Nifty is back at 9100-level after two years and that's where the similarity ends

Motilal Oswal research, in a report said that this rise in market cap was contributed by new listings in the current fiscal year.

NSE Nifty reached its near two-year peak earlier this month when it crossed 9100-mark reaching its all-time high.

Market cap of Nifty in March 2017 stood at Rs 62.4 lakh crore, a rise of 4.34% compared to Rs 59.8 lakh crore of March 2015.

Motilal Oswal research, in a report said that this rise in market cap was contributed by new listings in the current fiscal year.

A total of 25 companies got listed on NSE raising Rs 28,700 crore in FY17 against eight companies that raised Rs 3000 crore in FY15.

In last two years, Nifty's earnings have remained flat due to asset quality review, correction in commodity prices, slowdown in discretionary consumption and demonetisation.

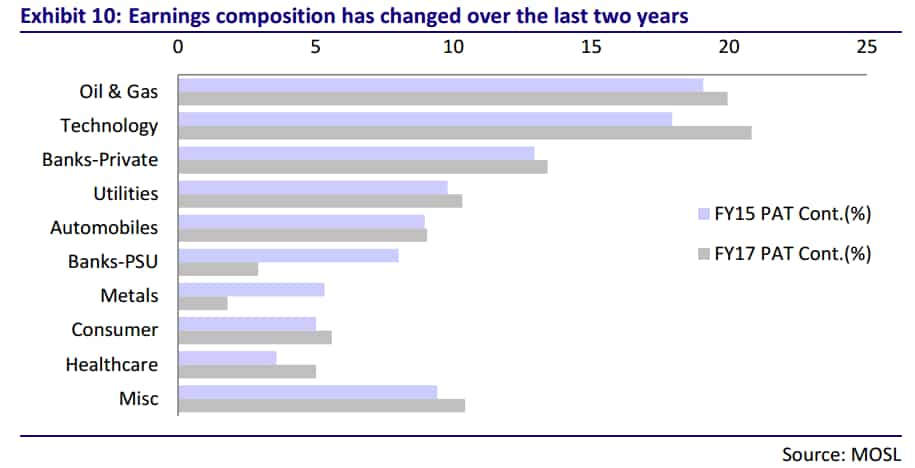

Earnings structure, however, has changed during these period. Many sectors have seen growth in their market share except metals and public sector undertakings (PSU) banks.

Shares of PSU banks decelerated to 2.9% FY17 from 8% in FY15, led by asset quality review, which resulted in sharp jump in provisions. While metal sectors market index reduced to 1.8% in FY17 against 5.3% of FY15, due to correction in commodity prices.

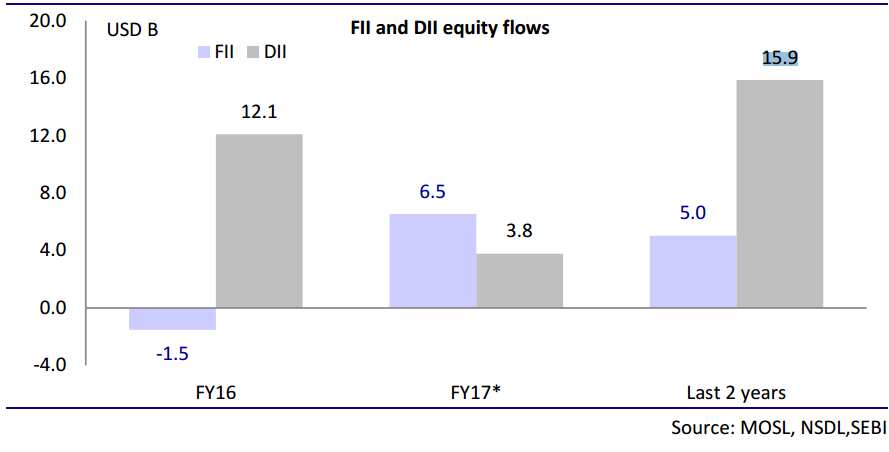

In case of institutional flows, DIIs (domestic institutional investors) dominated the market in FY17. Inflows from DIIs stood at $16 billion in last two years, while inflows from FIIs were relatively muted at $4.7 billion.

Also, foreign ownership of Nifty stocks fell 140 basis points over last two years, while DIIs and other domestic investors' ownership grew by 190 basis points.

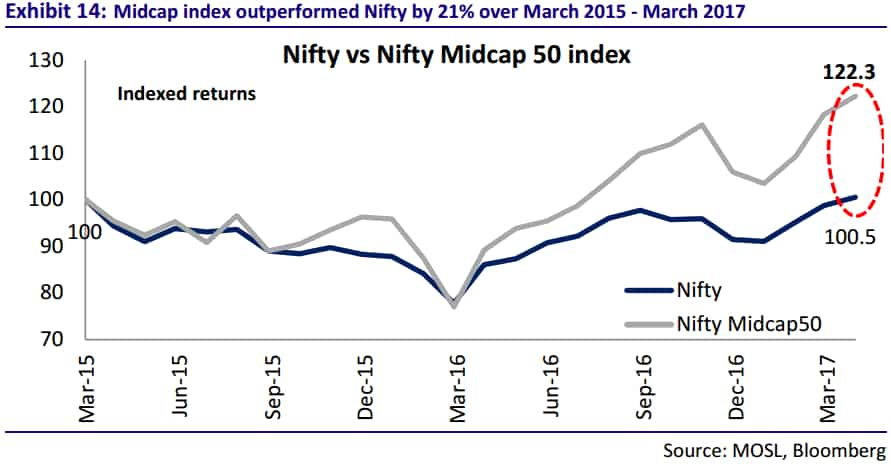

Motilal Oswal said, “The shift in institutional flows in favour of DIIs is reflected in the sharper outperformance of midcaps. ”

Nifty CNX Midcap index outperformed by 22% in March 2017. Where Nifty 50 gave returns of over 100%, Nifty midcap index provided returns of over 122%.

This would be the first time, where return gap between Nifty 50 and Nifty CNX index has widened at such levels.

After two years, among the Nifty stocks, Yes Bank (86% return), Maruti (63% return) and BPCL (62% return) have been the top-3 performers while Idea (down 50%), IDFC (35% decline) and Sun Pharma (down 31%) have been the laggards.

Moreover sectors like pharmaceuticals and IT have seen the maximum de-rating over the past 24 months due to slowdown in earnings growth as well as tightening of the regulatory environment, added the report.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

03:53 PM IST

Sensex drops 170 points, Nifty below 23,950; oil & gas stocks rebound

Sensex drops 170 points, Nifty below 23,950; oil & gas stocks rebound FIRST TRADE: Equities fall for fifth consecutive day; Nifty holds on to 23,900 levels, Sensex down 208 pts

FIRST TRADE: Equities fall for fifth consecutive day; Nifty holds on to 23,900 levels, Sensex down 208 pts GIFT Nifty futures drop 60 pts; markets to open on a cautious note

GIFT Nifty futures drop 60 pts; markets to open on a cautious note Sensex slumps 964 pts, Nifty50 gives up 24,000 as bears dominate D-Street for 4th day

Sensex slumps 964 pts, Nifty50 gives up 24,000 as bears dominate D-Street for 4th day Nifty 50 sinks below 23,900 as Fed rate outlook disappoints global markets; Sensex slumps nearly 1,200 points

Nifty 50 sinks below 23,900 as Fed rate outlook disappoints global markets; Sensex slumps nearly 1,200 points