Nifty's rally in run-up to Budget about to halt? 10-year history suggests so

Going by the trend, experts believe investors should play it safe post the Budget as markets are already quoting higher valuations, just ripe enough to witness a correction on any negative trigger. Budget may provide some, they believe

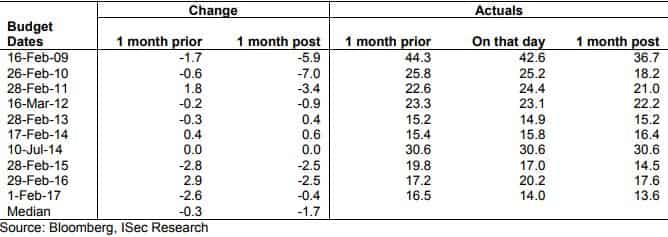

As investors await Finance Minister Arun Jaitley to unveil the Budget 2018, let's take a look at how markets performed one-month prior and post the Budget in the last ten years.

Interestingly, year 2018 marks just the third time the Nifty returned positive one-month prior to Budget in the last ten years since 2009. The index is up over 5 per cent so far this year, trading above 11,150. It is only in 2009 and 2017 that the 50-share index logged positive returns: 7 per cent and 4 per cent, respectively.

In 2017, the index managed to stay in green one-month post the Budget, up 3 per cent but incurred losses in 2009.

Nifty return one-month prior and post Budget

| Budget date | Prior | post |

| 1 Feb 18 | 5% | NA |

| 1 Feb 17 | 4.58% | 3.70% |

| 29 Feb 16 | -5.30% | 8.30% |

| 28 Feb 15 | -0.80% | -5.70% |

| 10 Jul 14 | -0.90% | -0.20% |

| 28 Feb 13 | -4.60% | -2% |

| 16 Mar 12 | -2.73% | -3% |

| 28 Feb 11 | -6.74% | 6.63% |

| 26 Feb 10 | -3% | 7% |

| 16 Feb 09 | 7.73% | -3% |

Going by the trend, experts believe investors should play it safe post the Budget as markets are already quoting higher valuations, just ripe enough to witness a correction on any negative trigger. Budget may provide some, they believe.

Meanwhile, volatility has also peaked ahead of the B-Day with India VIX, the so-called fear gauge, rising over 24% to 17.5 so far this year. However, the value is among the lowest in the past 10 pre-Budget periods.

"Market volatility in the pre-Budget period is the lowest as compared to the past 10 budgets indicating that unless the budget springs up a huge surprise in terms of a surge in fiscal deficit estimate or a regressive measure such as a retrospective LTCG regime, we do not envisage market volatility will increase post budget," said brokerage ICICI Securities in a research note.

Brokerage HDFC Securities sees few negatives from this budget, but adds the possibilities of an unexpected large positive is also limited.

“For the current year, markets have been rising (first in Oct 2017 and then in Jan 2018) without any significant corrections. Market volatility in the pre-budget period has also been the lowest as compared to the past 10 budgets. Hence the possibility of a large upmove post the Budget seems less likely. While optically the FM will deliver what the masses and classes want (and hence no immediate disappointment), a lot will depend on the way the government revenues and interest rates pan out in H1FY18,” said the brokerage.

On Monday, the S&P BSE Sensex and the Nifty50 hit another lifetime high. The Sensex gained as much as 348 points to its record high of 36,398.65, while the broader Nifty50 added 89 points to its fresh high of 11,159.15.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

11:32 AM IST

Zomato set to debut in Sensex, replacing JSW Steel

Zomato set to debut in Sensex, replacing JSW Steel Hamps Bio shares debut at 90% premium on BSE SME platform

Hamps Bio shares debut at 90% premium on BSE SME platform Traders' Diary: Buy, sell or hold strategy on Piramal Pharma, Vedanta, Thermax, Indus Tower, and other top stocks today

Traders' Diary: Buy, sell or hold strategy on Piramal Pharma, Vedanta, Thermax, Indus Tower, and other top stocks today Swiggy shares rise nearly 2% after Axis Capital initiates ‘buy’ rating

Swiggy shares rise nearly 2% after Axis Capital initiates ‘buy’ rating GIFT Nifty futures down 100 points; markets to track Fed meeting, Chinese data

GIFT Nifty futures down 100 points; markets to track Fed meeting, Chinese data