One year of GST: This regime made airfare in economy class cheaper, but business class turned expensive

One year of GST: The response has been mixed with some left confused about the digitized process and its norms.

One year of Goods and Services Tax (GST). This new tax regime replaced multi-layered, complex indirect tax structure with a simple, transparent and technology-driven tax system. The July 1, 2017 launch of GST aimed at creating a unified system and it was promptly hailed as the single biggest reform in the Indian system and it has come a long way since then. The response has been mixed with some left confused about the digitized process and its norms. Let’s have an understanding on how this regime impacted consumers in terms of their air fare tickets.

GST tax structure in airlines

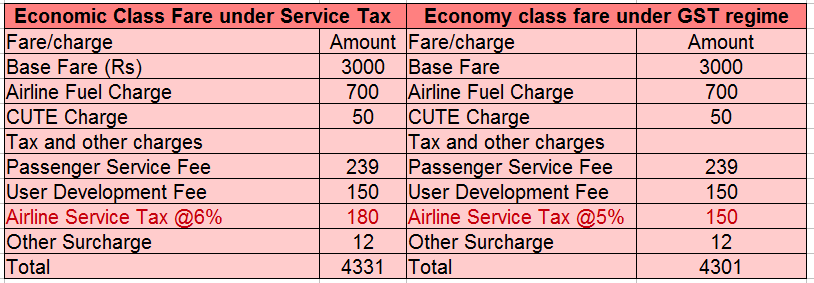

GST council has lowered the tax rate in economy class flight ticket to 5% from previous service tax of 6%.

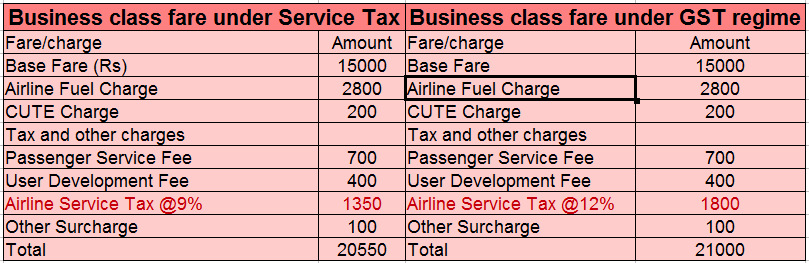

However, it increased business class tickets at a GST tax slab of 12% versus previous service tax of 9%.

Moreover, airlines can only claim input tax credit (ITC) on input services for the economy class, while in case of business class they can claim ITC for spare parts, food items and other inputs excluding cost on aviation fuel turbine (ATF) as it falls under purview of GST.

The government has also levied a GST of 5% on lease rentals paid by airlines.

A major portion of the airline's revenue is generated from economy class as this segment offers higher amount of seats.

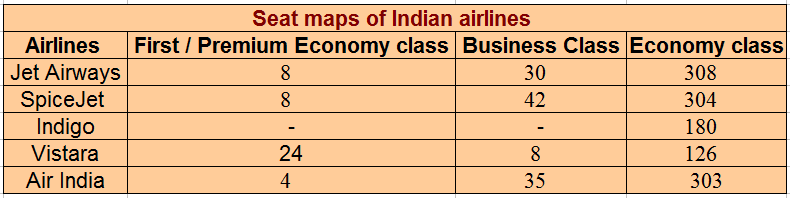

In India, airlines like Jet Airways, SpiceJet, Vistara and state-owned Air India offer business class seats.

Here's how GST has impacted airfare tickets.

From the above, it can be seen that, GST made business class more expensive, however it came as good news for economic class passengers.

According to ClearTax report, If you are a frequent flier, you will find the impact of GST on airfares and the new tax rates and ticket prices to your liking. The reduction in tax rate is positive for low-cost domestic carriers. However, it remains to be seen if the airlines will be willing to pass on the benefits of the reduced tax rate to customers going forward.

The report added, a major portion of the revenue generated from airlines comes from economy travellers. Moreover, airlines can only claim ITC on input services for the economy class while for the business class they can claim ITC for spare parts, food items and other inputs, apart from fuel.

Apart from business class, airlines also face higher Aviatian Turbine Fuel (ATF) expense which accounts major chunk of their expenses. ATF is currently not included in GST umbrella.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

01:14 PM IST

States not in favour of bringing ATF under GST, says finance minister

States not in favour of bringing ATF under GST, says finance minister 55th GST Council Meeting: No GST payable on penal charges levied & collected by banks & NBFCs from borrowers for non-compliance, says Nirmala Sitharaman

55th GST Council Meeting: No GST payable on penal charges levied & collected by banks & NBFCs from borrowers for non-compliance, says Nirmala Sitharaman  GST Council Meeting: Packaged & labelled popcorn with added sugar to attract 18% rate, decision on insurance products deferred

GST Council Meeting: Packaged & labelled popcorn with added sugar to attract 18% rate, decision on insurance products deferred  55th GST Council Meeting: Jet fuel inclusion, lower taxes on insurance policies to be considered

55th GST Council Meeting: Jet fuel inclusion, lower taxes on insurance policies to be considered GoM on GST rate rationalisation yet to submit report, GST Council to take final decision: CBIC

GoM on GST rate rationalisation yet to submit report, GST Council to take final decision: CBIC