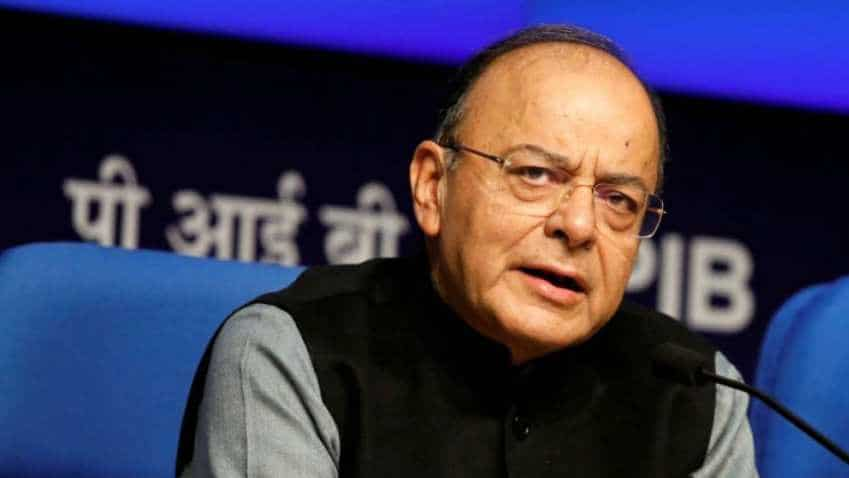

Not Rs 2.50 lakh crore! Arun Jaitley reveals this shocking big number!

Addressing a press conference in New Delhi, Arun Jaitley said the bank lending before 2008 was Rs 18 lakh crore, and it jumped to Rs 55 lakh crore between 2008 and 2014. He said the nature of lending was as if there would be no tomorrow, adding that the real picture was known by the government as well as RBI after 2015.

Finance Minister Arun Jaitley today said the real picture of Non Performing Assets (NPAs) crisis in banks was actually revealed only in 2015, because the previous UPA government had swept the same under the carpet. He said the actual figure came out to be a whopping Rs 8.50 lakh crore and not Rs 2.50 lakh crore!

Addressing a press conference in New Delhi, Arun Jaitley said the bank lending before 2008 was Rs 18 lakh crore, and it jumped to Rs 55 lakh crore between 2008 and 2014. He said the nature of lending was as if there would be no tomorrow, adding that the real picture was known by the government as well as RBI after 2015.

Jaitley also said that the banks had to face 2-3 challenges that were hampering their lending because many were in a fragile state.

Another surprise that Arun Jaitley pulled was the shock announcement regarding merger of Dena Bank, Vijaya Bank and Bank of Baroda. The finance minister said, "Government had announced in the budget that consolidation of banks was also in our agenda and the first step has been announced."

He also clarified that "No employee will face any service conditions which are adverse in nature. The best of the service conditions will apply to all of them."

Financial services secretary Rajiv Kumar stated that these state-controlled lenders will continue to work as independent entities, while addressing media persons. He said that employees interest would be protected in the merger process. The merger of five SBI associate banks five associate banks and the Bharatiya Mahila Bank was done without any job losses, he added.

Watch this Zee Business video

The government today announced the merger of public sector banks Bank of Baroda, Dena Bank and Vijaya Bank.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

07:36 PM IST

Centre vs RBI row: 'Urjit Patel resignation would send bad signal, as Raghuram Rajan's did'

Centre vs RBI row: 'Urjit Patel resignation would send bad signal, as Raghuram Rajan's did' Finance Secretary Hasmukh Adhia to retire on Nov 30

Finance Secretary Hasmukh Adhia to retire on Nov 30 Arun Jaitley calls for quality debates on economic policies

Arun Jaitley calls for quality debates on economic policies Arun Jaitley now eyes Top 50 spot on World Bank Ease of Doing Business ranking

Arun Jaitley now eyes Top 50 spot on World Bank Ease of Doing Business ranking Govt, RBI rift: FM assures on central bank autonomy; sources say Section 7 of RBI Act not invoked

Govt, RBI rift: FM assures on central bank autonomy; sources say Section 7 of RBI Act not invoked