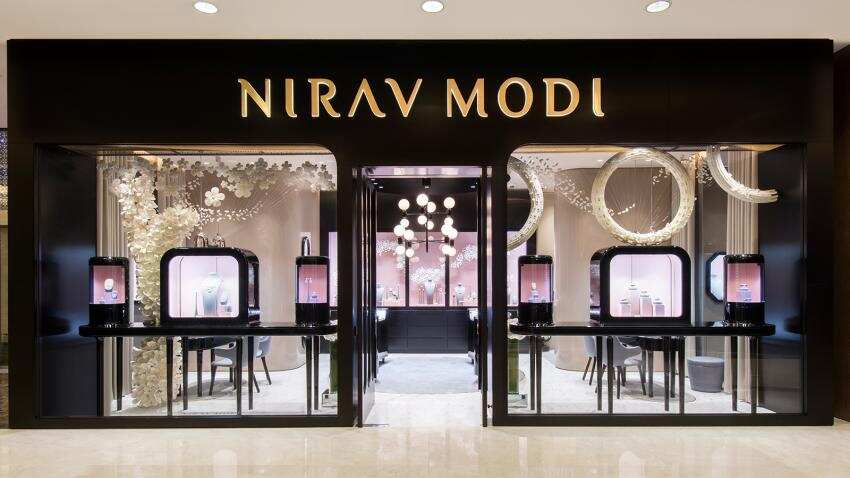

Nirav Modi, who was alleged to have carried out fraudulent transactions worth over Rs 11,400 crore in Punjab National Bank, had left the country in the first week of January.

The CBI has approached the Interpol to locate billionaire jewellery designer Nirav Modi and his family who had left the country in the first week of January, weeks before scam was reported to the agency, officials said.

Officials said the CBI approached the Interpol with a request for issuing Diffusion Notice which was aimed at locating an individual.

"This (diffusion) is less formal than a notice but is also used to request the arrest or location of an individual or additional information in relation to a police investigation. A diffusion is circulated directly by an NCB (CBI in this case) to the member countries of their choice, or to the entire INTERPOL membership and is simultaneously recorded in Interpol’s Information System," the website of Interpol says.

The CBI was confident about getting a location of Modi and his family by today, they said.

Modi, who was alleged to have carried out fraudulent transactions worth over Rs 11,400 crore in Punjab National Bank, had left the country in the first week of January.

The 46-year old, who holds an Indian passport, left India on January 1, while his brother Nishal, a Belgian citizen, departed from the country on same day. However, whether they travelled together has to be probed, they said.

Modi's wife Ami, a US citizen, left on January 6 and his uncle and business partner Mehul Choksi, the promoter of Gitanjali jewellery chain, left on January 4, the officials said.

The CBI and the Enforcement Directorate have approached the government seeking revocation of passports of Modi and Choksi.

The billionaire diamond merchant, a regular on the lists of rich and famous Indians since 2013, was booked by the CBI, along with wife, brother and Choksi on January 31, for allegedly cheating the state-run Punjab National Bank to the tune of Rs 280 crore.

The bank again approached the CBI within a fortnight of the first complaint giving details of more transactions which were over Rs 11,400 crore.

The question as to why the PNB did not send a complaint to the CBI and decided to give it in tranches is also under the scanner of the agency, they said.

The bank has claimed in three complaints to the CBI that so far it has detected 150 Letters of Undertaking (LoUs) which were fraudulently issued by its officials in connivance with Modi and the other accused in the case, the officials said.

An LoU is a letter of comfort issued by one bank to branches of other banks, based on which foreign branches offer credit to buyers.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

10:48 AM IST

PNB fraud-accused Mehul Choksi's Gitanjali Gems, 8 other firms can't trade in shares from September 9. Here's why

PNB fraud-accused Mehul Choksi's Gitanjali Gems, 8 other firms can't trade in shares from September 9. Here's why PNB fraud: Hong Kong regulator enhances supervision of lender's HK branch

PNB fraud: Hong Kong regulator enhances supervision of lender's HK branch Will PNB see any ray of hope; analysts trim down ratings

Will PNB see any ray of hope; analysts trim down ratings This is why Rs 13,500cr PNB fraud case went undetected

This is why Rs 13,500cr PNB fraud case went undetected PNB fraud: World Bank plays down scam, says not a systemic problem

PNB fraud: World Bank plays down scam, says not a systemic problem