Most newly-listed companies on BSE see rise in market cap

Financial Year 2017 is proving to be a good year for newly listed companies. Thus far, 11 companies have listed their shares on the Indian bourses and a quick look at their market caps since their debut on the exchanges, shows that most of them have had a good run so far.

Financial Year 2017 is proving to be a good year for newly listed companies. Thus far, 11 companies have listed their shares on the Indian bourses and a quick look at their market caps since their debut on the exchanges, shows that most of them have had a good run so far.

The 11 companies that were listed since April this year are - Equitas Holding, Thyrocare Technologies, Ujjivan Financial Service, Parag Milk Food, Mahanagar Gas Ltd (MGL), Quess Corp, L&T Infotech, Advanced Enzyme, Dilip Buildcon, SP Apparels and, the recently listed RBL Bank.

On September 8, the BSE closed above the 29,000-level for the first time in 17 months.

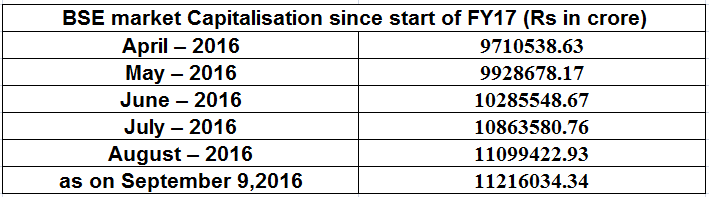

With that, its market cap also set a new high of Rs 112 lakh crore. On August 31, BSE's market cap was around Rs 111 lakh crore.

When the market capitalisation of BSE-listed companies reached Rs 100 lakh crore, Kalpana Morparia, CEO, J.P. Morgan India had said, "This is indeed a historic milestone and is testimony to the vision, spirit and hard work of Indian entrepreneurs and the stakeholders who partner them in their businesses.

"India's economic potential is well-documented. The capital markets have a symbiotic role to play with policy makers in fostering growth. A substantial improvement in the policy environment should enable a sharp pick-up in the growth momentum in the years ahead leading to sustained wealth creation for investors," she added.

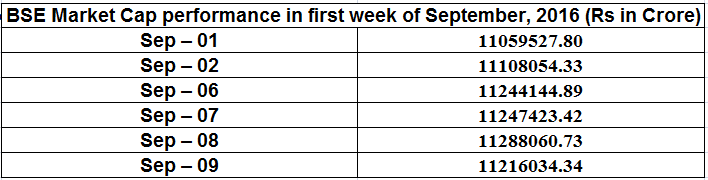

On Friday, September 9, the markets closed down 248 points because of weak cues from the global markets. The market cap of the companies also declined by 0.63% compared to the previous trading session.

But despite this, BSE's market capitalization has increased by 15.50% since the beginning of the fiscal. In the first week of Septemeber, BSE's market cap grew 1.41%.

Since the start of September, the market cap of BSE has risen consistently on a daily basis, except a decline recorded in Friday's trading session.

Thanks to Friday's tumble, the market cap of all the 11 listed companies also took a hit. This was in the range of 0.50% - 3%.

Between Thursday's market close and Friday's close nearly 300 points under the red line, the market share of several companies took a hit.

Here's how the market cap changed in one trading session.

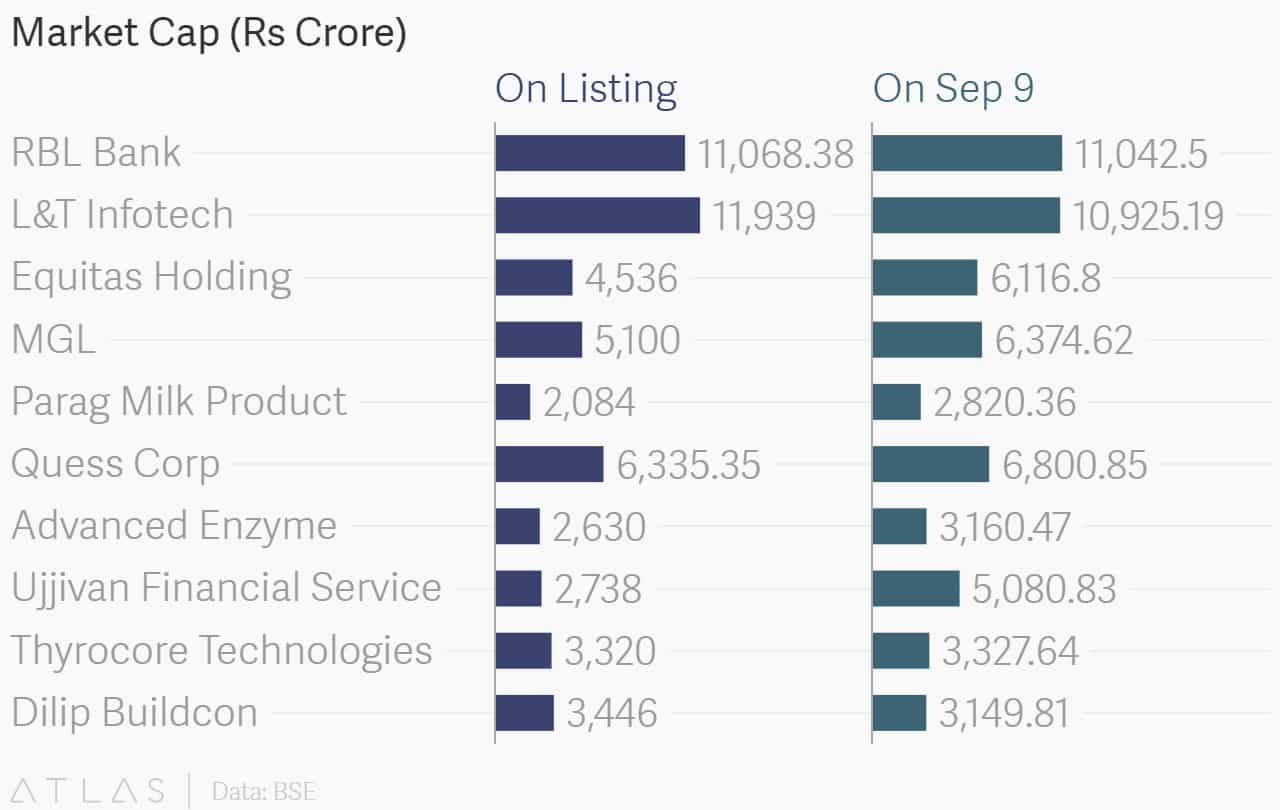

However, overall, from the date of listing till September 9, eight out of the 11 newly-listed companies saw a rise in their market share on the BSE.

Here's a look at how the 11 companies' market share have fared since they were listed earlier this year.

The top three companies that saw their market cap rise since the time of listing, were Ujjivan Financial Service, Parag Milk Product and Equitas Holding.

The market cap of Ujjivan Financial Services grew the most -- by 86% -- from Rs 2,738 crore at the time of getting listed to Rs 5,080.83 crore on Friday.

Both Parag Milk Product and Equitas Holding's market shares grew by nearly 35% each, to Rs 2820.36 crore and Rs 6116.80 crore, respectively. At the time of listing their market cap was around Rs 2084 crore (Parag Milk) and Rs 4536 crore (Equitas).

Mahanagar Gas Limited (MGL) and Advanced Enzyme also witnessed growth in their market caps by 25% and 20%, respectively, to Rs 6374.62 crore and Rs 3160.47 crore.

Quess Corp which was a huge hit during it's IPO and was oversubscribed 145 times, saw a sluggish performance in its market cap. At present, its market cap was at Rs 6800.85 crore, up 7.35% from Rs 6335.35 crore since the time of listing.

The latest company to list its shares on the domestic bourse was RBI Bank.

Its market share at the time of listing was Rs 11,068.38 crore which had improved by nearly 2% on Thursday to Rs 11,288.42 crore.

That changed on Friday. RBL's market cap fell below the level it was at when the company first listed its shares. RBL closed the week with its market cap at Rs 11,042.50 crore, 0.23% lower than the original market cap.

Dilip Buildcon and L&T Infotech were the only two companies that saw their market cap falling lower than it was at the time of listing.

The market cap of Dilip Buildcon was down 8.59% at Rs 3,149.81 crore compared to the Rs 3,446 crore at the time of listing.

Larsen & Toubro-backed L&T Infotech saw its market cap declining by 8.49% at Rs 10,925.19 crore against Rs 11,939 crore. On Thursday, its market cap was at Rs 11,048.32.

L&T Infotech was also the only company that listed its shares this fiscal at a discount. All the other companies' shares were listed at a premium from their issue price band.

Led by the listing at discount, L&T Infotech has also not managed to recover its issue price since the time till now even if Sensex has been soaring in the past few weeks.

The L&T Group will be launching another IPO -- L&T Technology on September 12.

Lastly, Thycore Technologies' market cap has been subdued to Rs 3327.64 crore, sequential rise of 0.23% versus Rs 3320 crore since listing on May 9,2016.

Together, the 11 companies have managed to raise nearly Rs 9,500 crore via their IPOs.

On September 19, ICICI Prudential will be listing its shares on the domestic market. The company is looking to raise Rs 5,000 crore from the domestic market, making it the biggest IPO since Coal India's Rs 15,000 crore IPO in 2010.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Top 7 SBI Mutual Funds With Best SIP Returns in 1 Year: Rs 25,000 monthly SIP investment in No.1 fund has jumped to Rs 3,58,404

Compounding Returns: Rs 5,000 monthly SIP investment for 30 years vs Rs 17,500 monthly SIP for 20 years? Which can give higher return? Know here

SBI Guaranteed Return Scheme: Know how much maturity amount you will get on Rs 2 lakh, 2.5 lakh, 3 lakh, 3.5 lakh and Rs 4 lakh investments under Amrit Vrishti FD scheme

NTPC Green Energy's Rs 10,000-crore IPO opens; Anil Singhvi expects stock to deliver multibagger return

SBI Senior Citizen FD Interest Rates: Know how Rs 5 lakh, Rs 10 lakh, and Rs 15 lakh investments will give in maturity in Amrit Vrishti, 1-, 3-, and 5-year fixed deposit schemes

SBI FD Interest Rates for General and Senior Citizens: Here's what India's top lender is offering in its 1-, 3-, 5-year, & Amrit Vrishti fixed deposit schemes

03:58 PM IST

BSE Q2 profit surges 3-fold to Rs 346 crore

BSE Q2 profit surges 3-fold to Rs 346 crore NSE, BSE say functioning normal; not impacted by Microsoft outage

NSE, BSE say functioning normal; not impacted by Microsoft outage GST meeting outcome, Fed policy report key triggers to drive markets next week

GST meeting outcome, Fed policy report key triggers to drive markets next week  Market cap of BSE-listed companies touches $5 trillion

Market cap of BSE-listed companies touches $5 trillion Warburg Pincus pares 1.3% stake in IDFC FIRST Bank worth Rs 790 crore

Warburg Pincus pares 1.3% stake in IDFC FIRST Bank worth Rs 790 crore